Updated July 7, 2023

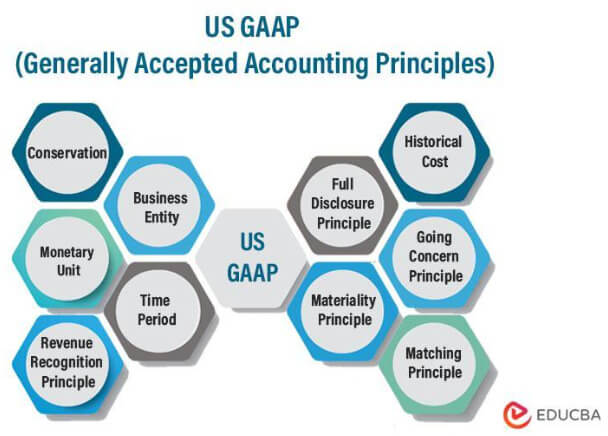

What is US GAAP?

US GAAP (Generally Accepted Accounting Principles) are accounting standards that make financial data consistent and comparable across organizations.

For instance, Microsoft and Tesla adhere to US GAAP standards, but Snapchat doesn’t. Therefore, Microsoft and Tesla can compare their statements across firms, but Snapchat cannot. It encompasses accounting practices companies must adhere to while reporting their financial statements. The rules of these principles are set by the Financial Accounting Standards Board (FASB).

Key Highlights

- US GAAP is a set of rules that govern accounting practices in the United States. These principles help make financial information uniform and comparable between different companies

- They provide a framework for understanding how to measure and report a company’s income (or loss) from operations

- Some prominent principles are consistency, continuity, regularity, periodicity, and others

- IFRS principles are all-inclusive and international companies can easily use them. In contrast, US GAAP can be a little complex.

US GAAP Principles

a) Regularity

- It states that accountants must follow the US-GAAP while preparing financial statements that investors, creditors, and other stakeholders use to evaluate a company’s performance

- It guides them about the type of transactions to record and report promptly.

b) Prudence

- All records, statements, reports, etc., should be verifiable and based on validated statistics

- Accountants should disregard any information derived from assumptions.

c) Sincerity

- This principle governs the sincere representation of the gathered information

- Every accountant responsible for building finance reports should follow specific rules and portray the data accurately.

d) Continuity

- While creating finance documents, accountants should assume that the firm will be in business for eternity

- It impacts the measures and allows an accurate asset valuation of a company.

e) Periodicity

- This principle states that entities must follow a financial reporting period (quarterly or annual)

- For each period, the firm has to record its transactions, create a report and disclose its financial performance.

f) Consistency

- It ensures that companies follow the same financial reporting standard consistently for every accounting period as well for each step of the reporting process

- As a result, firms can easily compare these consistent reports with their historical data and across other firms.

g) Materiality

- Financial reports should include all financial and accounting information

- In case of any minute financing errors, accountants should make necessary adjustments to rectify the mistakes.

h) Faith

- This principle presumes that accountants act with professional care and exercise due diligence

- All finances recorded and reported should be honest and correct.

i) Non-Compensation

- Companies should comply with this principle by openly reporting both negative and positive aspects of their business

- They should not cover any debts or assets under income to maintain transparency.

j) Permanence

- Financial reporting procedures should be consistent, allowing for comparison of the company’s financial information

- It also allows people outside the firm to analyze the reports without complexity.

Accounting Standards Codifications (ASC)

FASB (Financial Accounting Standards Board) sets the standard accounting codifications to provide uniformity to a company’s financial reports. Some common ASC codes are,

1. ASC 205 – Presentations of Financial Statements

- It provides understanding and establishes the framework for overall financial statement presentation

- It guides companies through reporting discontinued operations, accounting on a liquidation basis, going concern, and even comparative statements.

2. ASC 210 – Balance Sheet

- It is a technique of specifically presenting the balance sheet among the financial statements

- The guidelines cover the methodological classification of assets and liabilities, the balance sheet offset, and more.

3. ASC 215 and 225 – Shareholder Equity and Income Statement

- This code gives several rules for the effective presentation of the income and shareholder’s equity statement

- Additionally, it lays out the easy distribution of a firm’s finances along with understanding their income and expenses flow.

4. ASC 230 – Statement of Cash Flow

- This ASC standard issues an apparent allotment of cash flow to operating, financing, and investing divisions

- As the cash flow statement has information about cash receipts, cash payments, etc., this code lists method activities such as direct and indirect for guided reporting.

Example of US GAAP Financial Statements

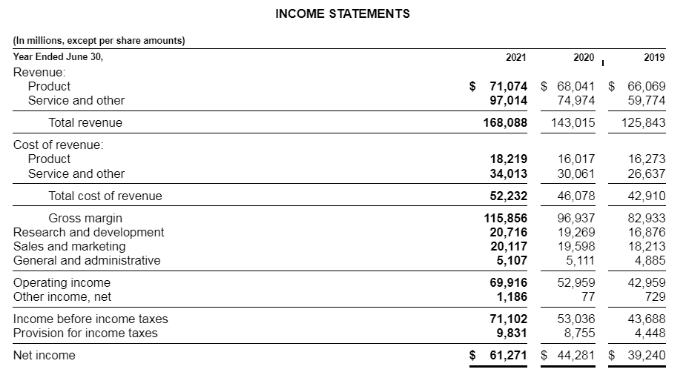

Example of Microsoft’s 2021 Income Statement (Source: Microsoft Annual Report):

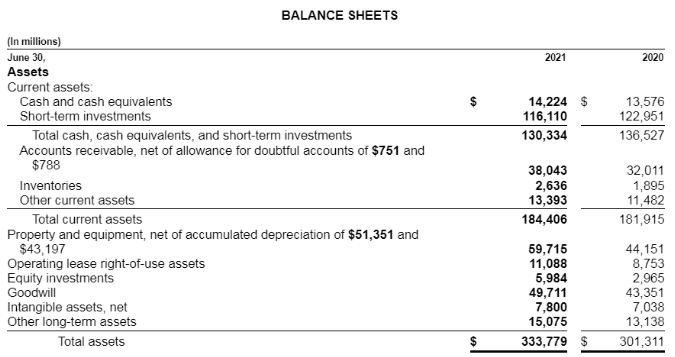

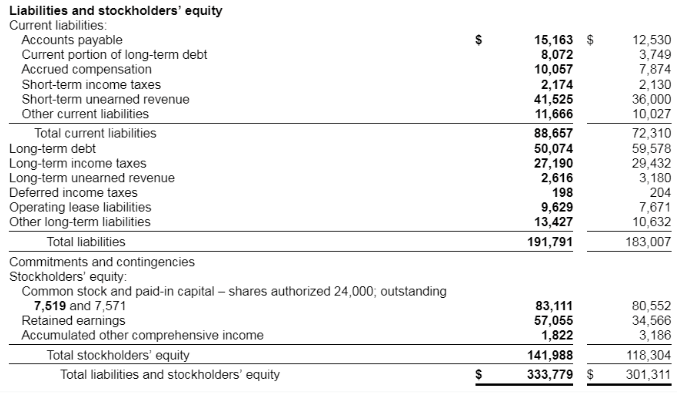

Microsoft’s 2021 Balance Sheet:

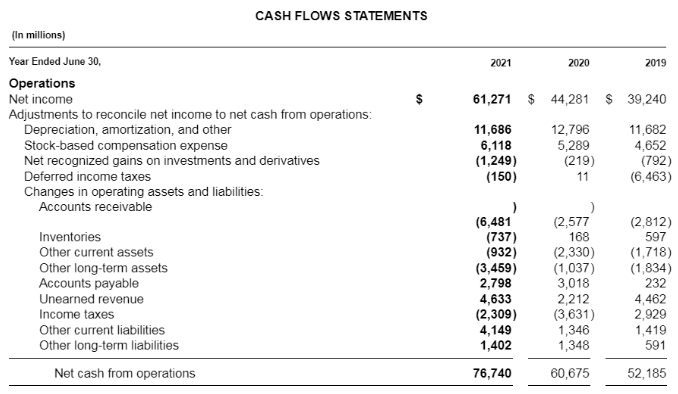

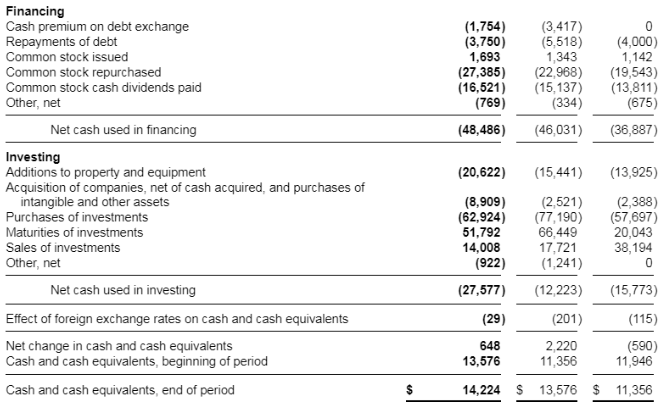

Cash Flow Statement:

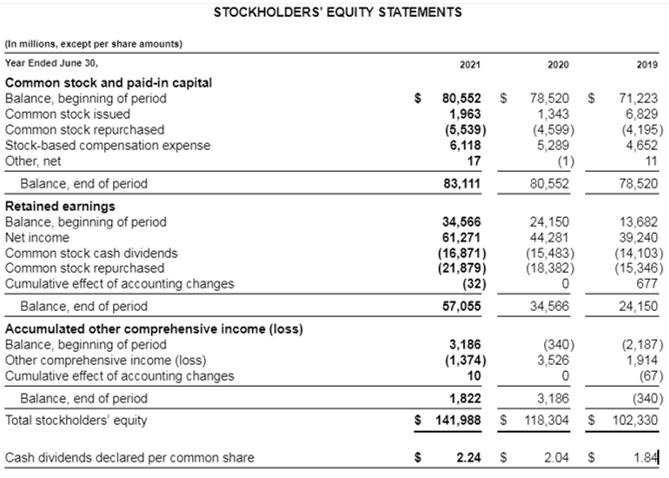

Example of Microsoft’s 2021 Shareholder’s Equity Statements:

Features of US GAAP

- Every company should present their performance report to their shareholders, creditors, etc., to maintain their confidence

- These reports can help the management to make essential investment decisions for the business

- The availability of the reports to the general public provides potential investors with crucial information about the company and can help raise funding.

Non-GAAP Reporting

- Non-GAAP earnings provide a different way of calculating a company’s finances

- Mostly private as well as a few public companies use this standard as it gives a more accurate picture of the company’s performance

- For example, a company’s primary revenue is from one product line. Suppose it was temporarily out-of-stock for the quarter. However, they can adjust their revenue figures to reflect earnings from the out-of-stock product line as well

- Companies that use this kind of accounting may then produce two sets of numbers – GAAP numbers and non-GAAP numbers – for their financial reports

- In addition to earnings following generally accepted accounting principles, many businesses also disclose non-GAAP results

- Investors look at both when evaluating performance to find a range.

Difference Between US GAAP vs. IFRS

| US GAAP | IFRS |

| Governance | |

| It is a set of generally accepted accounting principles that govern the preparation of financial statements in the United States | IFRS are international accounting standards that make financial statements comparable across companies in different sectors and countries |

| Users | |

| It is an accounting framework that the United States and other English-speaking countries use | These are the most common accounting standards across the world. More than 150 countries use it |

| Issuance | |

| The Financial Accounting Standards Board, known as FASB, issues these standards | The International Accounting Standards Board (IASB) issues them |

| Standardization Structure | |

| These are standards that all US public companies must use | These standards are available for all public interest entities, such as governments, public sector organizations, and non-profit organizations, to follow |

| Intangible Assets | |

| It prohibits the use of revaluation models | The reports include the cost or revaluation model |

| Statements of Financial Position | |

| These statements are less detailed, with minimal information about assets and liabilities. | It uses a more detailed presentation with more information about assets and liabilities. |

Types of US GAAP Companies

- All US public companies must follow these standards to design their financial statements

- The publicly traded companies, i.e., whose stocks are traded on the stock market and have investors other than the shareholders fall under the standard

- Additionally, other private firms can use this regulatory framework as well

- Public companies wanting to analyze their performance distinctly can use non-GAAP reporting but still have to report according to the US-GAAP standard.

Limitations of US GAAP

- It applies only to public companies or private companies with securities registered with a US stock exchange, which means it does not apply to many privately held businesses

- Lack of uniformity in practice due to its highly qualitative nature. Some accountants follow interpretations that differ from others

- International companies aiming to expand globally use a different set of rules which might interfere with their expansion in the US

- The set of standards is not precisely suitable for all kinds of businesses. Small-scale companies, start-ups, and even diverse huge companies can find these principles complex.

Frequently Asked Questions(FAQs)

Q1. What is US GAAP? Why is it important?

Answer: US GAAP rules establish a standardized and comparative way of accounting. It guarantees the accuracy and consistency of a firm’s financial records. It is also crucial for external activities like crowdfunding, open trading, deal negotiation, and more. In addition, It mandates disclosures of uncertainties or risks that may affect their obligations to creditors.

Q2. How does US GAAP work?

Answer: US GAAPs are the equivalent of International Financial Reporting Standards in the United States. They are highly detailed and reflect the current litigation environment in the United States. These are not permitted to deviate from SEC regulatory introversion.

Q3. How are US GAAP and IFRS different?

US GAAP follows an accrual-basis approach for reporting income and expenses, while IFRS uses both an accrual and cash-basis approach. Additionally, IFRS sets global accounting standards, whereas GAAP applies only to US public companies.

Recommended Articles

This was a guide to US GAAP. To learn more, please read the following articles,