Lagging Indicators Definition

Lagging indicators are variables, such as interest rates, profits, etc., that help analyze the market after the occurrence of a significant economic or financial event. For example, the increasing interest rates can indicate that the economy is in inflation. As a countermeasure, the government increases the interest rates.

They are essential corporate operations and strategy tools and can indicate asset acquisition/disposition in financial markets. They can also determine the direction of the economy in general. The unemployment rate, corporations’ profits, and labor cost per unit of output are some indicators.

Key Highlights

- Lagging indicators describe recent economic actions, occurrences, or developments and aid in detecting long-term trends or patterns.

- These indicators can be business indicators (used for performance evaluation) or technical indicators (used to comprehend changes in market prices).

- The most common examples are the unemployment rate, corporate profit reports, and GDP.

- While a leading indicator anticipates outcomes and events in the future, a lagging indicator evaluates whether the desired result has occurred in the past.

Examples of Lagging Indicators

Example #1: Trading

As per the trading lagging indicator SMA (simple moving average), the Bitcoin market will fall below the death cross. Passing the death cross (intersection of two averages) means the market will fall further. Therefore, it indicates that it is not a good position for traders to hold cryptocurrency.

Example #2: Economics

Company ABC has started using a new technology that has reduced production time and costs. They have constantly replaced old technology with new ones, improving their corporate profits. They consider the indicator and keep enhancing their gadgets with every further advancement.

Example #3: Safety

The chemical industry XYZ has frequent employee injuries while using a particular chemical. Therefore, considering the frequency rate of injuries as a lagging indicator, the company implements additional safety measures in using that chemical.

Types of Lagging Indicators

#1 The Unemployment Rate

- If the unemployment rate is low, fewer individuals are looking for work, and more people have been out of work for an extended period.

- It indicates that the nation is experiencing poor economic performance.

#2 Corporate Profit Reports

- Corporate Profit Reports are regarded as lagging economic indicators because the data only provides a retrospective look at the performance of the private sector.

- The private sector development and its influence can be measured by how the CPR figures alter over time in connection to the state of the economy.

#3 Interest Rates

- Interest rates are indicators that primarily concern the inflation rate. Thus, it may be an indicator of rising or declining inflation.

- The government changes, i.e., increases or decreases interest rates depending upon the nation’s inflation rate.

Indicators for Business

- Lagging indicators are key operational indicators (KPIs).

- They use variables such as sales, customer satisfaction, and revenue churn for computations.

- Businesses employ various tools to assess, monitor, and evaluate performance indicators.

- As at least some of them result from business decisions and operations, they provide an understanding of how businesses operate.

- Personal factors cannot easily affect these indicators.

Lagging Indicators in Trading

Technical indicators assess the current price of an asset after a specific price movement has occurred. It measures the value of a variable concerning its own moving average over a given period.

#1 Moving Averages (MA)

- The Moving Averages depend and move on past information. When the price level exceeds this average or when two levels cross one another, it generates indications like buy and sell.

- It is calculated based on previous price events, which maintains the current market price.

#2 The Moving Average Convergence Divergence Indicator

- As a trend-following indicator, the Moving Average Convergence Divergence works on the MA concept.

- Users of this tool must manage three elements: a histogram, and two MAs, one of which is the signal line while the other is the MACD line.

- The sole distinction is that these indicators only produce signals when two lines intersect while the trend is still in action.

#3 Bollinger Bands

- These rely on two outer lines and a 20-day simple moving average as the main input.

- The former displays both positive and negative SMA standard deviations.

- The same gauges market volatility. The bands get wider as the market becomes more unpredictable.

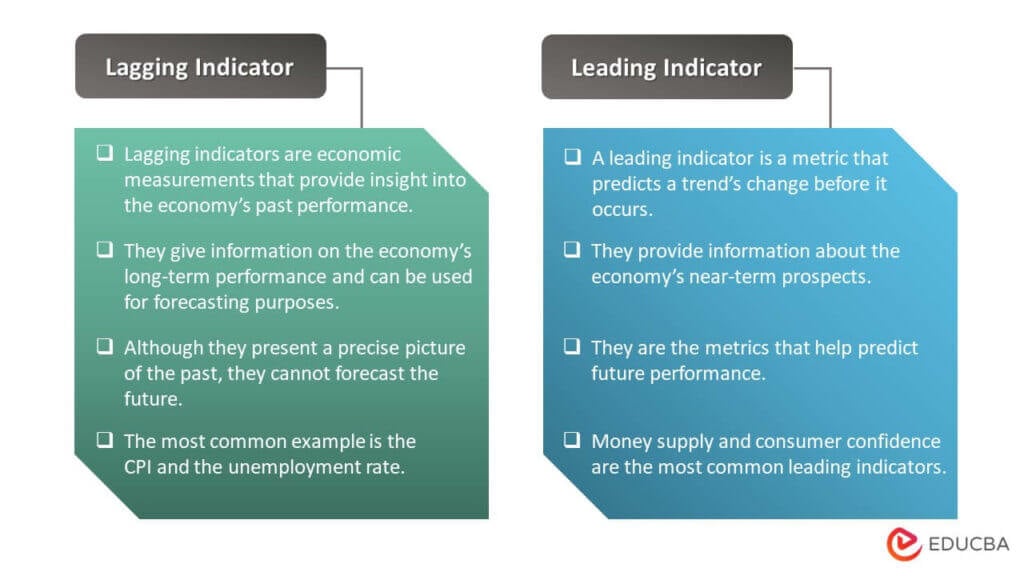

Difference Between Lagging vs. Leading Indicators

Limitations of Lagging Indicators

- Lagging indicators require time to measure since they track long-term trends.

- Since they are reactionary, indicators that are lagging are not ideal indicators when it comes to preventing problems.

- Although lagging indications are simpler to spot, they don’t reflect the present trend.

Final Thoughts

A lagging indicator is a sign that is proven correct after a substantial change. Thus, they confirm long-term trends but cannot predict them. It is feasible to ensure the presence of a change in the economy by examining these indicators. They also play a big part in safety and are crucial statistics in the trading and commercial sectors.

Frequently Asked Questions (FAQs)

Q1. What are the lagging indicators of safety?

Answer: In the safety aspect, a lagging indicator measures the effectiveness of the existing safety measures. They usually analyze the frequency and severity of past unfortunate events. They then help strategize any changes in those current measures. OSHA (Occupational Safety and Health Administration) uses indicators like injury severity, rate of fatalities, and more.

Q2. What are some examples of lagging indicators?

Answer: The unemployment rate, corporate profit reports, and labor costs per unit of output are a few examples of lagging indicators. Another example is sales revenue, which reflects revenue generated after an event has already occurred and takes time to develop.

Q3. What is the difference between leading indicators and lagging indicators?

Answer: A lagging indicator analyzes present output and performance, whereas a leading indicator advises company leaders on achieving desired objectives. It is simple to measure but hard to evaluate, whereas a leading indicator is dynamic but challenging to track.

Q4. Is inflation a lagging indicator?

Answer: Yes, we can use inflation as a lagging indicator. It is the rise in prices of products/services in an economy. Thus, there has been an increase in product demand, leading to a surge in prices. It can also signify economic growth.

Q5. When are lagging indicators used?

Answer: While these serve as key performance indicators (KPIs) in the business world, industrial units employ them to comprehend the trends in mishaps that have happened in the past due to a lack of safety precautions. Therefore, businesses take steps to raise safety standards. Additionally, these indicators are essential for the stock market since they enable traders to verify the current asset values before entering a deal.

Recommended Articles

This article explains everything about the Lagging Indicator. To know more, visit the following articles: