What is Taxation?

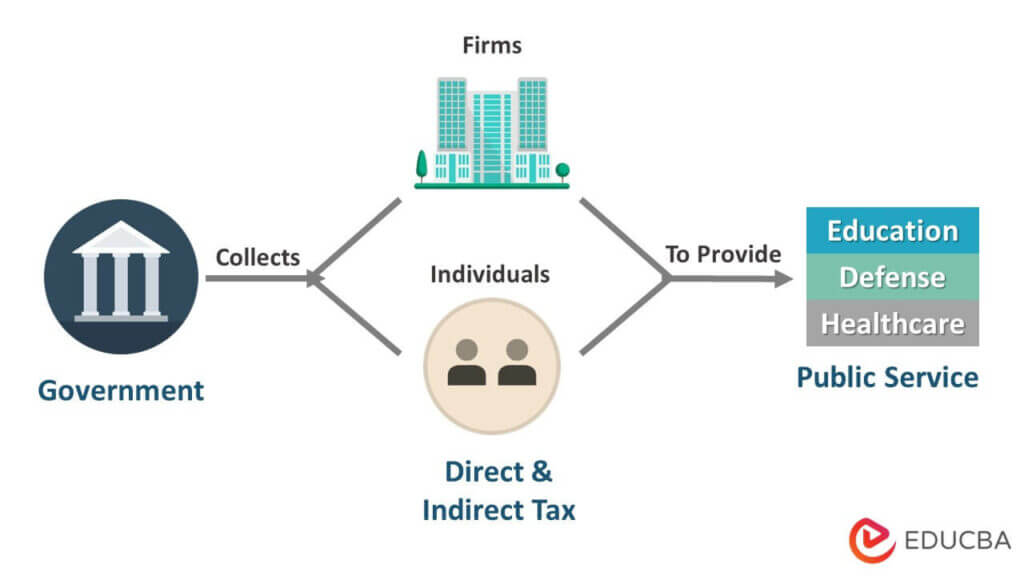

Taxation is when the government or taxing authority collects funds from citizens to serve the nation through public services. For example, in 2022, the US government collected $4.90 trillion in revenue. This revenue’s primary source was taxation, including individual and corporate taxes.

Every government provides security, health services, education, and infrastructure to its people. Governments require funds to provide these services. A large part of that fund comes through taxation. Governments levy different taxes depending on various criteria such as income, expenditure, service, etc.

Key Highlights

- Governments impose direct and Indirect taxation to earn revenue for their public and social welfare schemes.

- Direct taxes are taxes directed toward the citizens. Indirect taxes occur at the destination of consumption of goods or services.

- Transparent, simple, and clearly defined tax laws complement the ease of administration and efficient use of revenue collected.

- Auditing of the taxation process is mandatorily followed for timely risk assessment and identifying the shortcomings in the process.

Examples

Example #1: UK

The UK had a tax collection of £716 billion, i.e., $755.38 billion in 2021-2022. As reported by HMRC, it is an increase from the previous year of around 22.5%.

Example #2: Canada

In September 2022, Canada reported a collection of $20.245 billion in taxes. Canada reports its taxes monthly, and this value was for August 2022.

Example #3: Microsoft

Microsoft paid taxes of $10.987 billion in 2022, where the company grossed a total profit of $72.7 billion.

Example #4: Apple

Apple recorded a net profit of $99.8 billion in 2022. They paid $19.3 billion as income tax which is more than 32.86% compared to the previous year.

Example #5

Mark is an employee at an MNC. His income is $31,000, which falls under the tax slab of $11,000-$44,725. Therefore, he has to pay $3,500 for taxes annually as per the tax percentage.

Types of Taxation

Direct

Direct taxes are levied by the taxation authority on individuals or companies directly. The taxpayer must pay these taxes as per the laws and cannot assign anyone else to pay for them.

- Income tax: Tax levied on the earnings of an individual or organization as per the applicable tax slabs (e.g., tax slabs for W-2).

- Capital gains tax: It is the tax on the gain from the sale of a non-inventory asset like stocks, bonds, precious metals, real estate, and property.

- Wealth tax: It is the tax for home or property owners that is as per their asset’s market value.

- Corporate tax: It is the tax on the company’s taxable income.

- Securities transaction tax: It is the tax paid on the sale or purchase of securities (excluding currency and commodities) through the recognized stock exchange.

- Gift tax: tax on the taxpayer who gives gifts in terms of money or assets.

Indirect

Indirect taxes are levied indirectly depending on the type of goods and services. The person providing the services or selling those goods acts as an intermediary in collecting the indirect tax.

- Excise duty: a tax levied on the manufacture and production of goods.

- Sales tax: a tax charged on the sale of goods.

- Services Tax: Tax charged on services provided.

- Customs duty: The tax on goods imports and exports, which depends on weight, value, dimensions, etc.

- Value-added Tax(VAT): Is applied at each stage of the supply chain when value adds to the product or services.

Principles

Simple and Clear

- The tax laws should be simple and easily understood by anyone, whether literate or illiterate.

- They should be easy to understand and refrain from promoting corruption through loopholes.

Effective

- Taxes should be according to the individual/firm’s ability to pay. It implies fair taxes based on their ability to pay.

- They should avoid Double and intentional non-taxation.

Ease of Administration

- The tax rules and forms and the mode of payments should be readily available to taxpayers and collectors.

- It should enable and support tax law enforcement equally.

Efficient

- They should enforce cost-efficient processes and rules for assessing, collecting, and controlling the taxation task.

Meet the Economic Goal

- It should provide timely and adequate revenue for the different activities planned by the government.

Flexible and Stable

- The tax laws should be dynamic and designed to adapt to technological and commercial developments.

- They should be durable enough to avoid frequent amendments.

Benefits & Uses of Taxation

- Taxation is a source of revenue for the authority collecting tax.

- Countries use it for the safety and security of the territories and internal law and order.

- It can also help fund research, training, and public and social welfare schemes and services like transport, healthcare, education, and infrastructure.

- Provides financial support for conserving heritage, culture, and the environment.

- It goes for governance expenses like salaries and pensions of government employees and helps in the payment of various loans and debts by the government.

- They are providing help to the underprivileged through social security schemes.

Final Thoughts

Taxation is undoubtedly an essential process in the successful rendering of responsibilities of a government. The society comprises people with different skills, earnings, and requirements. Proper utilization of revenue collected for the benefit and upliftment of the whole community is a daunting and exhaustive task for governments. Residents can support the government by readily and timely paying taxes.

Frequently Asked Questions(FAQs)

Q1. What are the 2 Classifications of taxes?

Answer: Taxes classify into two subdivisions, such as direct and indirect taxes. Direct taxes are paid by an individual citizen, for example, income tax. In contrast, indirect taxes are what businesses collect from customers and pay to the government; for example, tax on goods and services (GST).

Q2. What are the sources of taxes?

Answer: Taxes apply on individual incomes, i.e., income tax, as well as on goods and services, known as GST. There are other sources, such as customs duties, wealth taxes, corporate taxes, gift taxes, and union excise duties.

Q3. What is a tax ratio?

Answer: Tax ratio indicates an individual’s taxable income; hence, it depends on their income. Another implication of the tax ratio is the comparison of a nation’s collected taxes to its GDP. It is known as the Tax-to-GDP ratio, which signifies the government’s tax efficiency.

Q4. What affects the individual tax rate?

Answer: Every individual pays taxes according to their income slab. Thus, the tax rate eventually depends on individual income. However, some exclusions exist for taxable income, such as using the money for provident funds, insurance policies, charity, etc. Individuals can deduct those transactions from their income and then calculate their taxes.

Q5. Which taxation policy does the government employ?

Answer: It depends on the government as to which taxation policies it chooses for taxation. Progressive taxation is where the affluent pay more taxes than other counterparts, while regressive taxation is where the commoner is highly taxed. Proportional taxation is where the tax is according to the paying capacity of the entity.

Recommended Articles

This article taught you about taxation, its types, benefits, and principles. To learn more about this topic, you can refer to these articles.