Updated July 7, 2023

Definition

Leading Indicators are quantifiable data sets about the economy that can be used to anticipate future economic or business activity. For example, if the number of mortgage defaults begins to rise, we can use this leading indicator as a warning sign that the economy may also be heading in the wrong direction.

Leading indicators were originally employed in economics. Predicting the trajectory of GDP aids in improved monetary policy judgments by assisting economists in forecasting the future direction of economic activity.

Key Highlights

- A leading indicator represents a measured set of facts that can actively predict a potential financial activity or change.

- The consumer confidence index is a leading indicator that predicts what will happen in the future; when people are confident about their economic situation, they typically spend more money, which then drives economic growth

- It is advisable to examine a variety of leading indicators while making future planning decisions since different leading indicators differ in their reliability, accuracy, and guiding connections

- Consumer Confidence Index, Order Backlogs, and Purchasing Managers Index (PMI) are examples of leading indicators.

What are the Leading Indicators?

- A leading indicator is a metric that predicts a trend’s change before it occurs. This indicator offers valuable data for future forecasting and enables traders or investors to determine potential market movements when trading or investing.

- Unlike a lagging indicator, we can use a leading indicator to forecast future economic ups and downs

- It’s important to remember that it can help you make predictions. They’re not always accurate because they express what could happen rather than what will happen

- Leading indicators are more difficult to quantify but provide important insights into the future.

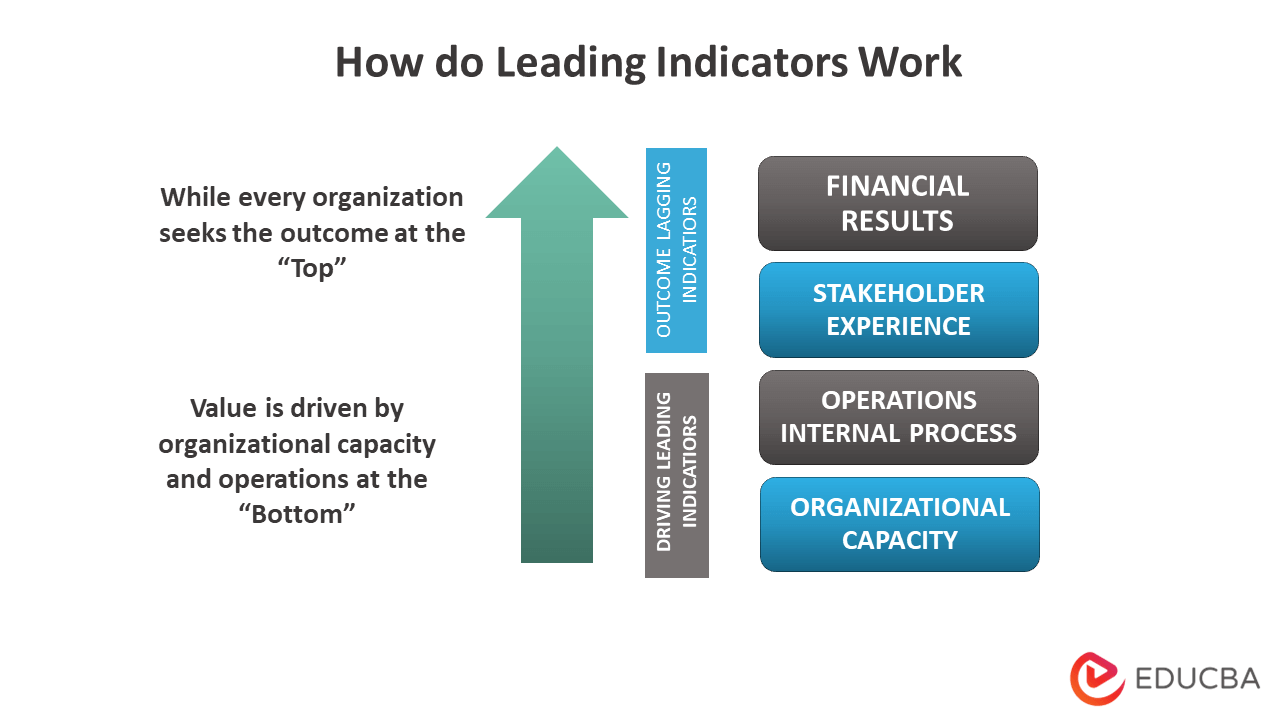

How Do Leading Indicators Work?

- Leading indicators are economic data that tend to change before the economy. The most frequently encountered example of this involves tracking stock prices as they fluctuate over a period of time.

- This can help companies and investors understand whether a particular trend is going to continue or shift in the future, helping them make better decisions about where and when they invest their money

- As an example, if you notice a rise in interest rates over the past few months but nothing significant has changed economically, it may indicate that economic growth could slow down because people won’t be willing to take on debt at higher rates

- The main indicators serve as a signal of information for economists and investors looking to forecast trends. Bond yields are regarded as a good indicator of the stock market because bond traders forecast and speculate on economic trends. These are, however, only indicators and are not always accurate

- The federal government monitors the overall money supply, which is a more complex indicator of leadership. In general, if there is a lot of money in consumers’ pockets, bank accounts, and bank safes, ready to invest in expanding businesses, the economy will be strong.

The agents who use leading indicators to improve their decision-making can be divided into four groups:

- Governments (through fiscal policy), and central banks (through monetary policy), must consider the evolution of leading indicators to take the most appropriate measures at all times

- Enterprises: Businesses must consider the leading indicators to accurately estimate demand and adjust supply to it

- Investors: Investors attempt to forecast changes in asset prices, which is why they require indicators that provide information on potential changes in the evolution of a company, sector, or economy to anticipate them

- Families: Families consider these indicators when deciding how much of their income to spend on consumption or savings.

Examples

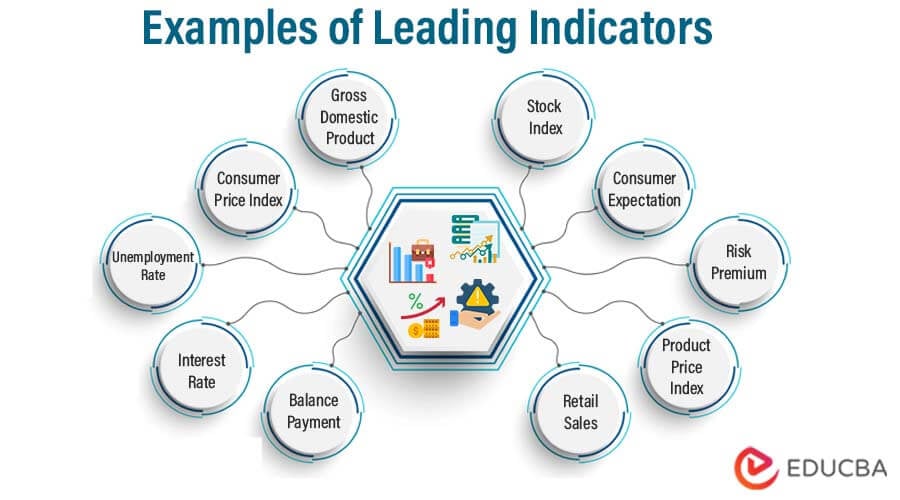

The following are the major examples:

Example 1: Gross Domestic Product (GDP)

- This falls under the category of coincident economic indicators. The Gross Domestic Product (GDP) varies by country, but the international economy largely governs it and is one of the most important when reviewing a territory’s macroeconomic characteristics

- This indicator assigns a monetary value to a country’s goods and services. GDP growth indicates a thriving economy, whereas GDP declines indicate a possible recession in the national economy.

Example 2: Consumer Price Index (CPI)

- The Consumer Price Index is responsible for showing how the price of consumer products, goods, and services move

- When used, you can know if we are in deflation (the opposite of inflation), indicating that prices are falling.

Example 3: Interest Rate

- The leading indicator, also known as Interest Rate, is quite well-known. This is the amount of money we pay for an economic loan

- In a nation’s case, this indicator measures the change in the value of currencies in international markets.

Example 4: Balance of Payments

- This indicator is responsible for measuring the amount of money that a country invests or spends in transactions with other countries and, at the same time, the amount of money that other countries spend in that country.

Example 5: Stock Index

- It is part of the so-called leading indicators. Where appropriate, it is used by calculating securities on a stock exchange. This makes it incredibly easier to analyze the prices of various companies in a country.

Example 6: Retail Sales

- The retail market, one of the most crucial sectors of any country’s economy, is designed to track and analyze the population’s consumption. With the knowledge of retail sales, you can know the future trends and thus forecast the market’s direction.

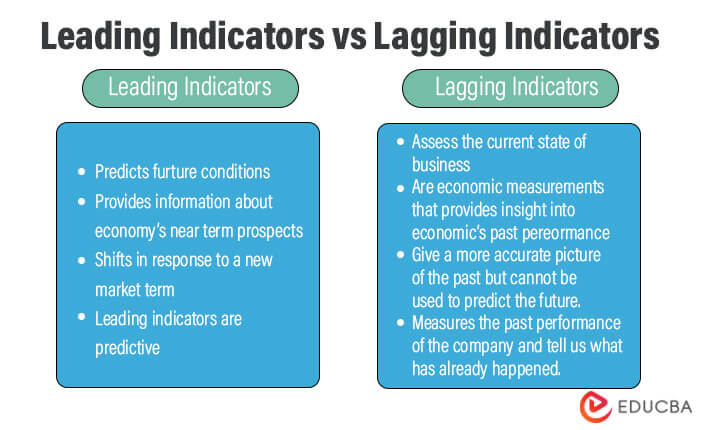

Leading vs. Lagging Indicator

Leading and Lagging indicators are technical analysis tools for assessing financial market strengths and weaknesses.

Leading Indicators

- It predicts future economic activity and comprises economic measurements. It provides information about the economy’s near-term prospects

- Leading indicators shift in response to a new market trend. Leading indicators are the metrics that predict future performance

- These indicators primarily transfer and guide the economic market cycle to forecast future economic changes.

- Before the real economy moves, the main indicators change. One can rely on these indicators to draw conclusions and forecast economic changes. Leading indicators are predictive

- The unemployment rate is a leading indicator of an economy’s health because it provides an indication of how much slack there is in the labor market. When unemployment is high, there is a lot of unused capacity in the labor market, which means employers have more power to raise wages and prices without worrying about inflationary pressures from too many workers chasing too few jobs.

Lagging Indicators

- Lagging indicators are economic measurements that provide insight into the economy’s past performance. They provide information about the economy’s long-term performance, and they can be used for forecasting purposes

- It gives a more accurate picture of the past but cannot be used to predict the future

- Lagging indicators measure the past performance of a company and tell us what has already happened

- The most common example of a lagging indicator is the unemployment rate. It takes time for an unemployed person to find a new job. If the unemployment rate is low, it means that there are not many people looking for jobs and therefore, there are not many people who have been unemployed for long periods of time

- Lagging indicators are the end result of all efforts to reach the goal.

Leading Indicators for Investors

- The S&P 500 index is an index of 500 large company stocks traded on America’s stock market. It’s used as a benchmark for U.S. stock market performance

- This is important information to know when U.S. markets are performing well. It can also be helpful to know if certain industries (like energy or technology) are performing better than others over time so you can adjust your portfolio accordingly.

Leading Indicators for Businesses

- Leading economic indicators (LEI) track statistics related to business activity, including manufacturing, employment, trade balances, and interest rates

- The U.S. National Bureau of Economic Research also calculates LEIs on a monthly basis by collecting data from thousands of firms. If you’re an investor or small business owner, it pays to keep tabs on these numbers—they may indicate when it’s time to pull back or move forward with your plans

- A key metric i.e., the Leading Index, helps predict turning points in gross domestic product six months before they occur.

Leading Indicators Methodology

- The leading indicators methodology is an economic forecasting tool that looks at key data from recent months to predict what will happen in upcoming months. This forecasting tool uses history as a baseline of expectation.

- A set of leading indicators gives investors and businesses a general idea of how an economy performs. The traditional set of leading indicators tracks factors that determine changes in economic activity six months to two years into the future.

Benefits of Leading Indicators

- They help to track the progress of a company and make better decisions.

- They are important because they allow us to take proactive steps to avoid potential problems

- Help us to better understand how the market is evolving, anticipate developments, and react quickly when needed

- They also give us a better understanding of what the customers want and need so that we can provide them with the best possible experience. Leading indicators can be applied in many industries, such as retail and manufacturing.

Frequently Asked Questions(FAQs)

Q1. What are the leading indicators?

Answer: Leading indicators are economic data that tend to change before the economy.

Q2. Who should take into account the evolution of leading indicators?

Answer: Governments, through fiscal policy, and central banks, through monetary policy, must both consider the evolution of leading indicators in order to take the most appropriate measures at all times.

Q3. Why are leading indicators important?

Answer: In a world of crisis, where the best conditions will prevent the collapse of all productive sectors, leading indicators provide key data on the economy in the coming months or years, as well as a visual of possible strategies. Companies, small businesses, investors, governments, and families all rely on leading indicators to stay alert and avoid or deal with unforeseen events.

Q5. Why is it important that indicators are not published too late?

Answer: The indicators must be published as soon as possible because one needs to work with the most up-to-date information possible in order to operate in the financial markets and make investment decisions.

Q6. What are the three main types of economic indicators?

Answer: Three types of economic indicators include leading, coincident, and lagging indicators. The type of indicator used depends on how far ahead in time it can provide information about what is happening in an economy. Although all three types play a role in signaling economic health, leading indicators are more effective at providing insight into future activity because they correlate with what will happen two or more months down the road.

Recommended Articles

This article explains everything about Leading Indicators. To know more, visit the following articles: