Updated July 13, 2023

Definition of Liquid Assets

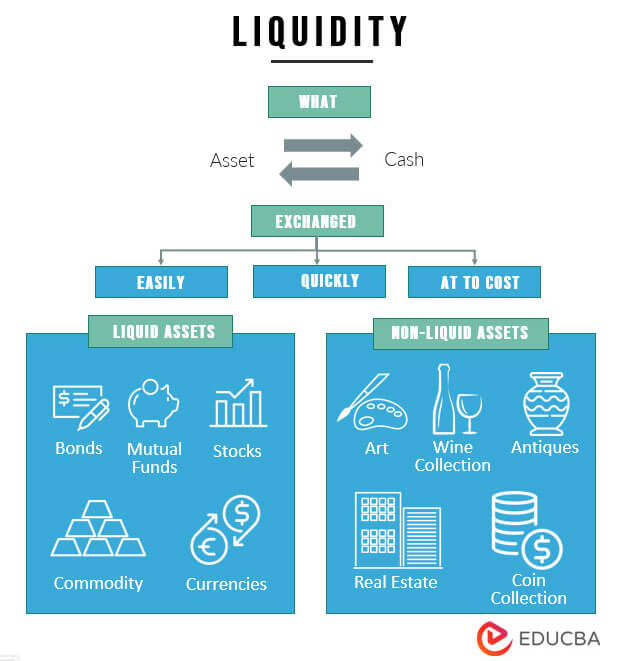

Liquid assets are those readily usable assets of the entity which can easily convert into cash in no time, having an almost negligible impact or zero risks on the value of assets, which can use for making urgent payments of business liabilities, payment of taxes, or transacting urgent business events and which is considered as the most crucial thing in the whole balance sheet of the company.

So in this topic, we will see different examples of liquid assets.

Explanation

- Liquidity refers to how easily an asset can be converted into cash. Having liquidity features in an asset is of utmost importance for a few organizations (and not all).

- Liquid assets can easily convert into realized money in no time because they are on the asset side of the balance sheet. Moreover, the organization can use them for immediate payments when required.

- Its conversion into cash does not take much transaction costs or effort since the ready market is always available. Thus, government bonds and many money market instruments are considered liquid assets.

- Money or currency is the biggest form of liquid asset. One country’s currency can exchange for another country’s currency quickly. This market is known as the foreign currency market, the most traded highest global market globally.

Examples of Liquid Assets

Let us understand the different aspects of liquid assets with the help of the following examples:

Example #1

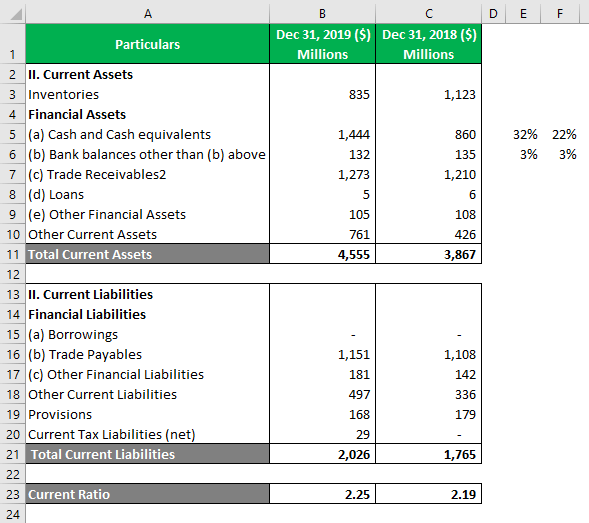

Let us have the extract of a balance sheet:

Explanation:

- As you can see, cash & cash equivalents form 32% of the total current assets of December 2019. The company’s current ratio is $ 4555 / $ 2026 = 2.25. An increased amount of cash & cash equivalents funds this huge number.

- You can also compare the same with December 2018 figures, 22% of total current assets. Thus, the company’s current ratio is $ 3867 / $ 1765 = $ 2.19, which is lower than the current ratio of Dec 2019.

Example #2

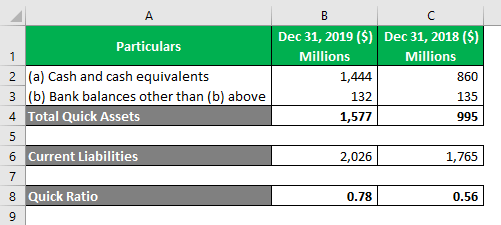

Let us have the same extract for different aspects:

Explanation:

- The quick asset dividend defines the quick ratio by current liabilities. The ratio is 0.78 for December 2019 & 0.56 for December 2018.

- This shows the extent of the importance of liquidity in the company. As a result, the company can pay $ 0.78 for 1$ of the current liability. This increase in the quick ratio uplifts the confidence of the investors.

- Thus, the quick ratio presents the real purpose of liquidity.

Example #3

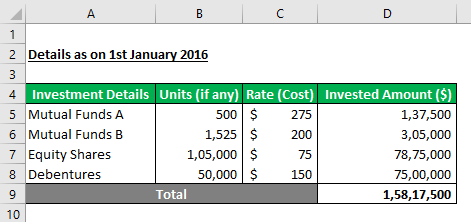

Let us take a look at the liquid assets held by an Individual as of 1st January 2016.

Explanation:

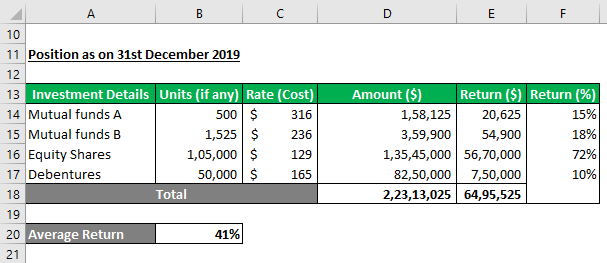

- Let’s say the position of the different investments as of 31st December 2019:

- These investments are held for 4 years, but this does not mean these are not liquid assets. The market rates are specific to the demand for investments in the open market. Therefore, the individual can any time encash these investments to earn profits. The returns are calculated by dividing the return amount ($) by the invested amount in the above table.

- The average return of the individual is $ 6,495,525 / 15,817,500 = 41%.

Example #4

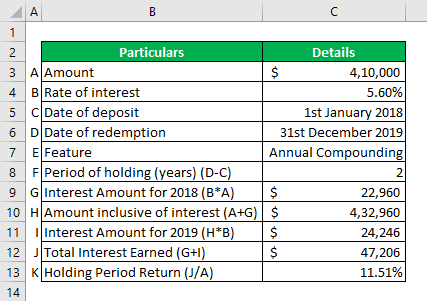

Let us have another example of a fixed deposit.

Explanation:

- The deposit holder can hold the fixed deposit for 2 years. However, fixed deposits are available for redemption as and when needed. Therefore, if the deposit holder wishes to break the fixed deposit today, he would still be eligible to earn interest for the period held to date.

- However, if he waits for the redemption date, he will earn a holding period gain of 11.51%. Thus, fixed deposits are considered the best & easy liquidity solutions.

Example #5

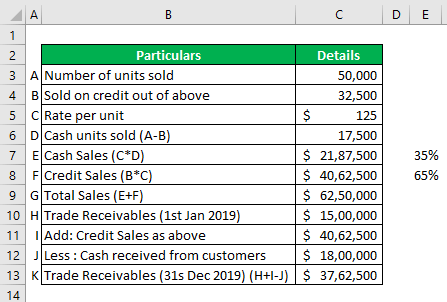

Let us take an example of trade receivables as per the following details:

Explanation:

- As we can observe, 65% of customers are credit customers. The company can sell the huge quantum of 32500 units only because of its credit policy. Accounts receivables are also treated as liquid assets.

- Normally, 1- or 2-month credit is allowed for customers. This increases the confidence amongst the customers.

- Also, companies know the percentage of defaults based on past experience, industry study, and analysis of customers’ purchase patterns and behavior. Thus, the amount on the balance sheet is net of provision for bad & doubtful debts.

- Yet, the balance amount is considered good & shown as a liquid company asset.

Conclusion

Liquidity is the fuel for starting any business venture. It is the first capital required to launch a new business successfully. Higher liquidity implies a greater capacity to pay immediate debt obligations. In some cases, government regulations make it mandatory to keep a certain amount of funds idle & ready for use. Such regulations are made for banking industries. However, one must also know a few non-liquid assets such as different types of coins, art, an investment made in real estate, the goodwill of a business, etc. These non-liquid assets can generate ample funds, but these are not readily saleable & are not made for selling in the normal course of business.

Recommended Articles

This is a guide to Liquid Assets Examples. Here we discuss the overview and top 5 practical Liquid Assets Examples, a detailed explanation, and a downloadable Excel template. You can also go through our other suggested articles to learn more –