Updated July 6, 2023

What is the Cost of Sales?

Cost of sales are expenses a business incurs to produce goods and services and generate sales. For Example, Nike’s cost of sale for FY 2022 was $25,231. It was $24,576 in FY 2021, which means it saw a rise of $655. It mainly consisted of inventory and warehousing costs.

It is the largest portion of most businesses’ expenses and helps firms in decision-making. It’s important because companies use it in different critical metrics for businesses, like gross and profit margins. Companies also use its percentage to compare with other similar companies.

Key Highlights

- Cost of sales is the cost that firms spend on every product they sell. It includes what you pay for raw materials, labor costs, and shipping and handling.

- A business can calculate it by adding the beginning inventory with purchases and subtracting the sum from the final inventory.

- It is the largest portion of most businesses’ expenses, so it’s important to calculate its percentage in total expenditure. When this percentage increases, profits decrease because less money is available after companies deduct costs.

Formula

The formula is,

Here,

- Beginning inventory is the stock available at the start of the financial year.

- Purchases are expenses you incur to add to your inventory.

- The final inventory is the inventory at the end of a financial year.

Examples of Cost of Sales

Example #1

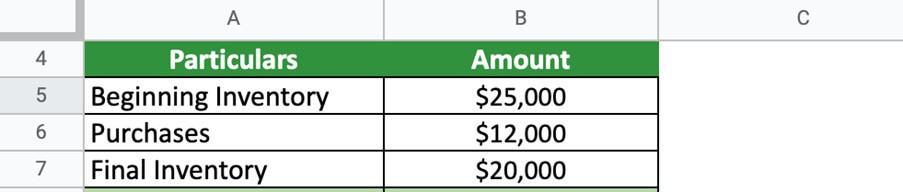

ABC Ltd is a paper manufacturing company. At the start of the financial year, it had an inventory of $25,000. They made purchases of raw materials worth $12,000 throughout the year. The inventory at the end of the financial year 2022 was $20,000. Calculate the cost of sales.

Given,

Solution,

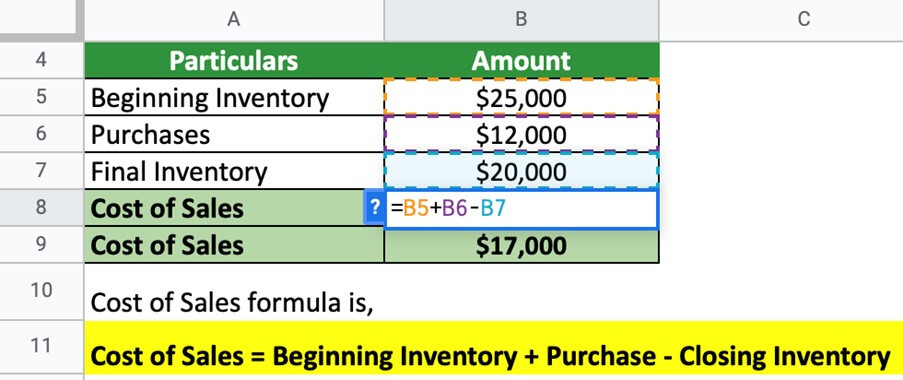

Implementing the formula,

The cost of sale for ABC Ltd is $17,000. It indicates that the company spent $17,000 on producing goods/services.

Example #2

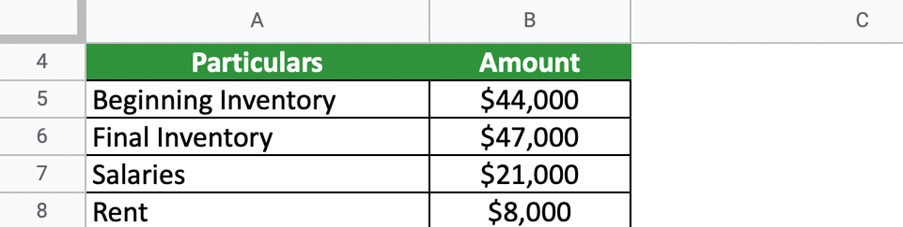

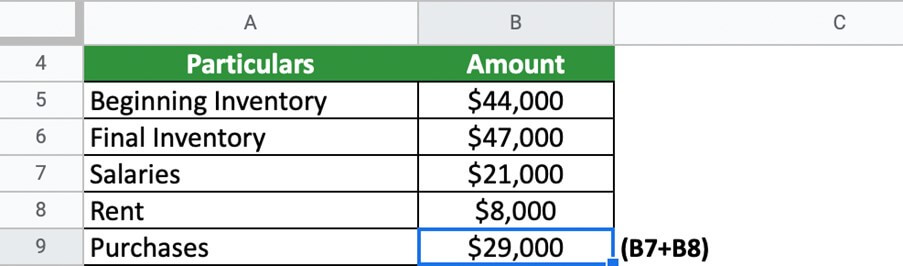

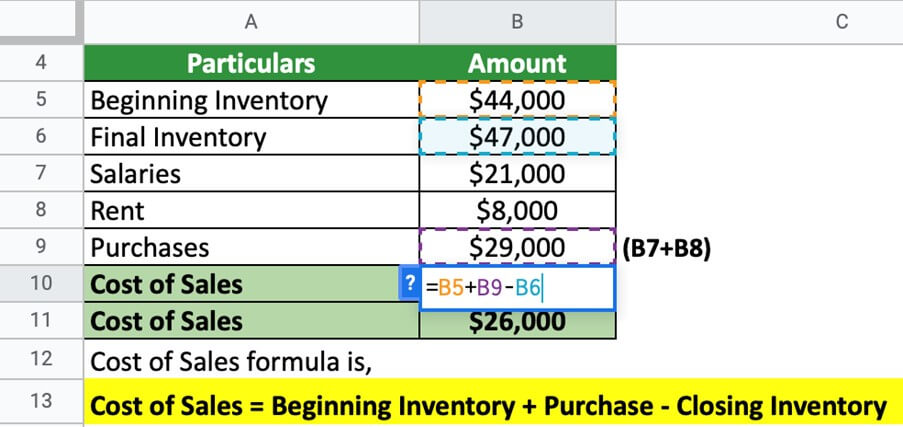

Tastebuds Ltd is in the food business. At the beginning of the financial year, it had an inventory of $44,000. It paid salaries worth $21,000, and rent costs around $8,000. At the end of the financial year 2022, the final inventory was $47,000. Calculate the Cost of Sales.

Given,

Solution,

Calculating Total Purchases,

Now, we calculate the Cost Of Sales,

The Cost of Sale is $26,000. It took Tastebuds Ltd $26,000 to generate sales and revenues.

Cost of Sales vs. Cost of Goods Sold

|

Cost of Sales |

Cost of Goods Sold |

|

| Analysis | It analyzes the direct and indirect costs of selling a company’s goods and services. | It analyzes the direct costs related to producing a company’s goods. |

| Location of Income Statement | Companies list it before the EBIT margin (operating profit over operating sales). | Because it includes all direct expenses related to generating revenue, companies list it after revenue. |

| Amount | It includes other costs. | When companies use both, COGS is always less than the cost of sale because COGS concentrates on a company’s direct costs. |

| Calculation | Its calculation reflects the number of goods sold. | The calculation for COGS reflects the number of goods a company manufactures. |

| Tax Deduction | It is not deductible for tax purposes. | A company’s tax deductions may increase, and its business profits may decrease by claiming COGS and other business expenses. |

Importance

- Businesses can use it to calculate their profit margin and profitability.

- It enables individuals to examine and evaluate their cost structure more clearly.

- It provides pricing clarity so that managers can run a successful business.

- It allows companies to create a pricing and discount strategy that works.

- Individuals can change their business model with its aid and make optimal decisions.

- It is an important metric to determine a company’s gross margin.

- It should always be looked at when trying to reduce expenses or increase profits, as this can significantly impact both.

Cost of Sales Calculator

Use the following calculator for Cost of Sales calculations.

| Beginning Inventory | |

| Purchases | |

| Final Inventory | |

| Cost of Sales = | |

| Cost of Sales = | Beginning Inventory + Purchases - Final Inventory |

| = | 0 + 0 - 0 = 0 |

Final Thoughts

The cost of sale measures how much money a company spends on producing and selling a product or service. In addition to providing an understanding of how much it costs a company to make and sell its products, it is also necessary to calculate it because it helps investors know what the net income will be before they take out the taxes.

Frequently Asked Questions(FAQs)

Q1. What is the cost of sale in accounting? Give an example of the cost of sales.

Answer: It is an accounting measure of the total amount a business spends on producing goods and services. It includes raw materials, labor, and overhead costs a company pays on generating a sale.

For example, a furniture company purchases wood (raw material) and hires an artisan to make a chair. The money the company spends on paying the craftsman and on the raw material comes under the cost of sale.

Q2. How to calculate the cost of sales?

Answer: We can calculate it by adding the purchases to the opening inventory and subtracting the sum from the closing inventory. The purchases in question are additions to the beginning inventory throughout the year. The formula is,

Cost of Sales = Beginning Inventory + Purchases – Final Inventory

Q3. Differentiate cost of sale vs. sales.

Answer: Cost of sale is a business expense that includes the various costs of producing goods and services. In contrast, sale are when businesses sell their product and service and earn an income.

Q4. Differentiate cost of sales vs. cost of goods sold.

Answer: Cost of sale is the total expense a company pays to sell its products and services. On the other hand, the cost of goods sold (COGS) is what a business spends on raw materials to produce finished goods.

Q5. Is the cost of sales an expense?

Answer: Yes, the cost of sale is an expense a company incurs to sell its product or services in a competitive market. It involves direct labor, raw material, and overhead expenses.

Recommended Articles

This was an EDUCBA guide to the Cost of Sales. To learn more about it, please read the following articles: