Updated August 14, 2023

What is Contractionary Monetary Policy?

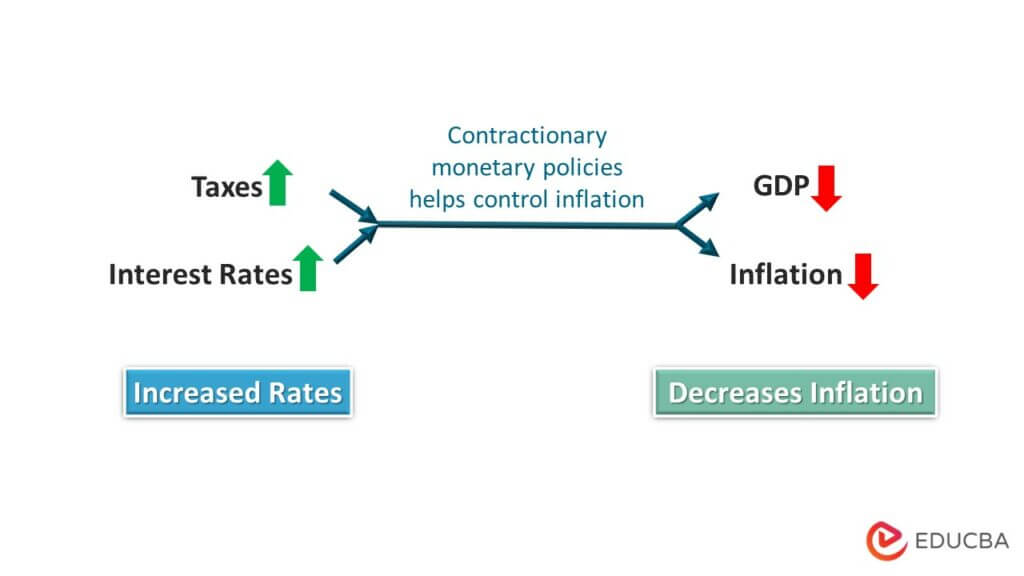

Contractionary Monetary Policy is a macroeconomic policy, like reducing expenditure or raising the interest rate to reduce the GDP and counter the effect of inflation.

For example, the Federal Reserve began hiking interest rates to combat stubbornly high inflation, which touched 9.1% in June 2022. It, in turn, will lead to lowered spending, and thus, product recess will decline over time.

It is a strategy to battle increasing inflation and advance economic growth. Its primary goal is to make borrowing and spending money harder for businesses and individuals. Thus, it avoids unsustainable capital investment or excessive market speculation by limiting the money supply. In such cases, the economy witnesses credit tightening, rising unemployment, reduction in private sector borrowing, and declining consumer spending.

Key Highlights

- Contractionary monetary policy is a strategy a country’s central bank adopts to slow the economy and manage increasing inflation during periods of rapid growth or other economic distortions

- The Federal Reserve’s policy consists of three primary fiscal measures: selling government securities, interest rates hikes, and the bank’s reserve requirement increment

- The policy’s fundamental goal is to limit the money supply, which it accomplishes by increasing the cost of credit cards, loans, and mortgages.

How Does Contractionary Monetary Policy Work?

The primary objective of contractionary policies is to control the inflation rates of a country. It is achievable by limiting the nation’s circular flow of money. As the central, commercial, and other small banks are in the center of circulation, their interest rates become the base of these policies. They raise their loan interest rates, lowering the economy’s capital activity. They also continuously sell government securities in large numbers, which leads to a fall in asset value.

Examples

Example #1

Inflation skyrocketed in the early 1970s. To control inflation, the Fed hiked interest rates from 9.4 to 11.0 from January to December 1974. As a result, inflation in 1976 fell to 5.8%. However, the OPEC energy crisis ruined the party, and inflation reached 14% in 1980. As a result, the Federal Reserve raised interest rates to 13.5% in 1980. The policy reversed the price trend, lowering inflation to 3.2% in 1983.

Example #2

President Bill Clinton used contractionary policy in 1993 as the Deficit Reduction Act and the Omnibus Budget Reconciliation Act of 1993. He increased the income taxes for various income brackets, added taxes for high-income earners in their Social Security benefits, ended some corporate subsidies, and provided tax credits. Finally, he raised the tax on gas by 4.3 cents per gallon, making it more challenging for corporations to get deductions on their entertainment tax.

Example #3

Fiscal 1972 to 1973, the government used contractionary policy to bring down inflation from 5.7% in 1770 to 3.2% in Dec 1772. The underlying reasons for the price upsurge were wage control and releasing the USD from the gold standard. To fight this, the Fed increased the Fed Funds rate to 11.22% in August from 3.88% in January. The result was reduced inflation to 3.2% from 5.7%. But after the crisis of OAPEC energy, the oil prices skyrocketed, inflation to 11.0% average 1974-75, and Fed funds to 1306 in July 1974%.

Effects

Lower Inflation

- The primary goal of CMP implementation is to tame hyperinflation in the economy. Because of policy execution, there is less money to lend to banks.

- As capital flows diminish, demand for goods and services declines, resulting in low inflation.

Reduces Government Debt

- The contractionary policy also helps to minimize the government’s fiscal deficit and national debt.

- Contractionary policy, for example, resulted in the United States government going from significantly in debt to a budget surplus during Bill Clinton’s presidency from 1993 to 2001.

Slower Economic Growth

- Higher interest rates have a significant impact on economic activity.

- Most companies and individuals postpone or cancel their expansion plans.

- Economic growth becomes sluggish as noticeable amounts of investments and capital expenditures in public and private sectors draw to a halt.

Higher Unemployment

- The rise in the unemployment rate is one of the negative consequences of contractionary policies.

- More individuals are unemployed as corporations and small businesses lay off employees or cancel expansion plans.

- For example, the unemployment rate in the United States reached 3.7% in October and will deteriorate to 4.5% in 2023 due to monetary tightening policy decisions.

Tools

Increasing Federal Fund Rates (FFR)

- The Federal Reserve raises the fed fund rate during a contractionary policy.

- These are the overnight borrowing rates that banks charge each other to satisfy their reserve requirements.

Increasing Short-Term Interest Rates (Discount Rates)

- Commercial banks borrow short-term loans from the central bank at discount rates to cover short-term liquidity shortfalls.

- The central bank can restrict the money supply by increasing the cost of short-term loans by raising the short-term interest rate.

Increase Reserve Requirements

- Commercial banks must keep a portion of their deposits with the central bank to fulfill liabilities in the case of unexpected withdrawals.

- It is one method through which the central bank regulates the money supply in the economy.

- Therefore, raising the reserve requirement hinders commercial banks from lending to the general people.

Selling Government Securities

- The Fed sells government-issued securities to commercial institutions through open market transactions.

- When banks buy T-bonds and bills, it signals that they have lesser funds to lend.

- As a result, the amount of money in circulation decreases.

Final Thoughts

During the economic growth cycle, inflation rises and exceeds the safe zone of 2%. It is a sign of an overheating economy that makes introducing a contractionary monetary policy compulsory. The Fed uses monetary instruments in an attempt to tighten the money supply. The policy implementation makes Loans, commodities, and services more costly. As a result, consumer demand and expenditure fall, resulting in low inflation.

Frequently Asked Questions (FAQs)

Q1. What are the advantages of contractionary monetary policy?

Answer: One key advantage of the policy is that it reduces the economy’s high inflationary pressures. With a limited money supply, goods and services prices begin to fall. Another advantage is that it strengthens government finances. With increased Federal Reserve discount rates, the government gains more money from bank borrowing.

Q2. How does contractionary monetary policy affect the stock market?

Answer: When governments employ contractionary monetary policies, it affects a business’ future valuation. As a result, the specific firms face a drop in stock prices. Thus, these policies affect the stock market negatively and may lead to losses for public companies. However, we also see that this effect only lasts for a short time, and the price of shares may return to normal over time.

Q3. What are the steps in contractionary monetary policy?

Answer: The Fed Increases the Federal Fund Rates (FFR): These are the overnight borrowing rates banks charge each other to satisfy their reserve requirements. The Fed Increases the Short-Term Interest Rates (Discount Rates). Commercial banks borrow short-term loans from the central bank at discount rates to cover short-term liquidity shortfalls. Thirdly, the Fed Increases the Reserve Requirements. Commercial banks must keep a portion of their deposits with the central bank to fulfill liabilities in the case of unexpected withdrawals. And lastly, the Fed sells Government Securities. The Fed sells government-issued securities to commercial institutions through open-market transactions.

Q4. When was a contractionary monetary policy used?

Answer: The Contractionary policy came into action in the 1980s when Paul Volcker, the then-Federal Reserve chair, ended the soaring inflation of the 1970s. The federal fund interest rates peaked at 20% in 1981. The Measured inflation levels fell to 3.2% in 1983 from 14% in 1980.

Q5. Why do interest rates rise as a result of monetary policy?

Answer: The tightening of the money supply due to monetary policy results in less cash accessible to banks. With reduced capital supply, financial institutions raise interest rates on all services like credit cards, mortgages, auto loans, etc.

Q6. What effect does the contractionary policy have on exports?

Answer: The policy execution reduces the money supply. It eventually leads to an increase in exchange rates. As the US dollar appreciates versus other currencies, exporting goods becomes more expensive in overseas markets. As a result, net exports decline.

Recommended Articles

The above is a guide to the Contractionary Monetary Policy. To learn more, please read the following articles: