Updated July 7, 2023

What is the Consumer Price Index?

The Consumer Price Index (CPI) is a financial indicator that tracks changes over time in the average price of goods/services that national households consume. For example, according to the US Bureau of Labor Statistics September 2022 report, the current CPI for the US is 296.808.

It is a weighted index of purchased consumer goods. This measure includes price changes for goods and services like food, apparel, transportation, medical care, etc. The nation’s government releases these reports every month. For instance, the index for October will release on November 10 in the US.

There are three indexes for this measure in the US: CPI-U and C-CPI-U analyze the prices for urban consumers, whereas CPI-W evaluates the clerks and wage workers. All three differ by population or by the commodities they consider.

Key Highlights

- The consumer price index is a statistic that tracks changes in the cost of a particular basket of goods/services over a specific time for a region.

- It is one of the standard methods to measure inflation in a broader economy.

- A positive index indicates a stable or increasing cost of living, i.e., inflation. In contrast, if it is negative, there is a decrease and can show deflation.

- It is known as a poor indicator of inflation rates because its methodology has various flaws, including the products included in the basket and the impact of their replacement.

Consumer Price Index US History – Table

The US started using the CPI index back in 1921. They used collected data to then release CPI reports for 1913 to 1921. Since then, it has been an essential tool for the country to measure various metrics

This table shows the historical CPI values for the US economy:

|

Year |

CPI Value |

Inflation Rate |

|

Initial Years of the Index |

||

|

1913 |

9.9 | |

|

1914 |

10.0 |

1.3% |

|

1915 |

10.1 |

0.9% |

| 1916 | 10.9 |

7.7% |

|

Index of Recent Years |

||

|

2019 |

255.7 | 1.8% |

| 2020 | 258.8 |

1.2% |

| 2021 | 271.0 |

4.7% |

Source: Federal Reserve Bank of Minneapolis

Uses of Consumer Price Index

- Most economists consider it to be one of the best measures of consumer inflation

- It allows a comparison of the economic growth of a region for distinct periods

- Additionally, using this, one can compare the economies of various nations

- It helps recognize the nation’s financial health and performance

- Accurately measures changes in commodity prices that help determine the cost of living and the economy’s purchasing power

- Businesses use this information to price items accurately and affordably

- It measures price variations within family dynamics and attests to their evolution in the market.

Consumer Price Index Formula

The formula for calculating CPI is,

- Economists gather retail prices for the products from the base and the current year

- They divide the current prices by the costs from the base year and multiply it by 100

- We subtract 100 from this final result because the base year CPI value is always 100

- The end value represents the percentage of increase/decrease in prices over time.

How To Calculate the Consumer Price Index? – Examples

You can use the CPI calculator to calculate its index value easily.

Example 1:

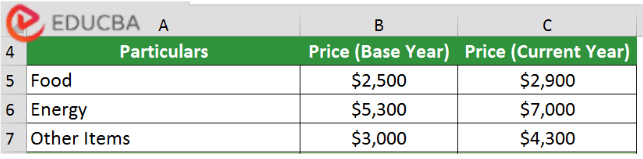

An economist wants to calculate the CPI for the product basket. The data is as follows,

- Food items price: base year = $2,500; current year = $2,900;

- Energy price: base year = $5,300; current year = $7,000;

- Other items: base year = $3,000; current year = 4,300;

Given,

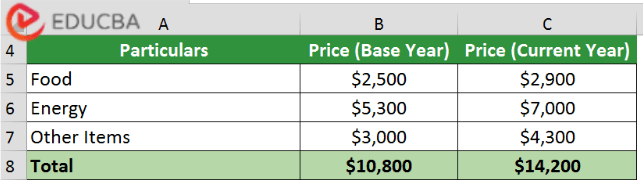

The total price of the product baskets is,

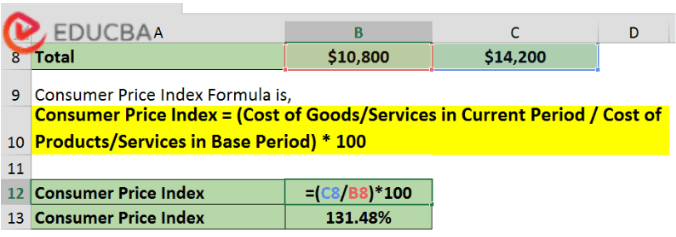

Implementing the formula,

Subtracting 100 from this total gives 31.48%. Therefore, it is the CPI for 2022.

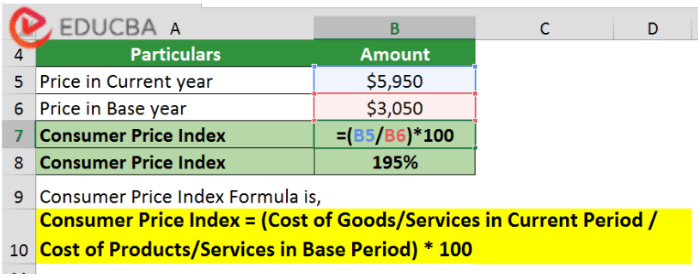

Example 2:

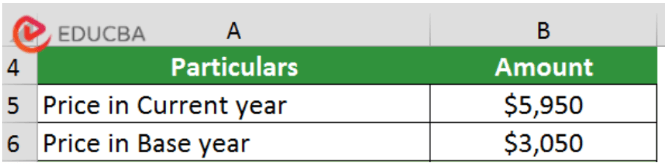

A country wants to calculate its 2022 CPI. They consider 1999 as the base year. The observed price of the product basket in the base and current year is $3,050 and $5,950, respectively.

Given,

Substituting the formula,

Subtracting 195 by 100 gives us 95. Thus, CPI for 2022 is 95. There has been a 95% increase since 1999.

Components of the Consumer Price Index

- The three categories of components are food, energy, and all commodities (other than food & energy)

- Food constitutes 13.63% of total components. It includes livestock, cereals, fruits & vegetables, non-alcoholic beverages, etc.

- The energy commodities like fuel, oil, gas, etc., contribute 8.2% to the total value.

- Other products and services such as Health care, Transportation, Hotels and restaurants, Clothing and footwear, and more make up the majority, i.e.78.12% of the total components list.

Benefits & Limitations

| Benefits | Limitations |

| The information update is frequent, so the economy has vast opportunities to advance. | The monthly release impacts financial markets, and unexpectedly high or low numbers affect investments. |

| The consumer benefits from it because it enables them to compare the evolution of prices over time. | It is not an ideal metric to gauge inflation or economic health |

| Financial analysts use it to evaluate and analyze inflation, changes in consumer habits, and price fluctuations across multiple categories | It accounts for urban consumers, which does not accurately represent the economy’s output or consumption. Hence, it ignores consumer demographics, which results in distortions by generalizations |

| Citizens can use it to calculate its effect on their income, investments, and spendings over time. | It is an inaccurate measure of the cost of living. For instance, it shows a low inflation rate even though the cost of energy has risen by more than 50% and the cost of popular food items by almost 30%. |

Conclusion

CPI is the basis for the annual cost of living adjustments and other government-funded programs. However, it is critical to acknowledge that there are certain limitations. BLS has revised the basket methodology to calculate the CPI several times. The changes are to eliminate/reduce the biases leading to overstating inflation.

Frequently Asked Questions(FAQs)

Q1. What does the consumer price index measure?

Answer: The consumer price index is usually the measure of inflation. It computes the price alterations (rise or fall) from a set period, which helps determine inflation rates.

Q2. What is a good CPI value?

Answer: A good CPI value should be neutral. Too high an index can mean inflation, while too low an index can mean deflation.

Q3. What is the difference between CPI vs. WPI vs. PPI?

Answer: CPI uses consumer-level retail prices to measure the average change in goods/services over time. WPI (Wholesale Price Index) considers wholesale prices and only uses goods for the calculation. PPI (Producer Price Index) is a modification of the WPI. The US government established the PPI as the WPI wasn’t a robust metric. Apart from goods, it considers services as well.

Recommended Articles

This article explains everything about the Consumer Price Index (CPI). To know more, visit the following links,