Updated July 20, 2023

Introduction of Cost Method

Cost Method is a method of accounting the investments where the investor has very little or no significant influence on investment, it is a method of counting where the fair value of an investment cannot be easily determined and investment stays at its original value on balance sheet unless the decline on fair value is recognized.

The cost method is defined as a conservative method of accounting the investments, wherein investor does not have full control over the investee as investors share in the investment will be 20% or less than 20%. In this case, the cost method directs that the investor must account for the investment at its historical value, which is the purchase price. This transaction accounts as an asset on the balance sheet of the investor. Once, the initial transaction of investment has been recorded, there is no need to adjust the value in the balance sheet.

If in case, it is recognized that the fair value of the investment has decreased below the recorded historical value, then the investor can modify the recorded value to its new fair market value. If in case, it is recognized that fair value has increased above the recorded historical value, an investor is not allowed to increase the recorded value of an investment as per Generally Accepted Accounting Principles (GAAP). Hence, the Cost method is a highly conservative method of accounting the investments. The cost method is used for accounting of various financial instruments such as fixed assets and investments.

How Does Cost Method Work?

In the cost method, the investor reports the transaction accounts as an asset on the balance sheet. When any dividend is received on the investment, it is immediately accounted on the income statement. The income received by dividend also increases the cash flow, which is recorded either under the investing section or operating section of the cash flow statement, which depends on the accounting policies of investor. On selling the assets in the future, the investor realizes a gain or loss on the sale. This gain/loss affects overall net income in the income statement, which ultimately affects investing cash flow.

Example of Cost Method

XYC Inc acquires a 15% interest in ABC Corporation for $300,000. After some period, ABC Corporation recognizes $50,000 of net income and issues dividends of $9,000. As per basic requirements of cost method, XYZ Inc records its initial investment of $300,000 and its 15% share of the $9,000in dividends.

Cost Method of Accounting

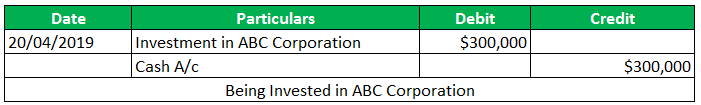

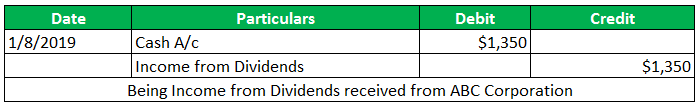

XYC Inc acquires a 15% interest in ABC Corporation for $300,000 on 20 April 2019. On 01 Aug’2019, ABC Corporation recognizes $50,000 of net income and issues dividends of $9,000. As per the basic requirements of cost method, XYZ Inc records its initial investment of $300,000 and its 15% share of the $9,000 in dividends.

Income from Dividends = 15% of 9000 = 1350$

When to use Cost Method?

Cost Method is applied under the following criteria:

- If the investor has no significant influence over the investment, which generally occurs when an investor owns 20% or less in investment.

- The fair value of the investment cannot be easily determined.

Cost Method vs Equity Method

The equity method of accounting is generally used under a scenario when investment results in a 20% to 50% stake in another entity unless it can be clearly exhibit that the investment done by the investor doesn’t result in a significant amount of influence or control over the investee. In the equity method, the investment is initially recorded in the same manner as recorded in the cost method. However, the amount is eventually adjusted to account for investor’s share in the company’s profits and losses.

In this method, Dividends are not considered as income. Rather, they are treated as a return on the investment made and lessen the listed value of investor’s shares.

- Let’s take an example, suppose ABC Inc acquires a 45% stake in XYZ Corp for $40 million, and that ABC Inc CEO has been given a seat on the board (which is primarily an influence).

- ABC Inc would record the investment at $40 million costs in the books in the same way mentioned under the cost method. However, if XYZ Corp recognizes a net income of $10 million during the next year, ABC would take 45% of that amount, or $4.5 million, which ABC Inc would add to its listed value, and record it as return on income.

In cost method, consider you have purchased a stock, now the stock purchased will be recorded on a balance sheet as a non-current asset at the historical purchase price, and will not be adjusted unless shares are sold, or you purchase additional shares. If you receive any dividend, it will be recorded as income and will be taxed as such.

Advantages and Disadvantages

Below are mentioned the advantages and disadvantages:

Advantages

Some of the advantages are given below:

- It involves much less paper work as compared to other methods of Accounting.

- In the cost method, the transaction is recorded once the investment made, which is a one line entry. After which the recorded value is adjusted only when there is any decline in Fair value is recognized.

- Any income generated from Dividends or Net Profit from investee will be recorded separately in the Income statement. The value will not be deducted from the value of the investment.

- Income generated form Dividends or profits received from investee is recorded in the Income Statement under Cost Method. The advantage of this process is that the value of equity investment does not decrease and hence the amount receive affects cash flow.

- All transactions are recorded based on evidence in the form of receipts of Sale/purchase. Hence, there is no scope of manipulation of facts.

Disadvantages

Some of the disadvantages are given below:

- Once the initial transaction has been recorded, the cost method does allow adjustment of Value unless the Fair value of investment declines. Hence, it does not record fair fluctuation on the asset.

- It does not record gains until gains are realized.

- It does not take inflation in consideration. It assumes that the value of currency remains the same over time.

Conclusion

It is among the most conservatives methods used for accounting the investments made where the investment stays on the balance sheet at its original purchase cost instead of fair market value. Cost Method is generally applied when investors’ stake in investment is 20% or less.

Recommended Articles

This is a guide to Cost Method. Here we also discuss the introduction to Cost Method and how does it work along with advantages and disadvantages. You may also have a look at the following articles to learn more –