Updated July 19, 2023

Definition of Accounts Payable Cycle

Accounts payable Cycle refers to the series of all the necessary steps that are to be followed by the production, purchase/ procurement, and accounts department to complete all the activities that are essential to acquire the goods & services that includes the three main steps where the first step is to place the purchase order after selecting the vendor than to get the goods delivered and finally paying off the debts to that supplier/vendor.

Explanation

Accounts Payable Cycle refers to the process that must be followed, especially by the production, purchase, and accounts payable division of the company, to complete a purchase of goods & services. The step involves all the essential activities necessary to complete a purchase in a business. The cycle starts with the determination of the number of goods required, selecting the vendor, negotiation with the vendor, placing the order at the decided price, taking confirmation from the supplier, receiving goods & services, an inspection of the goods delivered, entry of invoice and then ends with the payment to the supplier.

Step for Accounts Payable Cycle

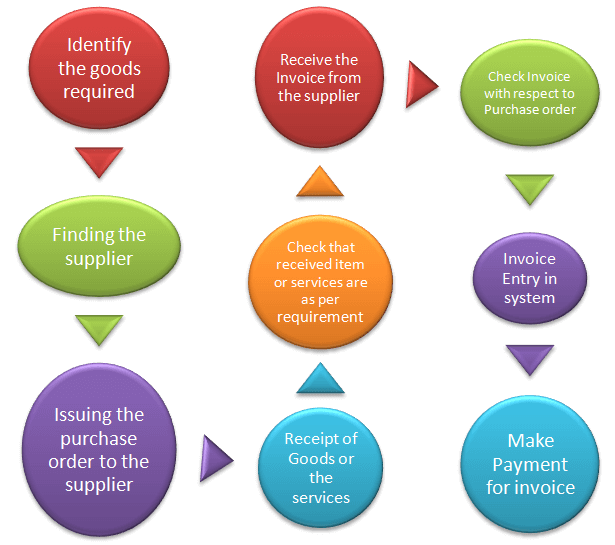

Below is the diagram showing the cycle of Accounts payable.

Now the above steps are explained in detail below:

Step #1: Identify the Goods Required

The company’s production department should first identify the requirements of the materials needed for production in the business. Then the production department should inform about their requirements to the purchasing department of that company.

Step #2: Finding the Supplier

After identifying the requirements of the production department, the purchasing department should verify if any orders for similar materials have already been placed. If the purchasing department has not placed any orders for the required materials, their next step is to initiate a search for a suitable supplier who can fulfill the requirements. The choice of supplier depends upon many factors such as price, locality, credit policies, ease of transportation, past connections of the company with the vendors, etc. Generally, the company places orders with vendors with whom it has regular dealings. In the case of new vendors, the company sends a proposal to all potential suppliers and receives quotations for price and quantity.

Step #3: Issuing the Purchase Order to The Supplier

Then after the selection of a vendor, the purchase order is created in the name of the selected vendor, which states the required quantity of material and the negotiated price along with the other terms & conditions, such as the deadline of delivery, and it is mailed/sent to the supplier, and after that, the acceptance from the supplier is to be received through the mail or other means.

Step #4: Receipt of Goods or the Services

The company prepares a Goods Receipt (GR) to formally acknowledge the receipt of goods when they arrive at the company’s gate from the supplier.

Step #5: Check that the Received Item or Services Are as Per Requirement

After that, the inspection of goods is done, which includes both a quality check & quantity check. In quality check, the company verifies that there are no defective products and ensures that all the products meet the required quality standards.

Step #6: Receive the Invoice From the Supplier

Then the invoice from the supplier is to be received, which states the amount & quantity of material purchased along with the taxes required to be paid on it.

Step #7: Check the Invoice with Respect to the Purchase Order

The company matches the invoice with the purchase order, comparing the quantity and rate mentioned in the purchase order to ensure they align with the quantity and rate on the invoice. If there are any deviations, the company must withhold the payment.

Step #8: Invoice Entry in System

After the successful completion of the steps mentioned above, ledger accounts are updated, and the invoice details are entered in the books of accounts, which contain the information about the date on which payment is due, the rate & quantity of the material purchased, etc.

Step #9: Make Payment for Invoice

The payment can be made through bank transfers, UPI transfers, and net banking, or even in cash which totally depends upon the terms & conditions of the purchase.

Benefits

Different benefits of the accounts payable cycle are as follows:

- The accounts payable cycle tracks all the steps involved in purchasing goods and services, and management can ensure that the company duly follows all the steps and can track back anything that goes missing using the accounts payable cycle to identify the reasons for it.

- Automating the accounts payable cycle can minimize human errors and reduce the time involved in the process.

Disadvantages

Different disadvantages of the accounts payable cycle are as follows:

- The process is time-consuming as this is a long process involving many steps, and even passing on the information to different-different departments takes lots of time.

- Even getting approvals from various departments at different stages is time-consuming, resulting in delaying the payment process.

Conclusion

Therefore, the accounts payable cycle is the series of steps that are followed to complete the requirement of the purchase of goods & services by the company. The main steps of the process of accounts payable are the issuance of the purchase order, receipt of goods and invoice, and then processing of the payment.

Recommended Articles

This is a guide to the Accounts Payable Cycle. Here we also discuss the definition and step for the accounts payable cycle along with benefits and disadvantages. You may also have a look at the following articles to learn more –