Updated July 17, 2023

What is Cash Value Life Insurance?

The term “cash value life insurance” refers to permanent life insurance with a component of cash value savings. The policyholder can use the policy’s cash value component for various purposes, such as taking a loan, withdrawing cash, or paying the policy premium.

However, a life insurance policy’s cash value component is only available until the policyholder survives. If the policyholder passes away, the beneficiaries will receive the death benefit, not the cash value component.

Explanation

In cash-value life insurance, a particular portion of the premium goes for accumulating the death benefit and covering the cost of the association. In contrast, the remaining amount goes into the cash value. Basically, in cash-value life insurance, the premium payment can be divided into three places:

- Cash value

- Cost of insurance benefits

- Policy fees and charges

The cash value component of life insurance attracts interest income and other investment gains as it grows tax-deferred.

How Does it Work?

A cash-value life insurance policy usually sets the premium at a pre-determined rate. The cash value component typically doesn’t accrue until 2-5 years from the policy start date. Once it starts accruing, the cash value becomes available for the policyholder per pre-defined policy guidelines. However, the cash value is open to the policyholder during their lifetime. The insurance company retains the cash value component if the policyholder dies, and the beneficiary receives only the death benefit.

Example

Let us take a simple example to illustrate the concept of cash-value life insurance. Let us assume a policy with a death benefit of $50,000. There is no outstanding loan or cash withdrawal against the procedure and the accumulated cash value of $20,000. Determine the insurer’s liability in case the policyholder passes away.

If the policyholder dies, the insurer must pay the death benefit in full, i.e., $50,000. In such a scenario, the cash value of $20,000 will go back to the insurer. Therefore, the actual liability of the insurance company is $30,000 (= $50,000 – $20,000).

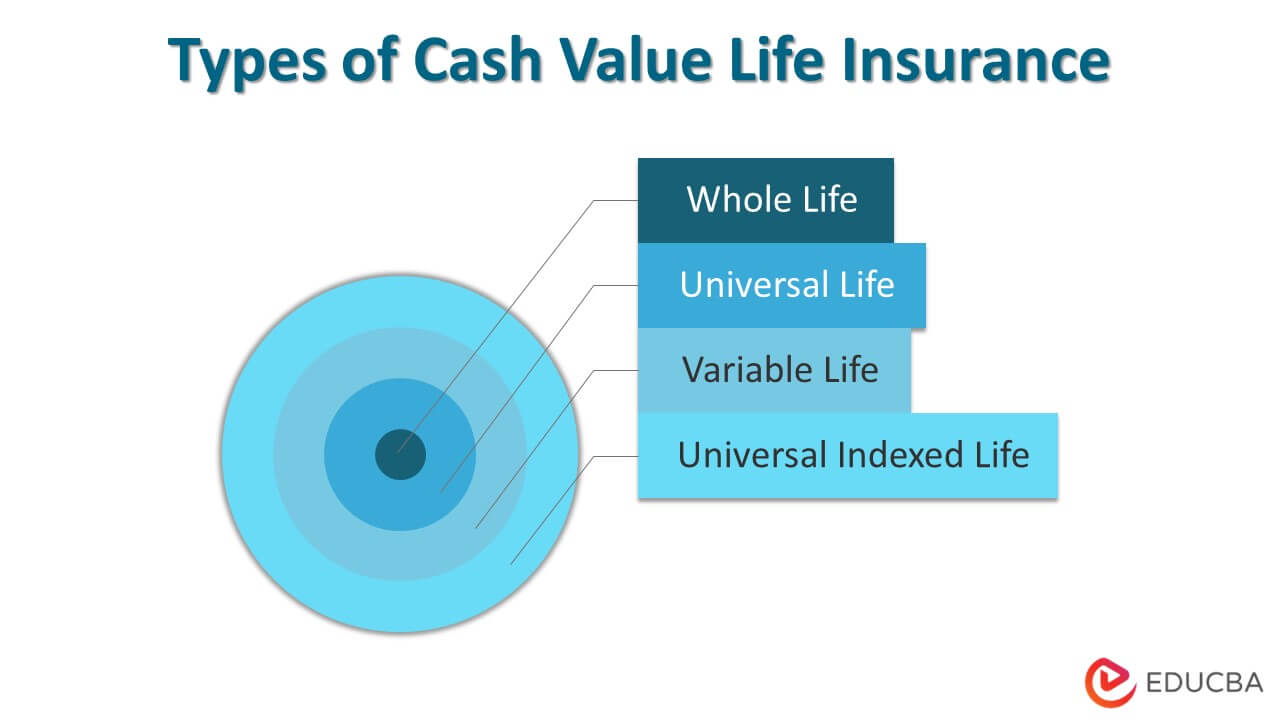

Types of Cash Value Life Insurance

Let us now look at some of the most common policies:

- Whole Life: As the name suggests, this policy type offers the policyholder lifetime coverage. Initially determined based on the policyholder’s age, the premium remains constant over the entire tenure. Starting such a policy at a young age is best as the premium will be lower. The policy is available for a term as short as 15 years that can go up to 65 years.

- Universal Life: This policy offers a lower but guaranteed rate of return and leverages deferred tax methodology. In such a policy, the insurer invests only a small portion of the premium. It should be noted that the policy stays in force as long as the policyholders pay the premiums regularly. It is also known as an adjustable flexible premium policy.

- Variable Life: In this type of policy, the value of the death benefit and the cash value component varies as the insurance company invests the premium into several investment options like the equity market, bond market, etc. As such, the insurer in this type of policy issues a prospectus that states where all the investment has been made. The policyholder is offered the option to select the accounts to invest the premium. Therefore, the investment risk is the primary risk in such a case.

- Universal Indexed Life: This type of policy is very similar to the universal life, but the only difference is that the cash value component is invested in various avenues like indexed funds or indices, such as S&P 500, Moody, etc. Therefore, in this case, the cash value depends on the index’s performance, and the investment risk is the leading risk.

How to Withdraw Cash Value Life Insurance

There are several ways to withdraw cash for life insurance. In the case of universal life, the policyholder has the flexibility to remove a particular portion of the cash value partially. On the other hand, in their whole life, the policyholder can only take out cash value through a policy loan. The other way to withdraw cash value insurance is through policy surrender, after which the policy becomes null and void. A fee will be charged against the withdrawal that varies per policy guidelines and withdrawal method.

Advantages

Some of the significant advantages are as follows:

- The beneficiary receives financial support from the death benefit after the policyholder dies.

- Both the cash value component and the death benefit are assets that can be availed in times of adversity.

- Some insurers pay a dividend on the cash value component that acts as a passive income source.

- Such policies have tax benefits as the cash value grows on a tax-deferred basis.

- The cash value component of the policies can be used as collateral for taking out loans.

Disadvantages

Some of the major disadvantages are as follows:

- The cash value component is not available for withdrawal for the initial 2-5 years.

- This type of policy is costlier than term life insurance policies with similar death benefits.

- The beneficiaries don’t receive the cash value component after the policyholder’s death.

- Usually, cash-value insurance policies generate lower returns than traditional investment avenues.

Conclusion

So, it can be seen that it offers multiple options for investment besides the substantial death benefit for the beneficiaries. The policyholder selects cash value or term life insurance given the benefits and limitations.

Recommended Articles

This is a guide to Cash Value Life Insurance. Here we also discuss the introduction and how it works, along with its advantages and disadvantages. You may also have a look at the following articles to learn more –