Updated July 6, 2023

What is a Fiscal Deficit?

A fiscal deficit is when a country’s revenue falls behind their expenditure causing a financial or monetary deficiency. For example, in the financial year 2022, the federal government of the United States of America witnessed a fiscal deficit. The government’s expenditure reached $6.27 trillion in this deficit, and the revenue collected was $4.90 trillion. Here, it’s quite evident that the overall expenditure exceeded the collection by $1.375 trillion and, thus, resulted in a deficit.

It can also be referred to as excess public expenses over income receipts and non-debt-generating capital earnings. Thus, it represents the total excess expenditure with borrowings over total revenue. Therefore, we can calculate the difference between the overall expenditure and revenue, representing a proportion of the Gross Domestic Product (GDP).

Real-World Examples

Example #1

In 2022, the United Kingdom government’s total debt accounted for £2,436.7 billion at the end of Quarter 2, i.e., April to June. This data equals 101.9% of the total GDP (Gross domestic product). Thus, the UK deficit was £43.9 billion in the 2nd Quarter, equaling 7.2% of the total GDP.

Example #2

According to the Indian government, the fiscal deficit for the first five months of FY 2022, April to August, reached $66.56 billion. The total tax collected was only 0.7 million, while the expenditure crossed 139 million.

Example #3

China’s fiscal deficit skyrocketed to an all-time high of about $1 trillion in the initial 9 months of 2022. In addition, the country’s overall revenue dropped to 6.6% to 15.3 trillion Yuan following the months of January to September because the Chinese government reached for more tax rebates.

Examples

Example #1

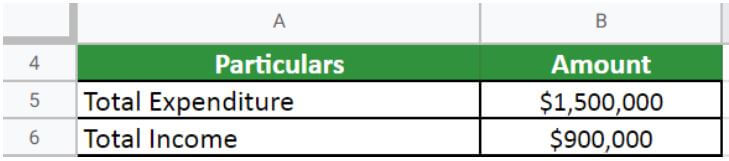

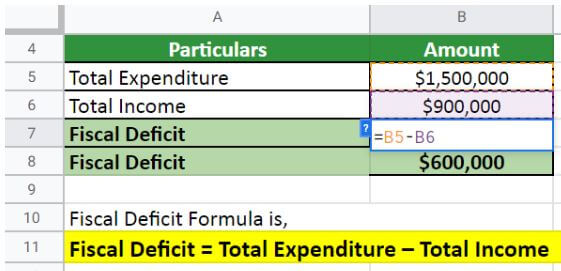

Country A’s total expenditure is $1,500,000, and its total revenue is $900,000 in 2021. Calculate its Fiscal Deficit.

Given,

Solution:

As per the formula,

Country A’s fiscal deficit is $600,000.

Example #2

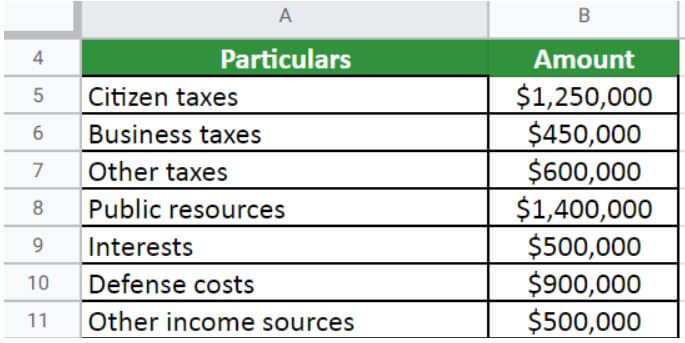

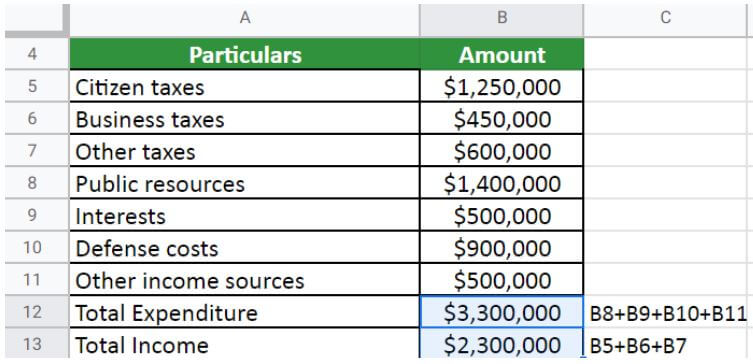

A nation’s income and revenue are as follows for 2021,

- Citizen taxes: $1,250,000

- Business taxes: 450,000

- Other Taxes: $600,000

- Public Resources: 1,400,000

- Interests: 500,000

- Defense: 900,000

- Other sources: 500,000

Calculate its fiscal deficit.

Given,

Solution:

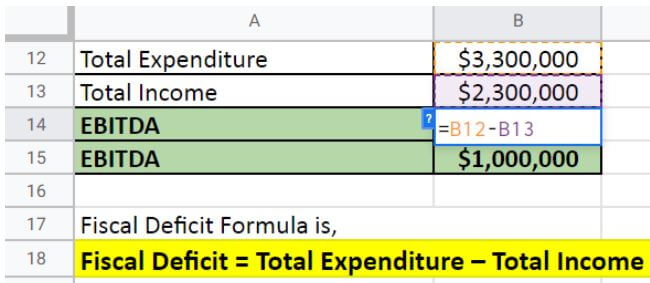

Let us calculate the total expenditure and income,

Implementing the formula,

The nation’s fiscal deficit was $1,000,000 in 2021.

Implications

Inflation

- When the government encounters a Fiscal deficit, it borrows money from banking regulators.

- To meet the requirements of the deficit, banking regulators have to print new currency.

- This process enhances the circulation of money in the economy but forms inflationary pressure.

Hinders Future Development

- Borrowings to meet the Fiscal Deficit lead to an upsurge of the financial load for future generations.

- The future generation becomes liable to repay the principal and the interest amount.

- It creates an unfavorable effect on the future development of an economy.

Debt Trap

- It specifies the overall borrowing requirements of the government. The borrowings contain the principal amount as well as interest rates.

- As these payments rise, the revenue expenditure also increases, resulting in a revenue Deficit.

- In this way, a chain reaction of fiscal and revenue deficits is built. Consequently, the government has to apply for more loans to repay the previous ones, leading the nation into a debt trap.

Foreign Dependency

- To compensate, the government relies more on foreign countries for borrowing.

- To help the deficit country, other countries help with funding.

- In the future, the inability to repay the excess funding can lead to debt.

Causes

#1 Revenue Deficit

- When the actual net receipts of a government exceed the projected receipts, then the revenue deficit occurs.

- It can be reduced by taking measures that could reduce the costs.

#2 Interest Payments

- If a country continues to run in it, the debt can ultimately pile up. The pile-up significantly increases the sum to be paid in interest, which can result in a fiscal deficit.

- For example, the United Kingdom paid €520 billion in interest alone in 2021. That accounts for about 50% of its overall fiscal deficit. This continues to work in a vicious cycle that will give rise to it in the future.

#3 Political Reasons

- Political reasons are considered the main cause. When the government spends more than it collects, it needs to make tough political decisions.

- It has to raise taxation, decrease spending, or just go for borrowing, which can result in a situation of debt.

#4 Extreme Government Borrowings

- For a specific period, a government spends more money than its income from taxes and revenue.

- This will eventually result in borrowing money from other countries or the IMF (International Monetary Fund), resulting in national debt.

Advantages and Disadvantages

|

Advantages |

Disadvantages |

| It adds to the government’s financial strength. | It can result in income disparity as people with fixed income are not benefited. |

| Borrowings generate extra money, and the interest amount related to it is reimbursed to the government. | The decrease in purchasing power of money leads to an outflow of wealth from the country. |

| It results in inflation, which proves to be beneficial under certain conditions. | Causes a rise in prices as well as inflationary pressure. |

| It reassures the government to use underemployed and unemployed resources, and hence, upsurges economic development. | It disrupts the complete investment system as the maximum investment concerns the rapid profit-yielding businesses and is not positive for long-term development. |

| The taxpayer’s excess money is loaned to the government to finance the deficit. Consequently, it does not trouble the taxpayer. | The weaker nations have scarcer employment opportunities because of the absence of other resources like machinery, infrastructure, etc. |

Final Thoughts

Countries with weak or slowed economic growth find this financial technique crucial. Nevertheless, deficit financing can be effective if satisfactory anti-inflation actions are utilized. It is an inevitable way to generate finance and should be implemented with other essential procedures. Therefore, it can be observed that it is the most vital tool to make an economy stable with increased employment and income.

Frequently Asked Questions (FAQs)

Q1. What is a Fiscal Deficit?

Answer: It can be referred to as the increase of public expenses over income receipts and non-debt-generating capital earnings. It indicates the total sum of borrowing a government needs.

Q2. What causes the fiscal deficit?

Answer: A federal budget deficit or fiscal deficit is observed when the government’s overall spending surpasses revenue or the income generated from investments, fees, or taxes. Such deficit conditions add up to the national or federal government debt.

Q3. Is the fiscal deficit good for the economy?

Answer: Overcoming any deficit is generally challenging, but employing the money for productive assets enhances employment and growth, positively impacting the economy.

Q4. How is the requirement for fiscal deficit encountered?

Answer: The requirement can be handled by borrowing money. The government controls its underperformance by borrowing from sources like public sector banks, the American Banking Regulators (like OCC, FRB, FDIC), overseas markets, capital markets, and the public.

Q5. What is the way to calculate the fiscal deficit?

Answer: For calculating, one needs to subtract the total revenue generated by the government in a fiscal year from the sum of expenditures that occurred simultaneously. To simplify this, Fiscal deficit = (Revenue expenditure – Revenue receipts) + (Capital expenditure – Capital receipts excluding borrowings).

Recommended Articles

This article has provided important details related to the fiscal deficit. This information includes examples, implications, causes, formulas, etc. Read the following articles for more details.