Updated July 17, 2023

Definition of Other Comprehensive Income

Other comprehensive income, commonly known as OCI, refers to those items of income or expenses that are not recognized in the profit or loss of an entity as a result of requirements mentioned in accounting standards.

Based on the treatment specified in the accounting standards, these items may or may not be reclassified into the profit or loss of an entity upon fulfillment of certain conditions.

Explanation

Some items of income and expenses are not transferred to the profit or loss of the entity; instead, they are shown as “other comprehensive income.” The amounts in this segment are transferred to the equity side of the balance sheet as “other equity.” These amounts do not impact the net profits of the entity. Items of income, expenses, gains, or losses are classified as OCI when they are yet to be realized by a commodity, and the accounting standards prescribe that such items be transferred to OCI.

Accounting standards also prescribe whether the items can be reclassified to the profit or loss when the objects are realized later. If an accounting standard allows a particular item of OCI to be reclassified to profit or loss, then the same shall be transferred from OCI to profit or loss once the conditions are met.

Examples of Other Comprehensive Income

The most common examples of other comprehensive income are listed below:

- Fair value gains or losses relating to PPE (Property, Plant & Equipment) when the entity follows the revaluation method, and the PPE is revalued to its fair value.

- Gains or losses on account of change in fair value of financial assets are classified under the category “Fair value through other comprehensive income.”

- Gains or losses due to remeasurement of liabilities under defined benefit plans, i.e., pension plan.

- Gains or losses arise due to the translation of the financial statements of a foreign operation or in case of translation when the functional currency is different from the reporting currency.

Categories of Other Comprehensive Income

There are two categories of other comprehensive income:

- Other comprehensive income that is to be reclassified to the profit or loss

- Other comprehensive income that is not to be reclassified to the profit or loss

Whether an item is to be reclassified is based on the accounting standards prescribed for such an item. When an item is reclassified to the profit or loss by an accounting standard, the amount lying in OCI is transferred to the profit or loss, and the amount accumulated as OCI in the equity portion of the balance sheet moves to retained earnings. Further, when an entity makes reclassifications, it is required to disclose such reclassification such as the nature, amount, and reason for the reclassification.

What is Included in Other Comprehensive Income?

As stated earlier, those items of income, expenses, losses, and gains are included in OCI, which are yet to be realized. Consider an example where an entity holds an item of PPE revalued at the end of the reporting year. This resulted in OCI gains, which are to be accumulated into other equity as the revaluation surplus. The revaluation gains are classified as OCI in this case because the gain is not yet realized, and the same will be realized only when the item is disposed of. When the PPE item is disposed of, the amounts in revaluation surplus are transferred to the profit or loss as income. This is done by GAAPs and IFRS.

Reporting for Other Comprehensive Income

The reporting for other comprehensive income is explained below:

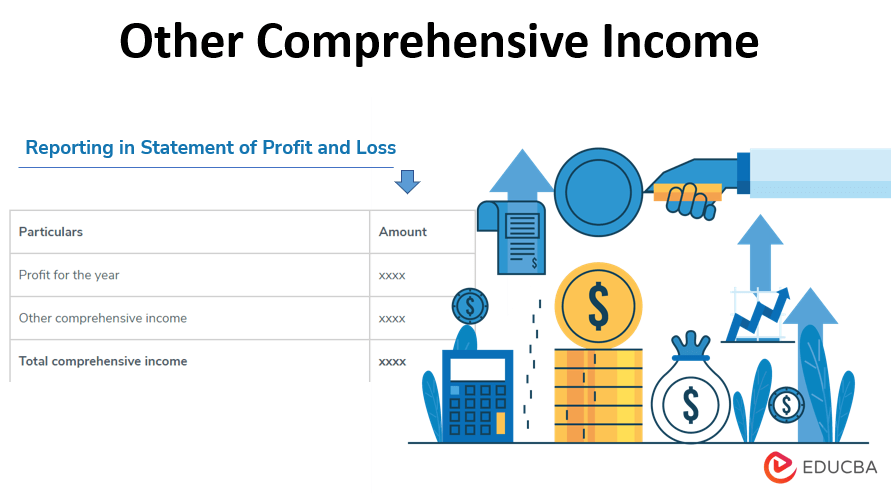

Reporting in Statement of Profit and Loss

The amount of OCI is shown in the profit and loss statement separately from the profit or loss. Profit or loss represents the net income earned by an entity, excluding OCI. The amount of profit or loss and OCI are added to determine “total comprehensive income.”

| Particulars | Amount |

| Profit for the year | xxxx |

| Other comprehensive income | xxxx |

| Total comprehensive income | xxxx |

Reporting in Balance Sheet

The accumulated amount of OCI is shown in equity in the balance sheet under the heading “Other Equity.” A statement of changes in equity is also prepared as part of the financial statements of an entity under which changes in other equity are shown. In this statement, changes in OCI that have occurred during the year are disclosed in their respective nature.

Importance of Other Comprehensive Income

Classifying items in OCI is essential as it helps identify the company’s overall profitability and earnings. Placing items as OCI in the statement of profit and loss account gives a clear idea about the profits accrued to an organization subject to realization. This leads to transparency in financial reporting.

Conclusion

Classifying items as other comprehensive items is based on GAAP and applicable accounting standards such as IFRS. It represents the gains or losses which are yet to be realized. The amount lying in OCI doesn’t affect an entity’s retained earnings.

Recommended Articles

This is a guide to Other Comprehensive Income. Here we also discuss the definition and categories of other comprehensive income along with examples and importance. You may also have a look at the following articles to learn more –