Updated July 14, 2023

Definition of Subordinated Debt

Subordinated debt (also known as junior debt) is a type of unsecured debt instrument that has lower priority over senior debt instruments or other corporate debts which has higher priority. In liquidation, such subordinated debt instruments are paid only after the senior debt instruments are paid in full.

Explanation

- The normal meaning of the word subordinate is “lower in ranking or position”. Debt means “a sum of money owed or due to another person”. Thus, subordinate debt is a type of debt instrument with lower priority.

- The said debt instrument has similar features to any other debt instrument, with the only exception concerning the priority of payment. Such priority of payment is necessary only in case of liquidation of the bond issuer. Otherwise, the debts are normally secured.

- Subordinated debt holders bear heavier risk than unsubordinated debts. This is because the holders of such instruments require a higher risk appetite. Thus, such bondholders are normally big corporate institutions. As a result, the credit rating is lower & they require a higher yield than what is paid to senior debt holders.

- The senior debt holders rank the higher priority of payment in the case of liquidation of the debtor. However, even if subordinate debts are riskier, they are paid before the settlement of equity holders of the Company. Thus, these cannot be said to be completely unsecured.

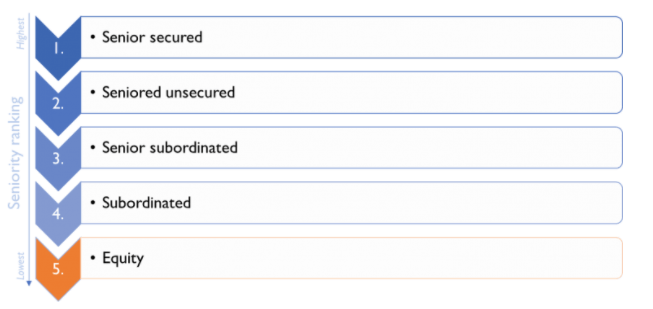

- The seniority of payment can be represented through the following charts:

Image Source: http://finanium.com/seniority-ranking-of-debt-securities-in-case-of-defaults/

How Does It Work?

- The debt issuer will issue bonds with its priority ranking features. The investors will invest as per their preference & risk rating appetite.

- Big corporations will invest considering the risk involved if the corporate issuer liquidates before maturity.

- During the period of holding bonds, the investors will receive interest from the issuer. If no liquidation occurs before the maturity date, all debt holders will get paid in full.

- However, in liquidation, the court will prioritize the outstanding loans. The court decides who will have the assets first. The debts which have a lower ranking in terms of payment will be classified as subordinated debt. The bondholders who will receive first are called priority debt holders.

Example of Subordinated Debt

Say a Corporation that operates has issued bonds with different maturity & face value. The details about the corporate issuer & its features are as follows:

| Particulars | Bond A | Bond B | Bond C |

| Face Value | $1,50,000 | $1,50,000 | $1,20,000 |

| Maturity (years) | 15 | 13 | 10 |

| Ranking | 1st | 2nd | 3rd |

| Interest Rate | 8% | 8% | 11% |

| Payment priority before | Equity | Equity | Bond A & B |

The Company is facing financial difficulties & has an approach for liquidating the entity. The status of the equity & liquid assets available for distribution is as follows.

| Assets of the Company available for distribution | $8,25,000 |

| Equity Share Capital | $9,00,000 |

Solution:

Bonds A & B B are unsubordinated since they have repayment priority before equity shareholders of the entity. Bond C is the subordinated debt, as confirmed by features & higher interest rates.

The repayment schedule would be as follows:

| Particulars | Amount ($) |

| Available assets for distribution | $8,25,000 |

| Less: Repaid to Bond A | $-1,50,000 |

| Less: Repaid to Bond B | $-1,50,000 |

| Net assets remaining | $5,25,000 |

| Less: Repaid to Bond C | $-1,20,000 |

| Net assets remaining | $4,05,000 |

| Less: Repaid to equity shareholders | $-4,05,000 |

| Loss borne by equity Shareholders | $4,95,000 |

Explanation:

- Since sufficient funds are available, bonds A & B are paid simultaneously. However, in case of insufficient funds, Bond A & B would be paid on a pro-rata basis & the holders of Bond C would get nothing.

- The equity holders must bear a loss of 55% of the amount invested at normal values.

- Thus, in any case, the subordinated bond holders get priority over equity shareholders.

Why Does Bank Issue Subordinated Debt?

- One needs to understand the difference between subordinated debt & normal debt. Normal debt holders have a normal risk rating & normal payment terms with a general charge over the assets. Normal debt is paid as & when the amount realizes from the secured assets in case of liquidation of the entity. Subordinate debts bear a much higher risk. Being junior in nature, these are paid only after the senior or normal debts are paid in full.

- Banks or other financial institutions are sensible enough to lend hard-earned money to the corporate issuer. The lender analyses the business of the corporate entity & all the associated risks in respect of such debt. Thus, it is very clear that such debt cannot offer to an entity with a small expansion base or small capital. Therefore, most subordinate debts are offered to large corporates flooded with sufficient DSCR (Debt Service Coverage Cost) & excess cashflows.

- After all committed costs, large corporations experience a flood of super cashflows. The lender is expected to issue capital to the entity more quickly to achieve a faster payback period.

- Large corporations are backed by sufficient experience in the relevant field or business of the company. Thus, the corporate has seen all the ups & downs of the business cycle. Also, the lender can analyze the strengths, weaknesses, opportunities & threats before providing the capital amount. Thus, it provides the overall picture to the lender of everything about the corporate issuer.

- Also, the solvency ratio of the large corporation is supported by break-even ratios, sensitivity ratios with respect to adverse movement in the selling prices & primary raw material prices, and critical liquidity ratios.

- Further, in the worst-case scenario, a larger corporation’s bankruptcy probability is much lower than a business with lower capital & lower domination in the market. Above are some reasons lenders offer capital in subordinated debts, even if the repayment priority is lower than normal debt.

Uses of Subordinated Debt

- Senior bondholders sometimes issue subordinated debts as an obligation regarding the priority of repayment. Thus, it provides assurance to the senior bonds about the ranking in payment.

- Anyways, the bank or the financial lender received the principal amount before the preferred equity & equity shareholders.

- These can be issued as a part & parcel of a securitization debt, which is backed by assets or any collateral security.

- In a few cases, the subordinated debt offers fixed monthly (in the form of dividends) if combined with other financial instruments.

- The cost of the issue is lower for subordinated debts.

- Further, it ensures no dilution of equity holders’ stake in the Company.

- It provides flexibility to the corporate issuer in respect of payment & thus reduces the stress over debts.

- Corporations consider subordinated debts as a long-term capital solution.

- Subordinated debts also have special provisions in tax laws for benefits or exemptions.

Conclusion

Subordinated debt (also considered junior debt) is riskier than unsubordinated or senior debt. Thus, potential lenders should consider the existing debt obligations of the corporate issuer before providing the capital amount. However, one should note that the lender checks various parameters before granting the loan amount. Also, the lender receives a higher interest rate than normal debt holders due to the higher risk involved.

Recommended Articles

This is a guide to Subordinated Debt. Here we also discuss the definition and how does subordinated debt work? Along with advantages and disadvantages. You may also have a look at the following articles to learn more –