Updated July 4, 2023

What is an Economic Recession?

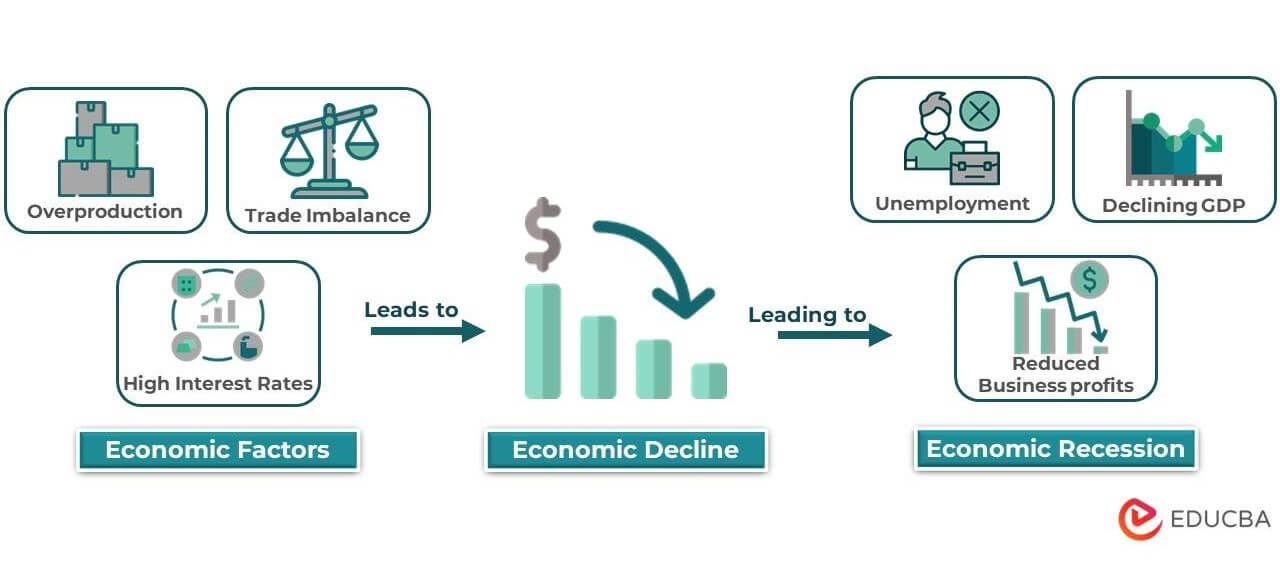

An economic recession is a period when the economy of a country is experiencing a decline, leading to reduced business profits, job losses, and lower consumer spending.

For example, let’s say that a country’s economy primarily survives on oil exports, and the oil price suddenly drops. It could cause businesses in that country to lose money, leading to job losses and decreased consumer spending. It, in turn, could cause the economy to enter into a recession.

Economic ression is a difficult time for many people, as it can lead to financial difficulties and job losses. However, economies are cyclical, and recessions often end with periods of growth and prosperity.

Key Highlights

- An economic recession is a period of overall economic deterioration.

- Some of its major causes are rising inflation, interest rates, product prices, and the fiscal deficit.

- To prepare for a recession, save extra capital, repay high-interest loans, create an emergency fund, etc.

- An extended recession can cause a decline in employment, economic growth, and market stability.

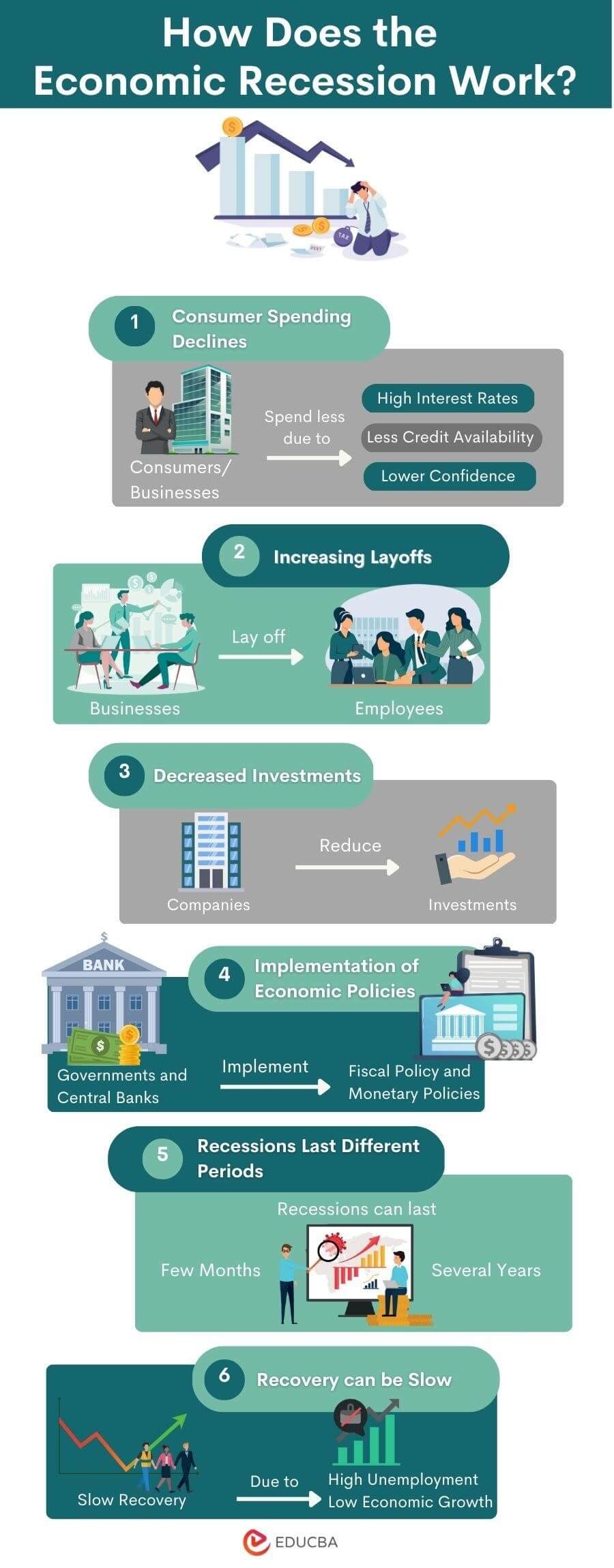

How Does the Economic Recession Work?

#1 Consumer spending declines

Factors such as higher interest rates, lower confidence, or less credit availability cause consumers and businesses to spend less, which starts recessions.

#2 Businesses lay off workers

Businesses lay off workers when spending decreases, further decreasing expenditure and economic activity.

#3 Businesses cut back on investment

A recession causes businesses to cut back on investments, banks to tighten lending rules, and consumers to reduce spending.

#4 Governments implement economic policies

Governments and central banks implement fiscal incentives and monetary easing policies to stimulate economic growth and stabilize the economy.

#5 Recessions can last different periods

Recessions can vary in duration and severity, with some lasting only a few months and others lasting for several years.

#6 Recovery from economic recessions can be slow

Recovery from a recession can be slow, with persistently high levels of unemployment and low economic growth rates even after the recession ends.

Case Study:

- Let’s say that the country XYZ is experiencing a decline in consumer spending due to increased interest rates.

- As a result, businesses in the country begin laying off workers, reducing spending and economic activity.

- It leads to a cutback in business investment, with banks in that country also tightening lending standards and consumers in the country reducing their spending.

- To address the situation, the government and central bank of the country implement fiscal incentives and monetary easing policies to stimulate economic growth and stabilize the economy.

- However, the recession lasts four years, during which the country’s GDP declines by 10%, and the unemployment rate increases from 5% to 15%.

- The recovery is slow, with high levels of unemployment and low economic growth rates persisting even after the recession ends.

Examples of Economic Recession

#1 2008 Global or Great Recession

The US housing market collapse in 2007 caused the Great Recession. Banks sold mortgage-backed securities using interest-only loans, which subprime borrowers couldn’t afford when rates changed. Housing prices dropped, leading to a financial crisis.

#2 The COVID-19 Economic recession

The COVID-19 pandemic caused the global economy to fall into a recession, known as the COVID-19 Economic Recession or Great Lockdown. The conflict led to higher interest rates, reduced economic growth, and US government bond market inversion. Inversions have contributed to past recessions, indicating a possible future slowdown.

#3 Current Economic Recession

The conflict between Russia and Ukraine in 2022 caused signs of an economic downturn. The dispute raised interest rates, reduced economic growth, and led to the US government bond market inversion. While economists don’t predict a recession, inversions have affected previous recessions, suggesting a possible future slowdown.

How to Track an Economic Recession?

Step #1 Look for declines in Gross Domestic Product (GDP)

GDP measures the total output of goods and services produced within a country. A decrease in GDP is often an indicator of an economic recession.

For example, during the 2008 financial crisis in the US, the country experienced a 2.8% decline in GDP in 2009, ending the longest economic expansion.

Step #2 Check employment numbers

Rising unemployment rates are a typical sign of a recession. Watch for increases in jobless claims, layoffs, and business closures.

For instance, during the COVID-19 pandemic in 2020, the US unemployment rate rose from 3.5% in February to 14.8% in April.

Step #3 Monitor consumer and business spending

When consumers and businesses cut back on spending, it can cause a recession. Retail sales, consumer confidence, and business investment are critical indicators to track.

For example, during the 1990 recession in Japan, consumer spending decreased by 1.4%, causing a decline in economic growth.

Step #4 Analyze inflation

During a recession, prices for goods and services often decrease as demand falls. Keep an eye on the inflation rate, indicating an early economic downturn.

For example, during the 2001 recession in Germany, the inflation rate decreased from 2.1% to 0.9%.

Step #5 Follow the stock market

The stock market can indicate overall economic health. Significant drops in major stock indices can signal a recession.

For instance, during the 2008 financial crisis in the US, the Dow Jones Industrial Average fell by 33.8% from its peak in October 2007 to its low in March 2009.

Step #6 Look at interest rates

Central banks often lower interest rates during a recession to stimulate economic growth. Rising interest rates can signal a slowdown while falling interest rates can indicate the beginning of a recovery.

For example, during the 2009 recession in the UK, the Bank of England lowered its interest rate from 5% to 0.5% to encourage borrowing and spending.

Causes of Economic Recession

Major causes of a recession are:

- Economic shocks: Economic shocks like natural disasters, a sudden shift in oil prices, and market crashes can trigger an economic recession.

- Overproduction and overspending: If businesses produce too many goods or consumers spend beyond their means, it can create an oversupply of goods and services, leading to a recession.

- A decline in consumer spending: A drop in consumer spending caused by high levels of debt, unemployment, or low consumer confidence, can lead to a reduction in demand and an economic recession.

- Tight monetary policy: When central banks increase interest rates or reduce the money supply, citizens reduce their spending, leading to a recession.

- Financial imbalances: Financial imbalances such as asset bubbles, where the price of an asset rises far beyond its intrinsic value, can eventually lead to a financial crisis and economic recession.

- International trade imbalances: Trade imbalances such as a large trade deficit can lead to a decline in the value of a country’s currency, making imports more expensive and exports less competitive, leading to a recession.

Effects of Economic Recession

Some of the impacts of a recession include:

- Job losses: One of the most significant effects of an economic recession is job losses. As businesses struggle to maintain profitability, they may lay off workers, reduce hours or benefits, or freeze hiring. It leads to increased unemployment and reduced consumer spending.

- Reduced consumer spending: People tend to cut back on discretionary spending and focus on essential items. It can lead to reduced sales for businesses, particularly those in the retail and hospitality industries.

- Declining GDP: Gross Domestic Product (GDP) measures the total value of goods and services produced in an economy. GDP typically falls as economic activity slows down.

- Decreased investment: During a recession, businesses may be reluctant to invest in new projects or expand their operations. It can lead to reduced economic growth and job opportunities.

- Financial market instability: Recessions can lead to instability in financial markets as investors become more risk-averse and seek to protect their investments. It can lead to a decline in stock prices and reduced access to credit.

- Government intervention: In some cases, governments may intervene in the economy during a recession to stimulate growth and prevent further declines. It may involve fiscal stimulus packages, interest rate cuts, or quantitative easing.

How to Prepare for an Economic Recession?

Preparing for an economic recession can help people and businesses weather the storm and keep their finances from worsening. Here are some steps that one can take to prepare for a recession:

Step #1 Build an emergency fund

- Build an emergency fund that includes rent/mortgage payments, food, utilities, and other essential bills.

- It should be able to cover basic living expenses for at least six months.

- This fund provides a financial cushion in case of job loss, reduced income, or unexpected expenses.

Step #2 Reduce debt

- Reducing high-interest debt, such as credit cards or personal loans, can free up cash flow and provide more financial flexibility during a recession.

- Consider prioritizing paying off high-interest debt first and avoid taking on new debt if possible.

Step #3 Review and adjust investments

- Reviewing investment portfolios and changing asset allocation can reduce the impact of market volatility during a recession.

- Consider diversifying investments into low-risk investments such as bonds and cash, and avoid taking on too much risk.

- Consult with a financial advisor to discuss investment strategies that align with risk tolerance and financial goals.

Step #4 Cut unnecessary expenses

- Review monthly payments and identify areas to reduce spending.

- Consider reducing subscription services, eating out less, and finding more affordable ways to enjoy hobbies and leisure activities.

- Cutting back on unnecessary expenses can free up cash flow, which one can use to build an emergency fund or pay down debt.

Step #5 Diversify income sources

- Diversifying sources of income can provide additional financial stability during a recession.

- Consider taking on a side job, starting a small business, or finding other income sources.

- Having multiple sources of income can help reduce the impact of job loss or reduced gain during a recession.

Step #6 Maintain a positive mindset

- Maintaining a positive attitude and focusing on personal and professional development can help individuals and businesses to adapt and thrive during difficult times.

- Consider taking online courses, learning new skills, or pursuing hobbies that can help provide a sense of purpose and fulfillment.

- A positive attitude and adaptability can help individuals and businesses navigate a recession and become more assertive on the other side.

Economic Recession Vs. Depression

| Basis | Economic Recession | Depression |

| Definition | It is a period of economic decline characterized by reduced economic output, rising unemployment, and decreased consumer and business confidence. | It is a severe and prolonged economic downturn characterized by high unemployment, low economic output, and a significant consumer and business confidence decline. |

| Duration | Generally lasts for a shorter period (typically six months to 1 year). | Lasts for several years (typically more than 3 years). |

| GDP Decline | A decline in GDP of less than 10%. | A decline in GDP of at least 10% or more. |

| Unemployment Rate | The unemployment rate generally rises but not as high as in a depression. | A high unemployment rate of at least 25%. |

| Consumer Spending | Reduced consumer spending due to economic uncertainty, but not as severe as in a depression. | Significantly reduced consumer spending due to economic uncertainty and job losses. |

| Policy Response | The government may implement stimulus measures but not to the same extent as in a depression. | Requires significant government intervention and stimulus measures to revive the economy. |

Frequently Asked Questions(FAQs)

Q1. How long does an economic recession stay?

Answer: The length can depend on many things, such as how bad the economic downturn is and how well government policies get the economy going again. Recessions usually last from a few months to a few years before the economy improves. The Great Depression of 1929 was the most prolonged, lasting ten years.

Q2. What actions should I avoid during an economic recession?

Answer: Avoid overspending, panic selling investments, and ignoring bills. For example, consider using public transportation, hold onto your investments, and prioritize paying bills to avoid further financial strain.

Q3. What should I purchase ahead of an economic recession?

Answer: As an economic recession approaches, it’s wise to proactively consider procuring essential goods, such as non-perishable food items, household supplies, and medical necessities. It’s also an excellent strategy to stock up on things likely to experience price hikes during the economic downturn.

Exploring defensive stocks and bonds can be smart, as they are often less susceptible to the negative impacts of economic downturns. By taking these proactive measures, individuals can prepare to weather the financial storm ahead and position themselves for future success.

Q4. What was the worst economic recession in history?

Answer: The Great Depression of 1929-1933 was the worst economic recession in history. It started in the United States and quickly spread to other countries. The stock market crashed, banks failed, and unemployment soared. Millions of people lost their homes and businesses. It took years for the global economy to recover from this devastating recession.

Recommended Article

We hope this EDUCBA information on the Economic Recession benefited you. For further guidance on economics-related topics, EDUCBA recommends these articles: