Updated July 3, 2023

Definition of Consolidated Financial Statement

A consolidated financial statement is like a single report card that combines the financial information of a parent company and all of its subsidiaries. It includes three main sections: Consolidated Balance Sheet, Consolidated Income Statement, and Consolidated Statement of Cash Flows.

Financial consolidation simplifies tracking the overall financial performance of a group as if it were a single entity.We prepare the statements when a parent company owns a controlling interest in one or more subsidiaries. A controlling interest means the parent company owns over 50% of the subsidiary’s voting stock. Consolidation combines parent and subsidiary financials, removes intercompany transactions, and adjusts for minority interests. The resulting consolidated financial statements provide a comprehensive view of the financial position and performance of the group as a whole rather than individual companies.

Purpose of Consolidated Financial Statement

The standalone statement reflects only the investment in a subsidiary, while a consolidated statement combines the parent’s and subsidiary’s financials. In contrast, the consolidated statement shows the total assets of the parent company and its subsidiaries. A consolidated statement provides a comprehensive view of group assets for informed decision-making.

Some of the key purposes of Consolidated Financial Statements include:

- Evaluating the overall performance and profitability of the group: The consolidated financial statements provide a complete picture of the revenues, expenses, and profits generated by the group, which helps evaluate the overall performance and profitability.

- Assessing the group’s financial position and solvency: The statements provide a complete picture of the group’s assets, liabilities, and equity, which helps assess the group’s financial position and solvency.

- Providing information for decision-making: These statements give valuable information for making investment and credit decisions related to the group.

- Compliance with accounting standards: For reliable and comparable financial information, consolidated financial statements must comply with accounting standards such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Example of Consolidated Financial Statement– Walmart Inc

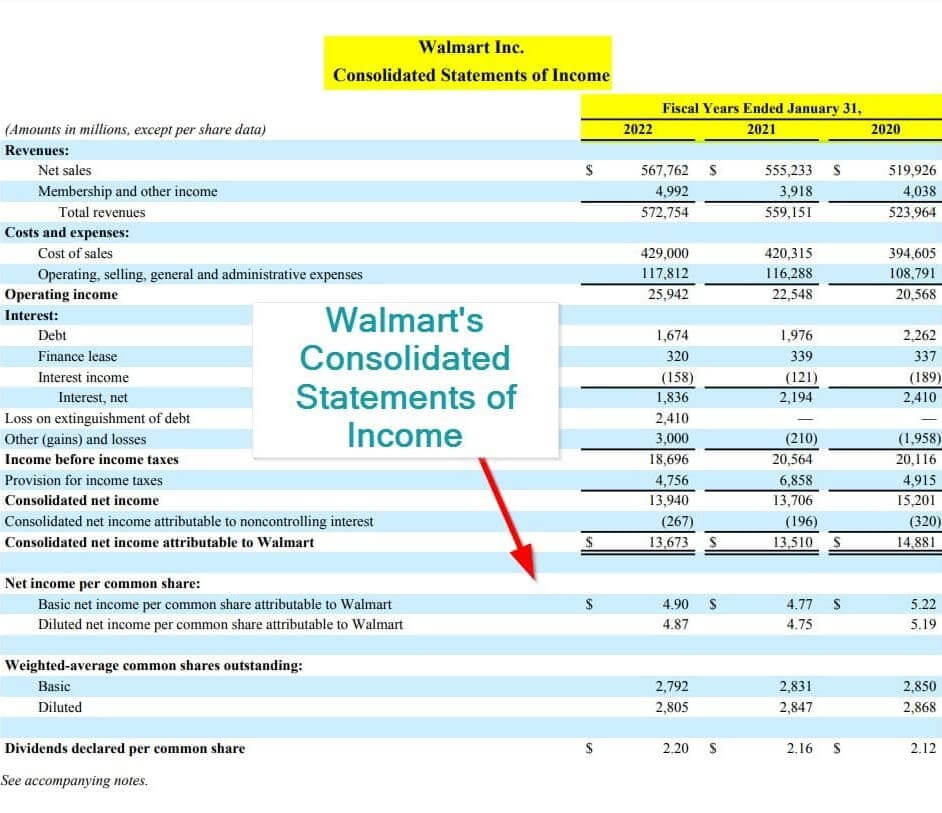

1. Consolidated Statements of Income

A Consolidated Statement of Income is a financial statement that provides an overview of a company’s revenue and expenses over a particular period. It is also known as an income statement, profit and loss statement, or statement of operations.

The statement typically lists all sources of revenue and subtracts all expenses, including the cost of goods sold, operating expenses, taxes, and interest expenses. The resulting figure is the net income or profit, which represents the amount of money the company has earned after accounting for all expenses.

(Source: Annual Report of Walmart Inc. for FY22)

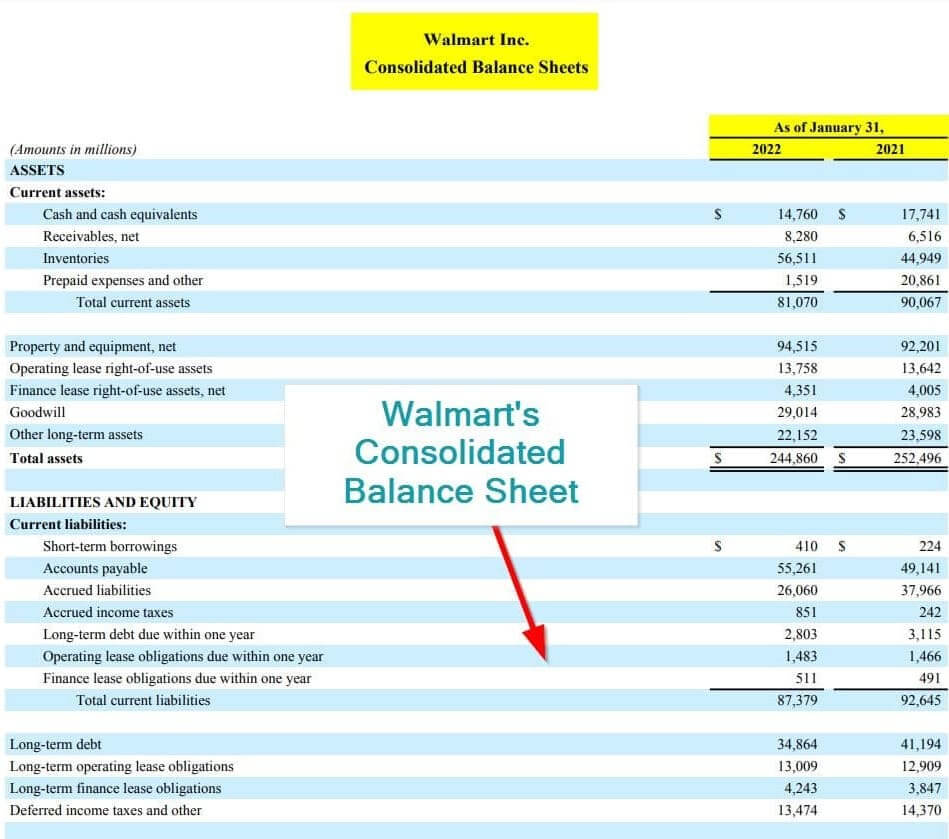

2. Consolidated Balance Sheet

A Consolidated Balance Sheet is a financial statement that provides a snapshot of a company’s assets, liabilities, and equity at a specific time. It is also known as a statement of financial position.

It includes the financial results of all company subsidiaries, which are combined and presented as a single entity. This provides a comprehensive view of the financial position of the entire group.

(Source: Annual Report of Walmart Inc. for FY22)

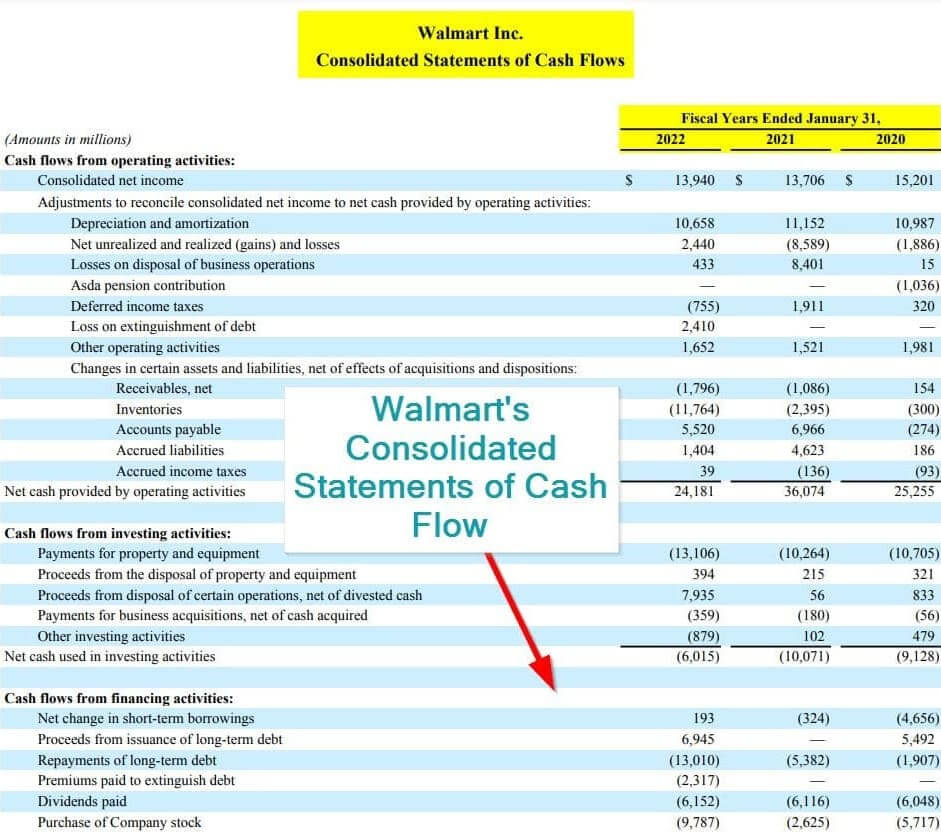

3. Consolidated Statements of Cash Flows

A Consolidated Statement of Cash Flows is a financial statement that provides information about a company’s cash inflows and outflows during a particular period. It summarizes the cash receipts and payments from operating, investing, and financing activities of the company and its subsidiaries, which are combined and presented as a single entity.

Moreover, the statement is divided into three sections: operating activities, investing activities, and financing activities.

(Source: Annual Report of Walmart Inc. for FY22)

Here, we have mentioned the major financial statements that a company prepares in a financial year. These reports are prepared according to the US GAAP and other accounting standards. In the financial statement of Walmart, we can comprehend that they have mentioned all the major data in proper formatting, which is accepted worldwide.

Who is Required to Prepare Consolidated Financial Statements?

The responsibility for preparing Consolidated Financial Statements falls primarily on the finance department of the parent company. The finance department may work with external auditors, tax advisors, or other professionals to ensure that the Consolidated Financial Statements comply with accounting standards and are accurate and reliable.

It is important to note that the preparation of Consolidated Financial Statements requires collaboration and communication between the parent company and its subsidiaries. The subsidiaries must provide the parent company with accurate and timely financial information to ensure that the Consolidated Financial Statements are complete and accurate.

How to Prepare a Consolidated Financial Statement?

- Identify the subsidiaries: List all subsidiaries under common control and determine their percentage of ownership by the parent company.

- Gather financial statements: Collect the financial statements of all the subsidiaries, including balance sheets, income statements, and cash flow statements.

- Eliminate intercompany transactions and balances: Identify and eliminate intercompany transactions and balances to avoid double counting in consolidated financial statements.

- Adjust for minority interests: If the parent company owns less than 100% of a subsidiary, calculate and adjust for minority interests in the consolidated financial statements.

- Ensure compliance with accounting standards: Ensure that the consolidated financial statements comply with accounting standards such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Check for errors and inconsistencies: Review the consolidated financial statements for any errors or inconsistencies, and ensure that they accurately reflect the financial position, performance, and cash flows of the group.

- Disclose any relevant information: Disclose any relevant information, such as significant accounting policies, contingencies, and related party transactions.

- Obtain audit or review: Engage external auditors or independent accountants to audit or review the consolidated financial statements to provide assurance of their accuracy and completeness.

- Communicate with subsidiaries: Clarify roles and responsibilities to prepare consolidated financial statements and resolve discrepancies.

Advantages & Disadvantages

|

Advantages |

Disadvantages |

| It provides a comprehensive view of the group’s financial position, performance, and cash flows, which is helpful in evaluating the overall financial health. | Preparing consolidated financial statements can be complex due to eliminating intercompany transactions and adjusting for minority interests. |

| It is a basis for comparing the group’s financial performance with other companies in the same industry or sector. | Consolidation may not provide a clear picture of individual subsidiary performance due to the blending of financial results. |

| It provides valuable information for making an investment, credit, and other financial decisions related to the group. | The statements may distort the group’s financial performance due to differences in accounting policies or practices between subsidiaries. |

| It reduces the burden of preparing separate financial statements for all subsidiaries and also reduces carbon emissions. | It is possible that they may not provide helpful information for specific stakeholders. |

Frequently Asked Questions (FAQs)

Q1. What are the 6 components of consolidated financial statements?

Answer: The six components of consolidated financial statements are:

- Consolidated balance sheet

- Consolidated income statement

- Statement of Comprehensive Income Consolidated

- Consolidated statement of changes in equity

- Consolidated statement of cash flows

- Notes to the consolidated financial statements

These six components provide a comprehensive view of the financial position, performance, and cash flows, which comply with accounting standards such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Q2. What is the difference between consolidated and regular financial statements?

Answer: Unconsolidated financial statement treats subsidiaries separately, while consolidated financial statement accounts for all subsidiaries collectively. Moreover, the parent company’s ownership stake is essential when compiling a consolidated financial statement.

Q3. What is the definition of a consolidated financial statement according to IFRS?

Answer: According to the standards of IFRS, a consolidated financial statement is prepared in accordance with International Financial Reporting Standards (IFRS), which provides a comprehensive view of the financial position and performance of a group of entities, including a parent company and its subsidiaries.

Recommended Articles

This is a guide to Consolidated Financial Statements. Here we also discuss the definition and purpose of the consolidated financial statement along with its advantages and disadvantages. You may also have a look at the following articles to learn more –