Updated July 17, 2023

What is Green Bonds?

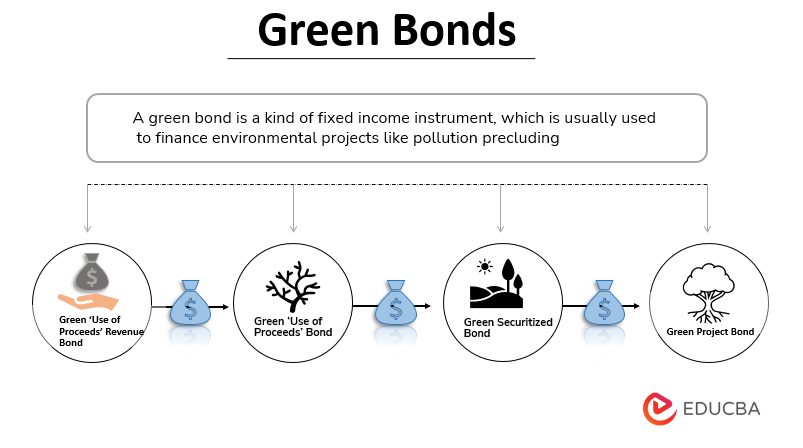

A green bond is a kind of fixed income instrument, which is usually used to finance environmental projects like pollution precluding, healthy water, decent transportation, etc. Such bonds are backed up by the issuer’s balance sheet so they hold the same credit rating as the issuer’s.

Explanation

The first green bond was issued by the World Bank in the year 2009. It is used for financing and encouraging climate-related and other environmental projects. These bonds precisely finance projects such as pollution precluding, healthy water, proper agricultural facilities, decent transportation, proper water supervision, etc. It also provides incentives to attract more investors.

These bonds are associated with assets and are backed up by the issuer’s balance sheet, so they have the same credit rating as that of the issuer.

How Does it Work?

Green bond markets provide investors with the opportunity to support environmental projects without any need for forfeiting financial returns. They are usually created to boost the fund or to finance environmental projects or climate change projects. The investors in the bond are entitled to get knowledge about the project they have invested in; the issuer has to provide detailed information about the project to investors investing in green bonds.

Examples

- USA: Tesla Motors Inc. was a great example. In the year 2013, it issued $600 million in convertible bonds.

- London Stock Exchange (LSE): The London stock exchange had introduced bond segments to give investors a fair picture of the green projects.

- Nigeria: To finance projects such as solar power, transportation, deforestation, etc., The Nigerian nation issued green bonds of $64 million to local investors.

Types of Green Bonds

They are a type of fixed income instrument used to finance environmental projects. They are classified into four types.

- Green ‘Use of Proceeds’ Revenue Bond: These types are secured by the projects producing income.

- Green ‘Use of Proceeds’ Bond: These types of bonds are secured by the assets.

- Green Securitized Bond: These types are secured by large pooled assets.

- Green Project Bond: These types are secured by the balance sheet and assets of the project.

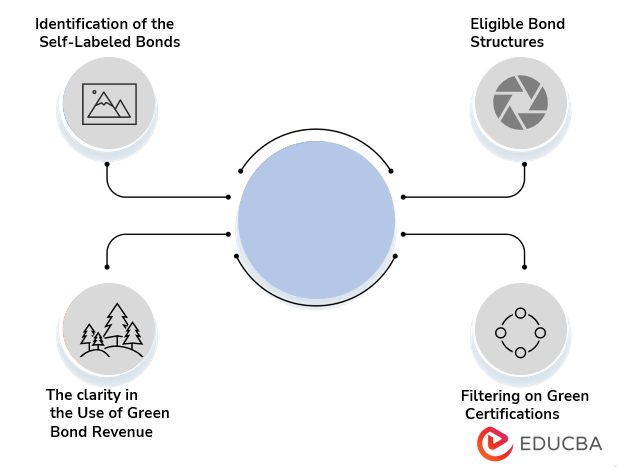

Criteria of Green Bonds

Climate bonds use clear criteria to clarify the bond index. It can be classified by the following process:

- Identification of the Self-Labeled Bonds: The issuer should label the bonds as ‘green’ in a public document to make it valid.

- Eligible Bond Structures: The eligible bond structure is the second step process of the classification of the green bond. Here eligible bonds are divided into two parts i.e. assets-linked and asset-backed structures.

- The Clarity in the Use of Green Bond Revenue: The issuer must use the green bond revenue in the green projects and if the issuer is using more than 5% of the revenue for general purposes then it is not considered green and these bonds will not be included in the green bonds.

- Filtering on Green Certifications: The assets are reviewed by the climate bond and if these bonds come in the climate bond taxonomy then these should be included in the bond list. And if it does not come in the climate bond taxonomy then it should be excluded.

The process of selecting the bonds in the blanket is reviewed yearly basis internally; the external experts can also give their advice whenever necessary.

Development in Green Bonds

Green bonds have shown unfailingly development in the past few years. This shows that the investors, as well as companies, are focusing on environmental growth, and taking the environment extremely important. The revenue is beneficial for green projects. This is because the investment of this revenue in the right place results in the development of projects. Almost every region of the world has seen a tremendous amount of growth in green bonds.

- It boosted $86 billion until the mid of 2019.

- Almost every region of the world has seen growth, precisely Asia has shown growth of around 30%.

- There was a dominance of Europe in the green bond market but it is taken by France which then became the most involved issuer nation.

Benefits of Investing in Green Bonds

Some of the benefits are given below:

- Creates Goodwill of the Company: As it is used to finance environmental projects it is a positive way of investing and creates a positive impact on the customers of the company which creates goodwill.

- Encourage More Investors: Many investors are willing to invest in environmental projects only and for them, it is the best possible choice to invest.

- Green Bonds Revenue: The revenue earned can be used by the investor to repay the loan to the bank as well as to increase their working capital.

- Helpful for the Environment: Green bonds help the environment by financing environmental projects which ultimately leads to the development of the environment.

Limitation

Some of the limitations are given below:

- Lack of liquidity: The investors usually look for liquidity while investing but green bonds do not provide this much level of liquidity so the investors hesitate to invest in them.

- Not sustainable: The investor usually prefers to invest in the company when the company is sustainable as a whole. But mostly the issuing companies in the green bonds are based on projects.

Conclusion

Green bonds are very beneficial for our environment as green projects lead to the development of the environment and investing in them also provides the investor with the ability to repay the loan to the bank and to raise the fund level by using green bonds revenue.

Recommended Articles

This is a guide to Green Bonds. Here we discuss the definition and how it works, along with its benefits and limitations. You may also have a look at the following articles to learn more –