Updated July 13, 2023

Operating Cash Flow Formula (Table of Contents)

What is the Operating Cash Flow Formula?

The term “operating cash flow” refers to the amount of cash a business generates through its regular operating activities during any given period. The formula for operating cash flow for a period starts with the company’s net income, wherein changes in certain assets & liabilities along with any non-cash items are added back, and increases in net working capital are deducted.

Mathematically, the formula for operating cash flow can be represented as,

Examples of Operating Cash Flow Formula

Let’s take an example to understand the calculation of Operating Cash Flow in a better manner.

Example #1

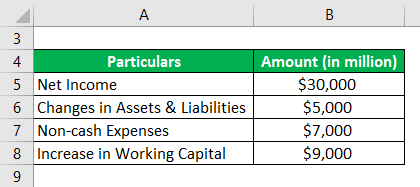

Let us take a simple example of a small firm to explain the computation of operating cash flow. The following financial information is available pertaining to the year 2019.

Solution:

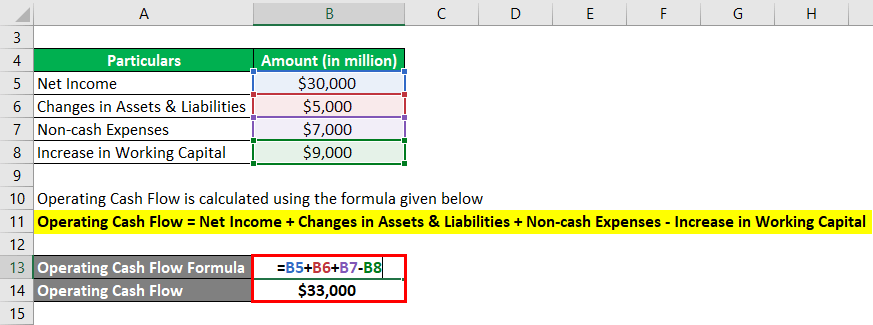

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Net Income + Changes in Assets & Liabilities + Non-cash Expenses – Increase in Working Capital

- Operating Cash Flow = $30,000 + $5,000 + $7,000 – $9,000

- Operating Cash Flow = $33,000

Therefore, the firm generated an operating cash flow of $33,000 in 2019.

Example #2

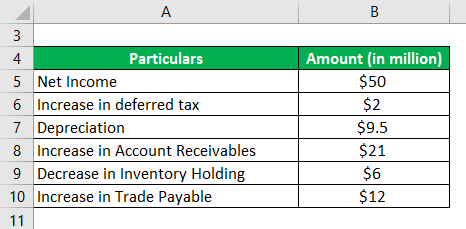

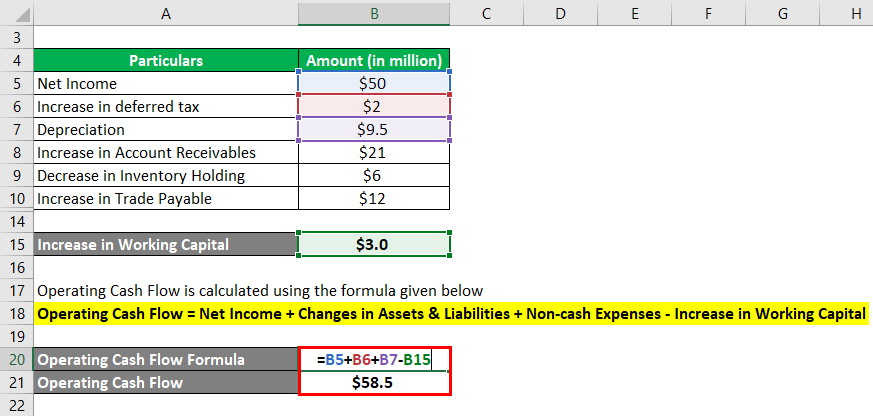

Let us take the example of SDF Inc. to illustrate the computation of operating cash flow. It is a wholesale trader of furniture in California. The company published the following financial information pertaining to the year 2019.

Solution:

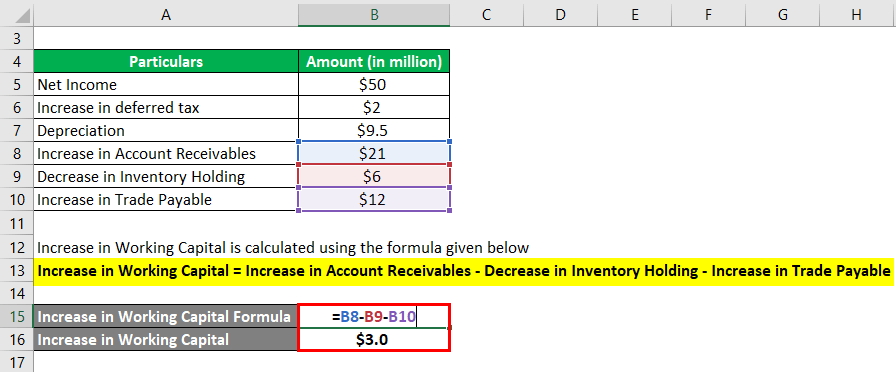

An increase in Working Capital is calculated using the formula given below

Increase in Working Capital = Increase in Account Receivables – Decrease in Inventory Holding – Increase in Trade Payable

- Increase in Working Capital = $21 million – $6 million – $12 million

- Increase in Working Capital = $3.0 million

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Net Income + Changes in Assets & Liabilities + Non-cash Expenses – Increase in Working Capital

- Operating Cash Flow = $50 million + $2 million + $9.5 million – $3.0 million

- Operating Cash Flow = $58.5 million

Therefore, SDF Inc.’s operating cash flow for 2019 stood at $58.5 million.

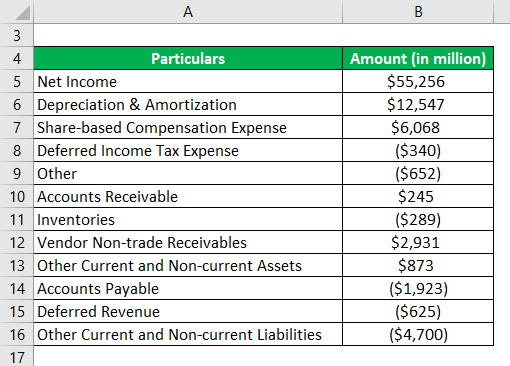

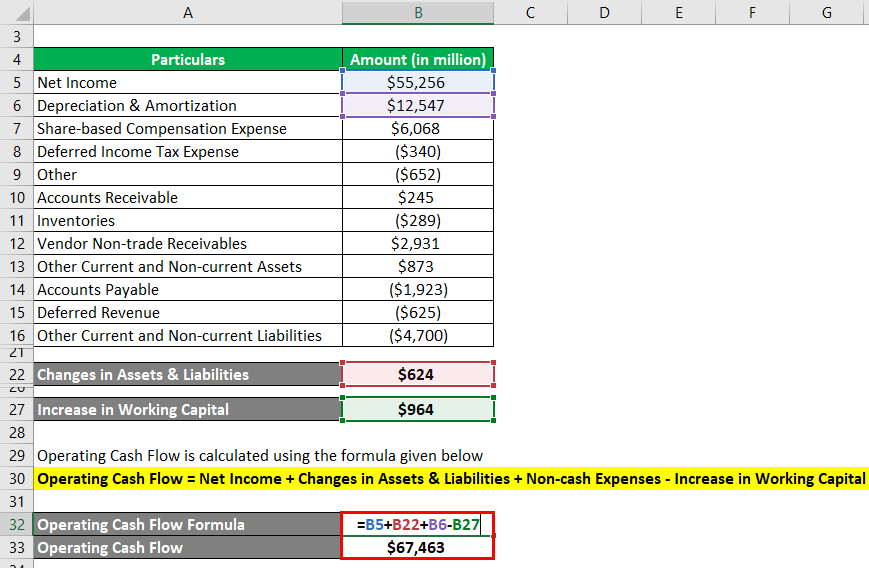

Example #3

Let us now take a real-life example to explain operating cash flow. The following information has been taken from the annual report of Apple Inc. pertaining to the year 2019:

Solution:

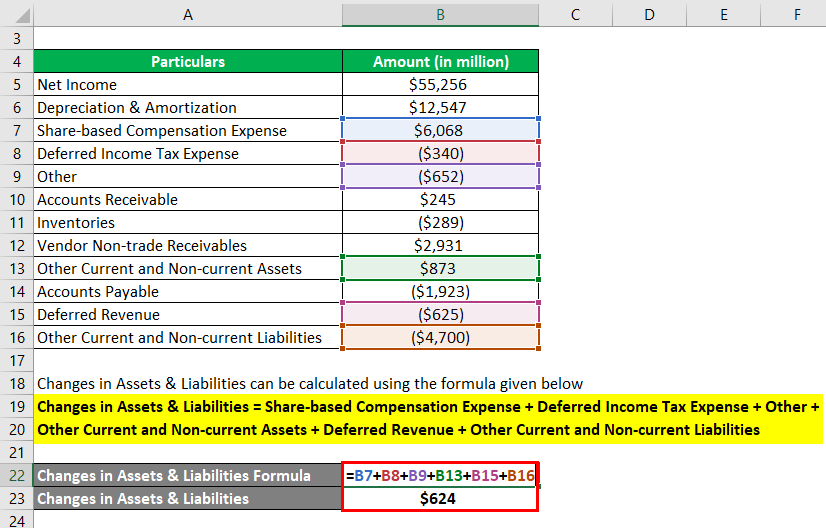

Changes in Assets & Liabilities can be calculated using the formula given below.

Changes in Assets & Liabilities = Share-based Compensation Expense + Deferred Income Tax Expense + Other + Other Current and Non-current Assets + Deferred Revenue + Other Current and Non-current Liabilities

- Changes in Assets & Liabilities = $6,068 million + ($340 million) + ($652 million) + $873 million + ($625 million) + ($4,700 million)

- Changes in Assets & Liabilities = $624 million

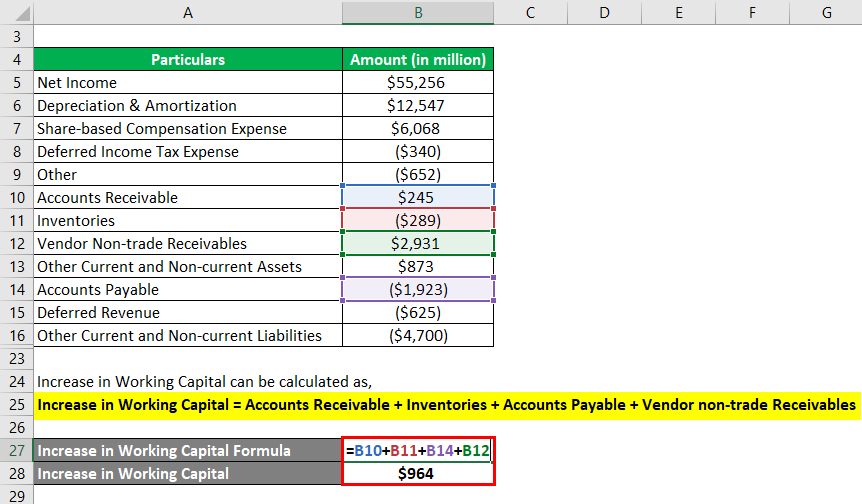

An increase in Working Capital can be calculated as,

Increase in Working Capital = Accounts Receivable + Inventories + Accounts Payable + Vendor non-trade Receivables.

- Increase in Working Capital = $245 million + ($289 million) + ($1,923 million) + $2,931 million

- Increase in Working Capital = $964 million

Operating Cash Flow is calculated using the formula given below

Operating Cash Flow = Net Income + Changes in Assets & Liabilities + Non-cash Expenses – Increase in Working Capital

- Operating Cash Flow = $55,256 million + $624 million + $12,547 million – $964 million

- Operating Cash Flow = $67,463 million

Therefore, Apple Inc.’s operating cash flow in 2019 was $69,391 million.

Link: https://s2.q4cdn.com/470004039/files/doc_financials/2019/ar/_10-K-2019-(As-Filed).pdf

Explanation

The below-mentioned steps can be followed to derive the formula for the operating cash flow of a company:

Step 1: The company’s net income can be taken from its profit & loss account. It is usually the last line item in the income statement.

Step 2: Next, determine the changes in assets & liabilities that refer to changes in certain line items in the balance sheet, which may include movement in deferred tax, stock-based compensation, etc.

Step 3: The non-cash expenses can be taken from the income statement. Some of the common examples are expenses for depreciation and amortization.

Step 4: Next, ascertain the net working capital requirement increase, which is an increase in inventories and trade receivables minus an increase in trade payables. All the line items are available on the balance sheet.

Step 5: Finally, the operating cash flow formula can be derived by adding up net income (step 1), changes in assets & liabilities (step 2), non-cash expenses (step 3), and deducting an increase in working Capital (step 4) as shown below.

Operating Cash Flow = Net Income + Changes in Assets & Liabilities + Non-cash Expenses – Increase in Working Capital

Relevance and Use of Operating Cash Flow Formula

The operating cash flow is important financial information as it captures the cash-generating ability of a company’s core business. Businesses with higher available cash can grow their operations through expansions and new product launches, consolidate their financial position by buying back their shares, pay higher dividends to boost shareholder confidence, or prepay debt obligations. On the other hand, if a company cannot generate enough cash from its core operations, it must raise funds from external sources, such as the debt or equity market.

Conclusion

So, it can be seen that the operating cash flow of a company is an important indicator of its financial position. As such, investors look for this information while analyzing any company.

Operating Cash Flow Formula Calculator

You can use the following Operating Cash Flow Calculator

| Net Income | |

| Changes in Assets & Liabilities | |

| Non-cash Expenses | |

| Increase in Working Capital | |

| Operating Cash Flow | |

| Operating Cash Flow = | Net Income + Changes in Assets & Liabilities - Non-cash Expenses - Increase in Working Capital |

| = | 0 + 0 + 0 - 0 |

| = | 0 |

Recommended Articles

This is a guide to Operating Cash Flow Formula. Here we discuss How to Calculate Operating Cash Flow, practical examples, and a downloadable Excel template. You may also look at the following articles to learn more –