Updated July 13, 2023

What is Business Structure?

“Business Structure” refers to an organization’s legal structure within a particular jurisdiction. The legal structure of an organization determines the actions that it can perform, its business responsibilities and obligations, tax regulations, etc.

The choice of the business structure depends mainly on the size and type of the business. Further, one can change the business structure as the company grows and the legal requirements change.

Key Takeaways

Some of the key takeaways of the article are:

- A company’s legal structure impacts its everyday activities and business operations.

- Sole proprietorship and partnership are the simplest forms of business structures as they require compliance with very few regulatory requirements.

- Corporations and limited liability companies offer liability protection to business owners, such that the owner’s assets are safe from business liabilities. But these structures are costly and complicated.

- Usually, entities start as sole proprietorships or partnerships and then gradually move to become corporations as the business evolves.

Purpose

The primary purpose is to define the extent of the business’s legal obligations to its owners. Further, it also states who owns the company, the distribution of profits, and the responsibilities of the managers/ owners, who have varying levels of responsibility in case of wrongdoing based on the business structure. Finally, each business structure is subject to different taxation regulations, which dictate how they are taxed.

Example

There are many examples all around us. For example, hair salons, general stores, sweet shops, or small retail shops are examples of sole proprietorships or partnership firms. On the other hand, many well-known companies, such as Anheuser-Busch, Westinghouse, Blockbuster, etc., have structured themselves as limited liability companies. Examples of corporations include Amazon, Microsoft, Google, Apple, General Motors, etc. The details of the various types have been discussed in the next section.

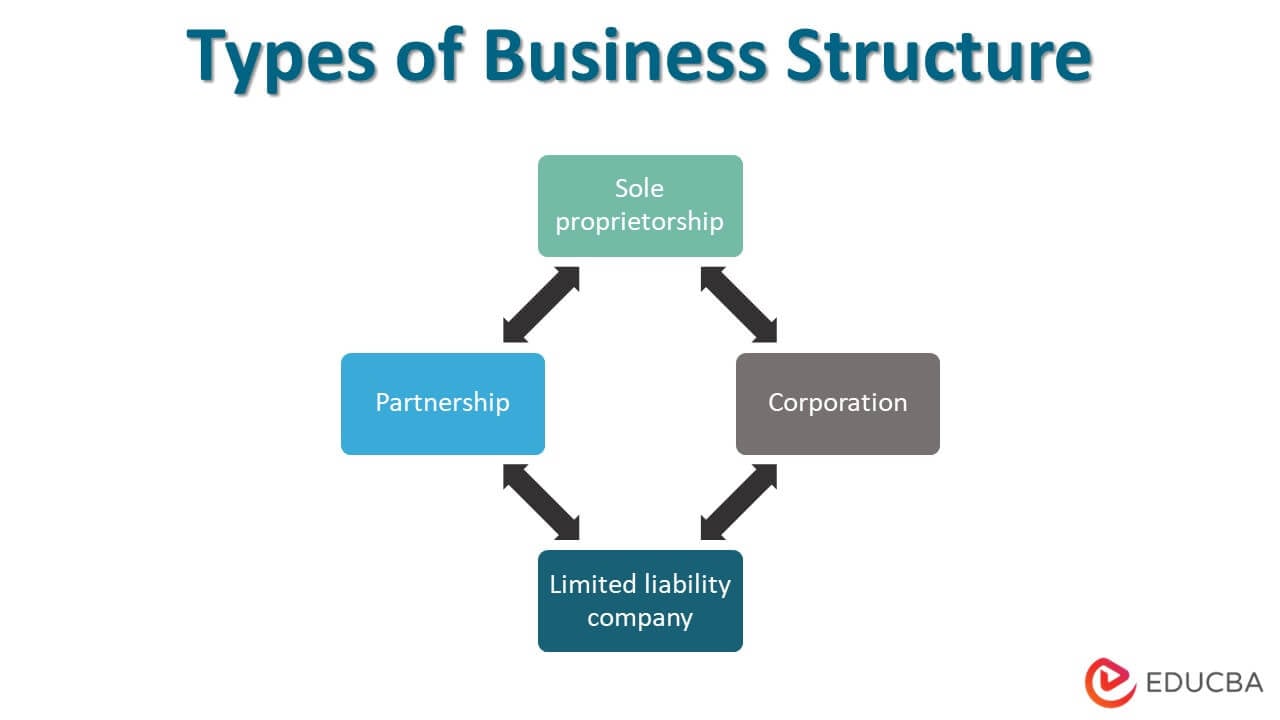

Types of Business Structure

It can be broadly categorized into four types – Sole proprietorship, Partnership, Corporation, and Limited Liability Companies.

1. Sole Proprietorship

It is the simplest and hence most common type. As the name suggests, a sole proprietorship is controlled by one person known as the sole proprietor. This doesn’t separate the business entity from its owner, as both share the assets and liabilities. Sole proprietors capture business expenses and personal income while filing tax returns. Hence, sole proprietors are liable for business losses, and if the business goes into debt, then the personal assets of proprietors might get confiscated.

2. Partnership

Two or more people own a partnership firm. All the partners actively participate in the business operations and are responsible for their liabilities. They also have shared in the profits and losses proportional to their share in the business. In a partnership, it is important to note that the partners’ profits are taxed only at the personal income level.

3. Corporation

A corporation separates the business entity from its owners; corporations are considered independent legal entities. This type provides the highest level of protection from personal liability. However, it should be noted that structuring as a limited liability company (LLC) is often considered more complex compared to other business structures. It requires extensive record-keeping, reporting, and compliance with various regulations and tax requirements. Double taxation occurs in a corporation because the company and shareholders are subject to taxation at the business entity and personal income levels, respectively.

4. Limited Liability Company

A limited liability company or LLC benefits from a sole proprietorship, partnership, and corporation business structure. An LLC separates business liabilities from personal liabilities. It provides liability protection just like corporations but without the pain of double taxation, as the owners can pass through taxes to the personal income level.

Changing Business Structure

It is possible to change the business structure at any time. Typically, companies make a humble start either in the form of sole proprietorship or partnership and eventually switch to a different structure later to cater to the business requirements. However, one must carefully consider, plan and consult professionals and colleagues before delving into structural change.

One of the most common reasons driving the change is taxation. Different business structures follow various taxation regulations and offer additional benefits. Sometimes such structural change can simplify the tax filing process. Some other reasons for business structure change include enhancing the legal protection of the business owners, raising funds, or improving the company’s credibility.

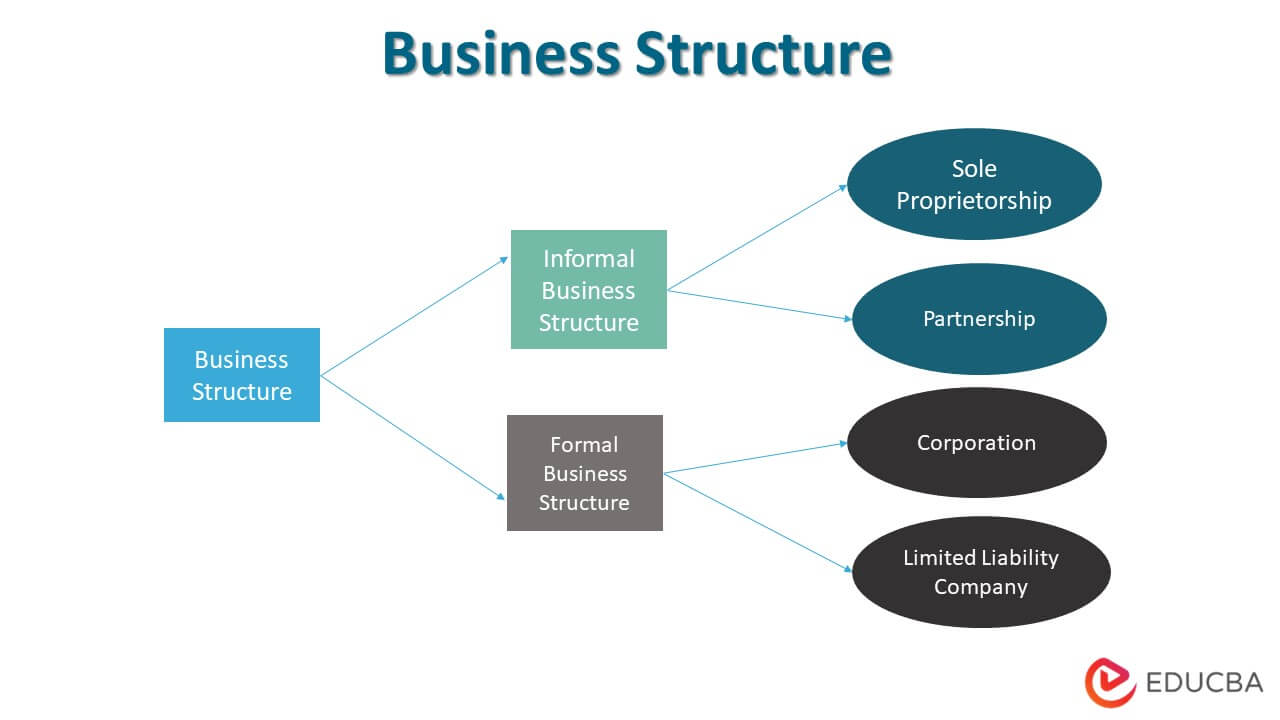

Business Structure Chart

Now, let us have a look at the business structures chart.

Informal business structures like sole proprietorship and partnership don’t provide liability protection because they don’t separate the business entity from its owner. Hence, the owner’s assets remain exposed to business liabilities, such as creditors, lawsuits, etc. However, the biggest positives of an informal business structure are its simplicity and the fact that it is less expensive to start a business.

Business structures like corporations and LLCs provide liability protection because they legally separate the business entity from its owners. Although these business structures are costly, the financial and legal advantages outweigh these disadvantages.

Conclusion

We can observe that owners select business structures based on their requirements. Each structure has advantages and disadvantages, which the owners should consider for choosing the appropriate business structure. Essentially, companies evaluate the benefits offered by each business structure and put it against its cost of deployment and the complexity of the process to identify the best structure for their businesses.

Recommended Articles

This is a guide to Business Structure. Here we discuss the definition, purpose, and types of business structure along with the example. You may also have a look at the following articles to learn more –