Updated July 10, 2023

What is Interest Rate Derivatives?

The term “interest rate derivatives” refers to the financial instruments whose values are linked to the movements in the market interest rate. These financial instruments can be in the form of futures, swaps, or options.

Financial institutions, banks, institutional investors, and companies use interest rate derivatives to hedge their positions and safeguard themselves from adverse changes in the market interest rates. In addition, these financial instruments are also sometimes used to refine an investor’s risk profile or speculate on interest rate movements.

Explanation of Interest Rate Derivatives

An underlying asset drives the value of any financial instrument, and in the case of an interest rate derivative, the market interest rate is the underlying asset. Interest rate derivatives can be as simple as plain vanilla-like interest swaps or as highly complex as exotic Bermudan swaptions. These financial instruments are usually used either to hedge against interest rate risk or to speculate on the direction of market interest rate movements in the future.

How Do Interest Rate Derivatives Work?

There are various types available in the market. However, the interest rate derivative is the most commonly used swap. So, let us look at how an interest rate swap work.

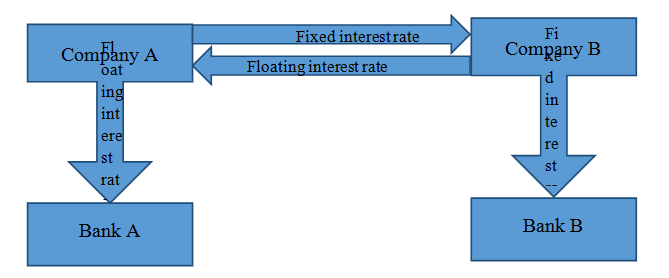

In an interest rate swap, two parties agree to exchange their loan arrangements, specifically swapping the interest payments while keeping the ownership of the corresponding debt unchanged. This means that only the interest payments are affected by the swap. For example, Company A pays a floating interest rate to Bank A, while Company B pays a fixed interest rate to Bank B. Both companies enter into an interest rate swap agreement, where Company A will pay the fixed interest rate, and Company B will pay the floating interest rate. Suppose the fixed interest rate exceeds the floating interest rate. In that case, Company A will pay the difference to Company B. Conversely, Company B will pay the difference to Company A if the fixed interest rate is lower than the floating interest rate.

Example of Interest Rate Derivatives

Example #1

Let us assume that ABCInc. had raised $20 million from the debt market at a floating interest rate, which effectively comes to be 4.5%. Now, the management of ABC Inc. is apprehensive that the market interest rates might surge in the future. On the other hand, SDF Inc. also has a loan of $20 million, on which it pays a fixed interest rate of 5%. SDF Inc. intends to move to a floating interest rate to take advantage of the lower rate. So, the two parties decided to enter into an interest rate swap agreement for the next three years. Determine the flow of interest payments in a quarter if

- the floating interest rate continues to remain at 4.5%

- the floating interest rate increases to 6%

Solution:

Given, Notional amount = $20 million

Since the floating interest rate of 4.5% is lower than the fixed interest rate of 5%, ABC Inc. will have to pay the differential interest payment to SDF Inc., which can be calculated as,

Quarterly interest payment ABC -> SDF = (Fixed Interest Rate – FLoating Interest Rate) * Notional Amount * 90 / 360

- Quarterly interest payment ABC -> SDF = (5% – 4.5%) * $20 million * 90 / 360

- Quarterly interest payment ABC -> SDF = $25,000

On the other hand, if the floating interest rate surges to6%and becomes greater than the fixed interest rate of 5%, then SDF Inc. will have to pay the differential interest payment to ABC Inc., which can be calculated as,

Quarterly Interest Payment SDF ->ABC = (Floating Interest Rate – Fixed interest Rate) * Notional Amount * 90 / 360

- Quarterly Interest Payment SDF ->ABC = (6% – 5%) * $20 million * 90 / 360

- Quarterly Interest Payment SDF ->ABC = $50,000

Types of Interest Rate Derivatives

There are several types of interest rate derivatives, and some of the major ones have been briefly described below.

- Interest rate swap: In these financial derivatives, fixed interest rate cash flows are exchanged with floating interest cash flows. These instruments convert liabilities from floating to fixed or vice versa. Initially, the value of an interest rate swap agreement is zero, which then changes based on the difference between floating and fixed interest rates.

- Swaption: These financial derivatives allow buyers to purchase an interest-rate swap agreement. The buyers pay a premium for the right to purchase; thus, they are not obligated to purchase.

- Interest rate future: In these financial derivatives, the counterparties agree on the future delivery of the concerned interest-bearing underlying asset.

- Interest rate cap: These types of financial derivatives put a ceiling on the movement of the interest rates and thus provide protection in an increasing interest rate environment.

- Interest rate floor: These financial derivatives protect the holder in a declining interest rate environment.

Advantages

Some of the major advantages are as follows:

- They are risk diversification instruments as they help mitigate the risk of unpredictable swings in the market interest rates.

- These instruments are very useful in lowering the cost of funds.

- They offer more liquidity than the underlying instrument

- These instruments can generate a positive yield regardless of market conditions.

Disadvantages

Some of the major disadvantages are as follows:

- If not implemented judiciously, then these instruments can result in huge losses.

- The inherent complexity of these instruments makes risk assessment very difficult.

Conclusion

Interest rate derivatives mitigate the risks associated with fluctuating market interest rates. However, if not executed wisely, these financial derivatives can result in significant losses, despite their ability to diversify risk and generate positive yields regardless of market conditions.

Recommended Articles

This is a guide to Interest Rate Derivatives. Here we also discuss how interest rate derivatives work with advantages and disadvantages. You may also have a look at the following articles to learn more –