Updated July 12, 2023

Introduction to Holding Company

A holding company incorporates as a corporation or LLC and does not engage in any business activities of its own. Instead, it holds a controlling interest in other companies and actively monitors their actions.

Features of Holding Company

Business owners to expand their business operations and scalability, diversify their business into multiple streams, and protect their assets. They establish a holding company to efficiently control various business streams and companies, wherein a single entity owns and controls all the companies. This allows for enhanced control over the other companies.

The parent company has ownership and controlling interest in the subsidiary company, either 100% or just enough stock, which can give them the controlling interest and voting power (i.e.) 51% or more. It doesn’t do any business activities of its own; instead, it invests in the subsidiary company and monitors its activities.

Subsidiary companies, also called operating companies, have their business activities, and that company’s management team independently manages it. It only oversees its activities, and they have the power to add or remove the senior management team of the subsidiary company. The management has the authority to merge or dissolve the subsidiary company, but they do not participate in its day-to-day business activities.

How Does it Make Money?

They can make money by selling their shares or the shares of the Subsidiary company or by external borrowings. It also receives income from its subsidiaries through dividends, Interest, Rent, and any chargeback for the services rendered by the holding company.

Types of Holding Company

Different types are mentioned below:

- Pure: Only for owning the stocks of a subsidiary company, it forms and exercises control over the companies where they have invested without participating in any other business activities.

- Parent: It exists when an organization acquires a controlling stake in another company or starts a new company under its control.

- Offspring Company: Some existing company starts a new company to exercise control.

- Proprietary: It is formed to hold only the total shares of the subsidiary company.

- Finance: It finances the subsidiaries and earns profits through that activity. It does not involve the business operations of other companies.

- Investment: It acts as an intermediary that deals with other companies’ investments. It actively invests in the securities and stocks of multiple companies and subsequently distributes the benefits and returns from these investments to the member companies. It does not involve the business operations of other companies.

- Primary: It is not a subsidiary of any other company. So, it becomes the ultimate holding company, which no other company controls.

- Intermediate: It is a holding company of another company (i.e.) a subsidiary and, simultaneously, a subsidiary to another company.

- Mixed: It runs its business activities and also controls other companies.

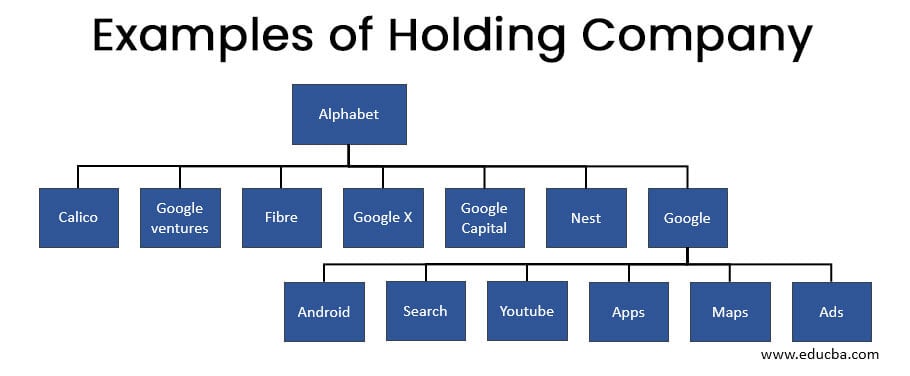

Examples

In the above chart, Alphabet is the Primary holding company with multiple subsidiaries. One of which is Google, an intermediate holding company that acts as both a holding company of other companies and a subsidiary company to Alphabet.

Advantages & Disadvantages of Holding Company

Some of the advantages & disadvantages are mentioned below:

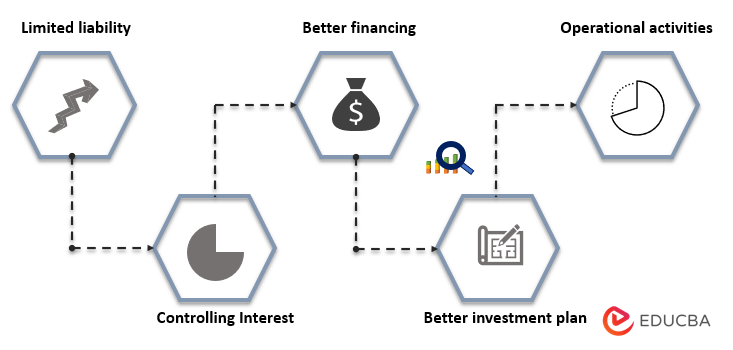

Advantages

- Limited liability: The holding company’s liability is limited to borrowing or credit and cannot be sued for any liability of its subsidiary companies. This legal structure protects the holding company’s assets and acts as a shield.

- Controlling Interest: They can control the subsidiary company with 51% holdings in that company. It need not own the company entirely to exercise the controlling interest.

- Better financing: Holding a company with solid financials can source the debt quickly from the external market compared to the subsidiary company. So they can quickly source the funds and transfer them to the subsidiary companies for business activities.

- Better investment plan: Holding companies can easily invest in other segments, including risky startups and new business avenues. It acts independently and is separated from the activities of the subsidiary company, so it will not affect the sentiments of other shareholders.

- Operational activities: They do not interfere in the day-to-day activities of the subsidiary company as they have their management to run the business. So, considering this advantage, it can manage many companies in different fields by placing trust and reliance on the subsidiary company management.

Disadvantages

- Cost of Operation: Incorporation and management come with an additional charge as it doesn’t have any business activities of its own to generate revenue, and it only brings additional costs like legal, Human resources, etc. A holding company may not be favorable unless multiple companies are manageable.

- Controlling Interest: If it doesn’t have 100% ownership in subsidiary companies, there can be a conflict of opinions in decision-making between the holding company and the minority shareholder. Also, if the holding company is not an expert in the business of a subsidiary company, it will be tough to make the right decisions.

- Difficulty in operation: The structure of the subsidiary company is a little complex and difficult to operate, unlike the single-entity structure. The records containing assets and liabilities must be appropriately maintained to prove to the law and external stakeholders that the companies are independent. The holding company only monitors the activities; if the subsidiary company goes bankrupt and there is no precise maintenance of records, the liability of the subsidiary company will extend to the holding company by lifting the corporate veil.

Conclusion

It is a business entity with no business operations and owns and controls the subsidiary company. It is predominantly formed in the case of multiple business segments, and they want to float each of these segments as a separate business entity; they want to have a single entity to control and manage the activities of all subsidiary companies. The most crucial feature of holding a company is the limited liability feature and protection of the company’s assets.

Recommended Articles

This is a guide to Holding Company. Here we also discuss the definition, features, types, and examples, along with advantages and disadvantages. You may also have a look at the following articles to learn more –