Updated June 2, 2023

Difference Between Marginal Costing vs Absorption Costing

Marginal Costing and absorption costing are two cost management techniques used to allocate the cost to the products produced for their valuation. Marginal costing allocates variable costs individually to the products and fixed costs are treated as period costs and deducted as an expense directly from the amount of contribution earned. In absorption costing fixed costs are also allocated to the cost of the product as overheads.

Marginal costing creates a differentiation between product costs and period costs. The variable costs incurred on the products are treated as product costs and the fixed costs incurred by the entity during a particular period are considered as period costs. Thus, in the case of marginal costing, while variable costs are added to the cost of products, fixed costs are not added to the product cost, instead, they are deducted from the contribution to arrive at the value of operating profit. Absorption costing as the name suggests absorbs or charges the fixed costs as well to the product cost. Thus, absorption costing allocates fixed costs also in addition to the variable costs to each product based on an absorption rate.

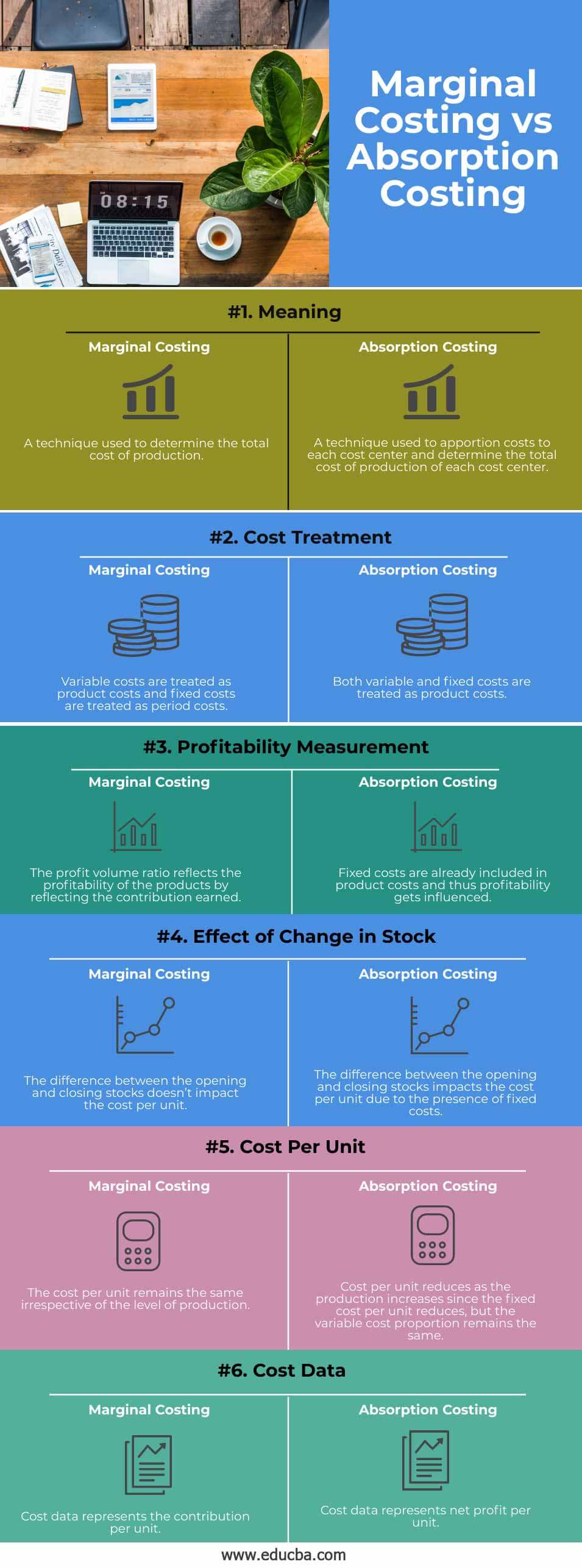

Head to Head Comparison between Marginal Costing vs Absorption Costing (Infographics)

Below are the top 6 differences between Marginal Costing vs Absorption Costing:

Key Differences between Marginal Costing vs Absorption Costing

The key differences between marginal costing and absorption costing are explained below:

1. Meaning

Marginal costing is a cost management technique that is used to determine the total cost of production. Absorption costing refers to the technique that allocates or apportions the total costs incurred to various cost centers to separately determine the cost of production in relation to each cost center.

2. Cost Treatment

Marginal costing identifies variable and fixed costs separately; variable costs are allocated to the product as product cost and fixed costs are considered as period costs and deducted directly from the contribution to arrive at operating profits. Absorption costing considers both fixed and variable costs as product costs and make allocations to the products.

3. Profitability Measurement

The profit volume (PV) ratio is used to measure the profits earned on products in marginal costing. PV Ratio gives the amount of contribution earned on products and fixed costs are reduced from the contribution to arrive at profits. Absorption costing appropriates a portion of fixed costs to products and as a result, the profitability of a product gets affected due to the inclusion of the fixed cost.

4. Effect on Change in Stock

In marginal costing, the cost per unit of a product doesn’t get affected due to variation in opening and closing stock. However, the difference in opening and closing inventory affects the cost per unit in absorption costing due to the effect of fixed costs.

5. Cost Per Unit

The cost per unit remains the same even if the level of production changes since only variable costs are included in product cost. In absorption costing, the cost per unit decreases as the production level increases due to the absorption of fixed costs. However, only the fixed cost reduces per unit and variable costs remain the same.

6. Cost Data

The cost data in marginal costing represents contribution per unit which can be used to calculate total contribution. It is calculated by reducing the variable cost per unit from the unit sales price. In absorption costing, cost data reflect net profit per unit of product which is calculated by reducing fixed and variable overheads from sales price per unit.

Marginal Costing vs Absorption Costing Comparison Table

The differences between marginal costing and absorption costing are tabulated below for better understanding:

|

Basis of Difference |

Marginal Costing |

Absorption Costing |

| Meaning | A technique used to determine the total cost of production. | A technique used to apportion costs to each cost center and determine the total cost of production of each cost center. |

| Cost Treatment | Variable costs are treated as product costs and fixed costs are treated as period costs. | Both variable and fixed costs are treated as product costs. |

| Profitability Measurement | The profit volume ratio reflects the profitability of the products by reflecting the contribution earned. | Fixed costs are already included in product costs and thus profitability gets influenced. |

| Effect of Change in Stock | The difference between the opening and closing stocks doesn’t impact the cost per unit. | The difference between the opening and closing stocks impacts the cost per unit due to the presence of fixed costs. |

| Cost Per Unit | The cost per unit remains the same irrespective of the level of production. | Cost per unit reduces as the production increases since the fixed cost per unit reduces, but the variable cost proportion remains the same. |

| Cost Data | Cost data represents the contribution per unit. | Cost data represents net profit per unit. |

Conclusion

Marginal and absorption costing provide different results in the income statement since both treat fixed costs differently. In marginal costing cost per unit doesn’t include the apportionment of fixed cost, while in absorption costing fixed costs are apportioned to each unit based on an absorption rate which is based on a budgeted production level.

Recommended Articles

This is a guide to Marginal Costing vs Absorption Costing. Here we also discuss the marginal costing vs absorption costing key differences with infographics and comparison table. You may also have a look at the following articles to learn more –