Updated July 11, 2023

Introduction to Credit Limit

When a lender offers you a credit card or line of credit, it specifies the maximum amount of credit that can be drawn by availing the credit card or line of credit. This maximum amount of credit is known as the Credit Limit (CL).

Typically, the lending institutions decide the CL based on the information provided by you as an applicant. A CL is a significant factor for personal liquidity as it can influence your credit score and, in turn, impact your ability to access future credit.

How Does Credit Limit Work?

Irrespective of whether you have a credit card or a line of credit, the CL works similarly. As a borrower, you can spend until you reach the CL. If you breach the CL, you will have to pay a penal interest in addition to the regular interest payment on the utilization, adversely impacting the credit score. Hence, it is advisable to maintain the utilization level (= Amount drawn / Credit limit * 100%) well below 100%, resulting in a healthy credit score and a lower borrowing rate.

Example

Let us take the example of David, who has recently acquired a credit card facility from a bank ABC Inc. The CL of the credit card is $5,000, which means that David can spend up to $5,000 with this credit card. Let us assume that David spent $ 3,000 at the start of the current month. Determine the available CL if

- David paid $1,500 at the end of the current month

- David didn’t pay anything

Solution:

Making payments increases your available CL as it is calculated by subtracting the credit utilized during the month from the total credit limit, considering no interest payment for simplicity in this case.

Therefore, if David paid $1,500 at the end of the month, we can calculate the available credit limit.

- Available CL = $5,000 – $3,000 + $1,500

- = $3,500

On the other hand, if David didn’t pay anything, then the available CL can be calculated as,

Available Credit Limit = Credit Limit – Expense During the Month + Payment During the Month

- Available CL = $5,000 – $3,000 + $0

- = $2,000

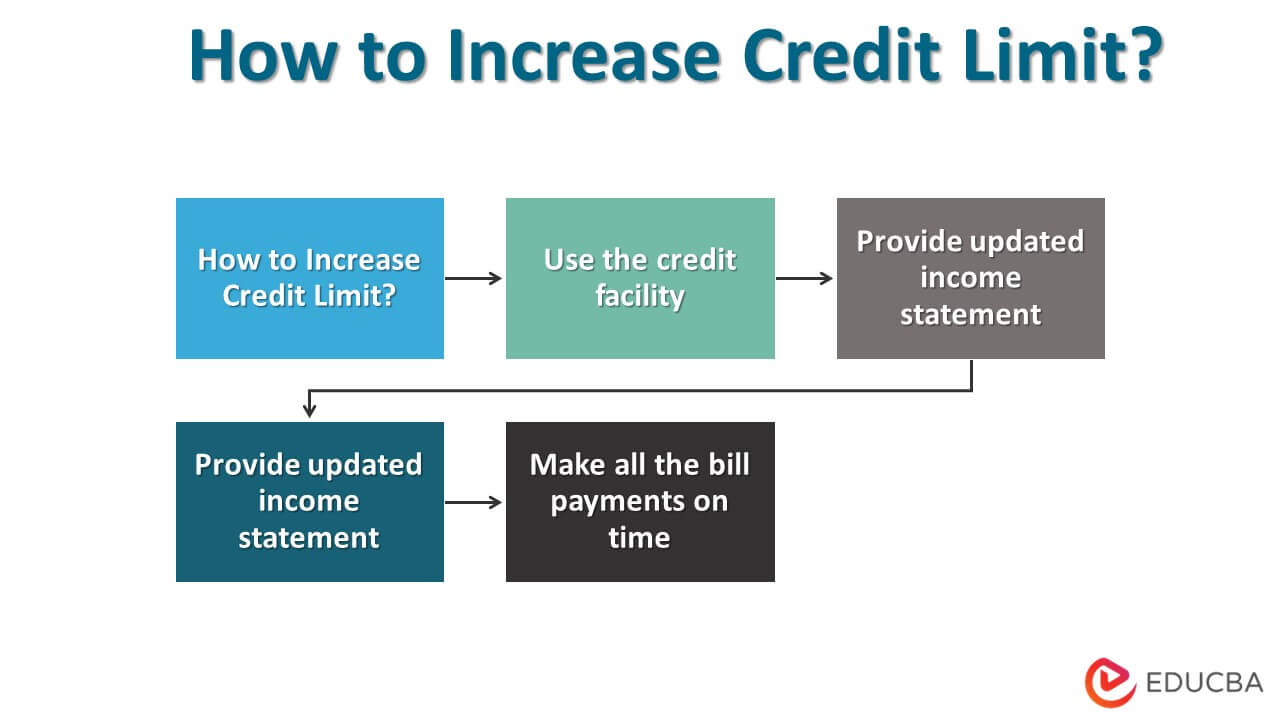

How to Increase Credit Limit?

If you intend to increase the CL of your existing credit facility, then you have to do some or all of the following:

- Use the credit facility: If you use the credit facility frequently and make the bill payments in full and on time, then it is likely that the bank may increase your CL.

- Provide updated income statement: If your income increases, you should provide the updated income statement (latest payslips) to the bank and request to enhance the existing limit. The bank will be willing to increase the CL in such a scenario.

- Apply for a new credit facility: If your existing bank is unwilling to increase your CL and you have a healthy credit history, you can also apply for a new credit facility, which might come with a higher CL.

- Make all the bill payments on time: If you make all the bill payments regularly and on time, your credit score will be healthy, and any lender will see you as a low-risk borrower. So, you must be patient and wait, as the bank may automatically offer you a higher CL.

How is Credit Limit Calculated?

Typically, lending institutions take into account the following factors while calculating the CL:

- Credit History: Your credit score is one of the most critical factors in calculating your CL. If you can maintain a clean credit history (no defaults or delayed payments), you can retain a good credit score, resulting in a higher CL and lower borrowing rate. On the other hand, if you have several defaults indicating reckless credit behavior, likely, banks may even reduce the existing credit limit. [Note: No credit history can also harm a prospective borrower as the lenders end up with no credit track record to rely on.]

- Debt-To-Income Ratio: The lenders also evaluate your income to assess the amount of debt that you can afford to repay. However, a higher income doesn’t guarantee a higher CL, as the banks are more interested in your debt-to-income ratio. The banks also look at the number of debts and your debt servicing history. Effectively, a higher debt-to-income ratio results in a lower CL and vice versa.

- Credit Limit Offered By Other Lenders: At times, the banks also take cognizance of the CL offered by the other banks while calculating the CL of their facility. So, the limit of your other facilities can also be one of the factors in deciding the credit limit.

What is a Good Credit Limit?

In the UK, the average CL lies in the £3,000 to £4,000, while some higher-income earners with a healthy credit history enjoy a credit limit of more than £10,000. On the other hand, the average credit limit in the US is around $22,750. It can be inferred that the definition of a reasonable credit limit varies across locations, and there cannot be any single correct answer to this question.

Conclusion

- A CL is the maximum credit a lender extends to a borrower.

- Lenders calculate the credit limit based on the borrower’s credit history, debt-to-income ratio, and existing credit limits.

- Low-risk borrowers are offered higher credit limits and vice versa.

Recommended Articles

This is a guide to Credit Limits. Here we also discuss the definition and how credit limits work, along with an example. You may also have a look at the following articles to learn more –