Wholly Owned Subsidiary Definition

A wholly-owned subsidiary is a company that has a parent company that owns its 100% common stock. An example would be Dell owning Alienware or Apple owning Beats.

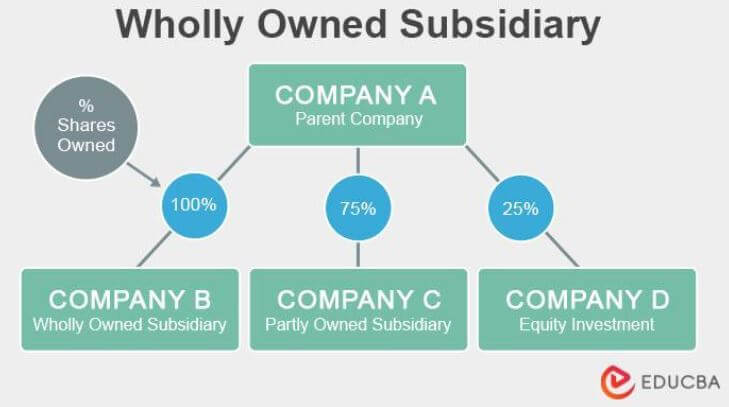

When one business owns another business, the first business is said to be the parent company, while the second business is said to be the subsidiary company. The parent company can either wholly or partially own the subsidiary company. A company is a subsidiary but not a wholly-owned subsidiary if the parent company holds between 51% and 99% of its equity.

Key Takeaways

- A wholly-owned subsidiary is a corporation whose common stock is owned entirely by another company. A company can become a wholly-owned subsidiary after being acquired by its parent corporation.

- Even though the subsidiary is legally separate, the parent company maintains total control over the subsidiary.

- The management control over operations and processes remains with the wholly-owned subsidiary.

- There are numerous tax benefits for a wholly-owned subsidiary. However, both the parent and the subsidiary have to file taxes separately.

Features of Wholly Owned Subsidiary

Some of the features are mentioned below:

- The parent company controls the subsidiary’s operations.

- The subsidiary legally has its own management team.

- The subsidiary can have a different location from the parent company. It can be in another state, country, or continent.

- The subsidiary must have an independent legal identity. However, the shares can be traded on the stock market for both companies to gain value.

- Both companies share the risks and rewards.

Examples of Wholly Owned Subsidiary

Here is an example of how wholly-owned subsidiaries work:

Assume three separate companies, A, B, and C.

A has 100% stock of B. In addition, B has 100% shares of C. In this situation, B and C are wholly-owned subsidiaries of A. Therefore, both companies should consolidate their financial accounts at the group level into the parent firm A.

Real-Life Examples of Wholly Owned Subsidiary

- Starbucks Japan is the Starbucks Group’s subsidiary.

Initially, in 1996, Starbucks Japan was a joint-venture establishment. It was between Starbucks Coffee Japan and Sazaby League. Later in 2006, Starbucks bought Sazaby League’s shares and became the sole owner of Starbucks Coffee Japan. This acquisition was a strategic decision by the company to have a foothold in the Japanese market.

- The Walt Disney Company wholly owns Marvel Entertainment.

Marvel was only a comic book company since its establishment in the 1930s. It had also almost been bankrupt. In 2009, Disney purchased Marvel for $4 billion. This acquisition proved to be the best decision for Marvel Entertainment and Disney.

Advantages and Disadvantages

A wholly-owned subsidiary’s strategy benefits and drawbacks can classify as financial, operational, and strategic.

a) Financial

- When a company is a wholly-owned subsidiary, it can consolidate the financial statements with its parent company. Other than tax benefits, it provides significant financial resources. The profits from either company can be invested in assets or to expand the firm. They can also reduce costs by interlinking their technologies.

- However, a considerable disadvantage would be the possibility of mistakes. A minute error can substantially impact their performance altogether.

b) Operational

- The parent company controls the management of the subsidiary at some level. Both companies can combine their resources and size to bargain deals. They can use either company’s expertise to attain growth. The integration of both their teams can lead to better administration and development.

- The disadvantage of this arrangement could be the lack of operational flexibility. In other words, the subsidiary’s success is dependent on its implementation.

c) Strategic

- Effective strategy building is one of the various advantages. If the subsidiary is foreign-based, the parent can use its resources to initiate overseas projects. It can lead to setting a base in an international market. It is also cost-effective.

- The only disadvantage can be due to cultural differences. Every country and company has different work cultures, which can overlap.

How is Accounting Done?

When a company is a wholly owned subsidiary of a parent company, they use consolidated accounting. In this method, the subsidiary’s financial statements merge with the parent company’s.

In this case, there is a requirement to record all intercompany loans from the subsidiary to the parent. They should also note investments from the parent to the subsidiary. Moreover, charges apply to overhead costs and payroll expenses.

Completing all adjusting entries and reviewing all financial statements is a must. If there have been any substantial profits, filing tax liabilities is necessary. After thoroughly reviewing all these essentials, the parent company can issue the financial statements.

Tax Advantages of Wholly Owned Subsidiary

The Wholly-Owned Subsidiary structure enables greater control over the business and its operations while reducing taxes and other liabilities. A Wholly-Owned Subsidiary is one of the most common subsidiary structures worldwide, but one should consider its specific tax advantages before incorporating it.

The tax advantages also depend on the company’s location.

A wholly-owned subsidiary is a company that is legally separate from its parent company but still retains all the same shares and assets. A parent company can set up a subsidiary in any country and be treated as an independent company for taxation purposes.

Tax benefits for the wholly-owned subsidiary include the following:

A) Taxation of Income and Dividends from Foreign Subsidiaries

The income from a U.S. subsidiary may be subject to U.S. tax if it is not a qualified or controlled foreign corporation. However, the profits would not be taxed if the subsidiary company were in a foreign country.

Suppose the foreign-based subsidiary distributes dividends to shareholders of the parent company, then it will be subject to taxation. However, If dividends are paid to non-resident shareholders, the government will not impose any withholding tax on these payments.

B) Organizations Exempt from Taxation

Tax-exempt organizations are those that are not subject to taxes. They may be nonprofit, religious, or educational institutions. Nonprofit and religious organizations are exempt from taxation because they conduct charitable activities and provide public service by guiding and supporting the people. Educational institutions can also be tax-exempt as they promote the general welfare of society. By providing education and training, they enhance the success of the workforce and, thus, the economy.

C) Statements of Consolidation

A company can consolidate its assets by acquiring an existing and operating company. In consolidated statements, both the parent and the subsidiary merge their financial statements. The profits from any of the parents or subsidiaries can cover their losses. Thus, consolidated tax filing can result in lower tax liability.

How to Set Up a Wholly Owned Subsidiary?

1. Research the Type of Business Entity that Best Suits your Needs

Choosing a company for a subsidiary is a crucial decision. The parent company must look for a company entity determining it by the type of business and the number of owners. Seeking assistance from legal and tax professionals is advisable.

2. Register your Company with the State in Which it will Operate

Some jurisdictions require you to register the name under which you operate with local government agencies. Creating a business usually does not need registering with the country or city government.

3. Obtain the Necessary License and Permits

While establishing a business, one of the first things to do is learn about permits and licenses required to operate legally. It is a requirement for many states that companies have a business permit or rights to run. Thus, corporations must ensure they have the proper papers.

4. Open a Business Bank Account and Apply for Needed Financing

The firm should register a business bank account as soon as it begins spending and receiving money. Checking, savings, merchant, and money market accounts are the most favorable options. Apply for funds and investments the company may need.

5. Establish your Company’s Corporate Structure by Creating Bylaws and Appointing Officers

An essential element in building a corporate structure is an organizational chart. It offers meaning and order to a workforce. Appoint workers for different roles and responsibilities basing it on the chart.

Conclusion

A wholly-owned subsidiary is a corporation whose common stock is owned entirely by its parent company. It enables the parent firm to diversify, manage, and potentially decrease risk. It, unlike other subsidiaries, has no duties to minority shareholders.

Wholly-owned subsidiaries have legal control over their management, but the parent company can implement changes on some level. However, the financial results of a wholly-owned subsidiary are disclosed in the parent company’s consolidated financial statement.

Frequently Asked Questions

Q1. How to establish a wholly owned subsidiary in a foreign country? How to enter a foreign market?

Answer: A company can establish a new operation or acquire a based organization to enter a foreign market. Enterprises can enter overseas markets via licensing or franchising to host country firms or form a joint venture with a host country firm.

Q2. How can a wholly owned subsidiary be set up?

Answer: To set up a wholly owned subsidiary, the parent company needs to have 100% ownership of the subsidiary’s equity. The parent company should also have control over the subsidiary’s operations and management and should be able to access all of its assets. They must apply for licenses and permits and open a separate business bank account.

Q3. Is tax filing needed for wholly owned subsidiaries? Does it require EIN?

Answer: Yes, the wholly owned subsidiaries file tax returns. It is a separate corporation even though owned by a parent company. The parent business can significantly lower its tax obligation and take advantage of deductions by consolidating its accounts. It does require EIN to file taxes.

Q4. What is the difference between a standard and a wholly owned subsidiary? Example for wholly owned subsidiaries.

Answer: A standard subsidiary is one in which the parent business holds 51% to 99% of another company. If another company owns 100% of the parent company, the company is a wholly-owned subsidiary. The benefit of establishing a regular subsidiary for certain large firms is that it permits them to reach overseas markets that would otherwise be closed to them.

An example is The Walt Disney Company owning EDL Holding Company LLC.

Q5. Who controls a wholly owned subsidiary?

Answer: The parent company has complete ownership and control over the subsidiary. It means that the parent company can make all decisions regarding the subsidiary, including day-to-day operations, long-term strategy, and financial management. The parent company also has the power to appoint and remove the subsidiary’s board of directors.

Recommended Articles

This article explains everything about a Wholly-owned subsidiary, from its meaning, features, advantages, and disadvantages, to examples. It also talks about the accounting and tax advantages of wholly-owned subsidiaries. You can learn more by reading the following articles.