Meaning of Invoice

In accounting, an invoice is a formal request for payment that a seller sends a buyer, mentioning all the items or services they offered and their prices.

An invoice includes crucial information such as:

⇒ Transaction date

⇒ Parties involved

⇒ Description of purchased products

⇒ Quantities

⇒ Prices

⇒ Payment terms

Invoicing is an integral part of every business, whether you are a small business owner, a large corporation, or a freelance service provider.

Table of Contents

Key Highlights

- An Invoice is a legal and commercial document that serves as both a request for payment and a record of the transaction for the vendor.

- It helps in record keeping, payment tracking, and inventory management, among other things.

- There are various types: Pro forma, interim, recurring, retainer, credit, debit, timesheet, past-due, and so on, all serving a different purpose.

- The main difference between an invoice and a receipt is that an invoice is a request for payment, while a receipt is a confirmation of payment.

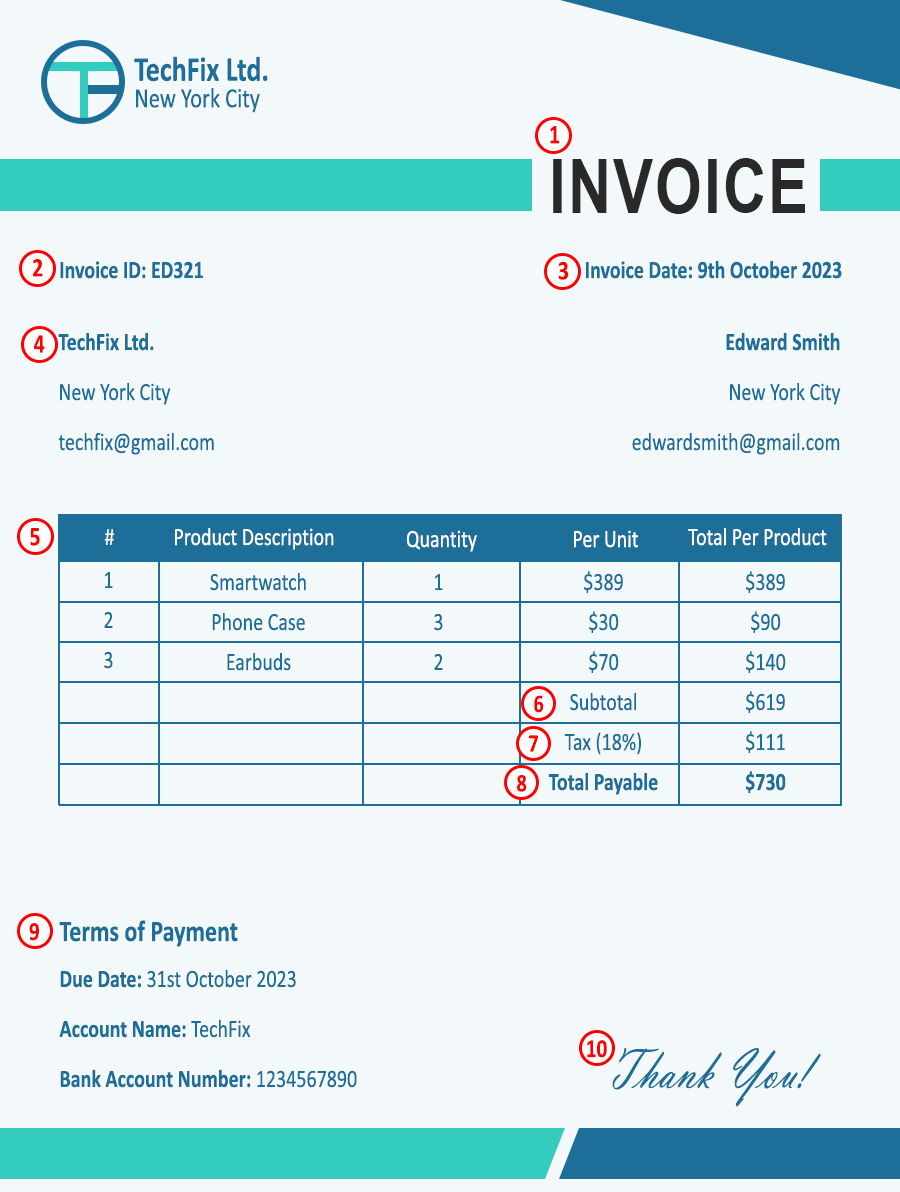

Elements

The structure of an invoice depends on its type, the type of business, and many other factors. However, it typically contains the following elements:

- The top of the document/paper should have the word “Invoice” to show the document’s purpose.

- Invoice ID/number

- Invoice Date

- Seller’s and buyer’s information (name, address, contact, etc.)

- A brief description of each product or service, including quantity, unit price, and total cost per product/service.

- The sum of all item costs before taxes or additional charges.

- Displays any applicable taxes, along with their rates and amounts.

- The grand total, after adding taxes and any additional fees.

- Specifies the due date, payment methods, and any late payment penalties.

- Optional section for additional information or special instructions.

Example

Below is an example of a typical invoice. You can find all the elements mentioned in the above section in the below sample.

Invoice Free Template

Find how you can create an easy-to-use invoice template in Excel. Or else, you can directly download a blank invoice template. You can also use an invoicing software like Eemel to automate your invoicing process.

Types

There are various kinds of invoices, each serving a distinct role. The most common types are:

1. Standard

This is the most common option most businesses use as it has a flexible format that they can easily customize, and it works for almost every industry. It simply provides a detailed breakdown of goods or services offered, including prices.

2. Sales

It is another common type. The seller sends this to the buyer once the sale is over. Along with the seller and buyer’s information, an itemized list of goods and services, and price, it might also include the payment link for the buyer.

3. Credit

It is also known as a credit memo or credit note. This comes into use when a buyer has returned an item or has accidentally overpaid, so the seller sends them a credit notice to offer a refund.

4. Debit

It is the complete opposite of a credit memo. While a credit memo offers a refund, the seller sends the debit memo to ask for additional charges. This can happen if the seller changes the order quantity or quicker delivery time. However, a seller must request the customer’s approval before issuing a debit memo.

5. E-Invoice (Electronic Invoice)

Instead of paper, these invoices use digital formats like PDF or specialized e-invoicing systems, which enhance efficiency and reduce paper-based processes.

6. Proforma

This is a preliminary invoice. A vendor sends it to the buyer before delivering the actual goods or services. It is to give the buyer an estimate of how much it can cost and also clarify the sale’s terms.

7. Retainer

Service providers use this to ask clients to make an advance payment. It guarantees that the business will provide the service at a future date.

8. Interim

It is also called an intermediate or a progress invoice. Vendors use this during a long-term project to request partial payment for the work already done.

9. Final

A vendor sends this after completing the entire project or delivering all the goods. It includes all costs and expenses related to the delivered goods or services, along with any applicable taxes and additional costs.

10. Past-Due

Sellers send this to remind clients of unpaid bills that have exceeded the due date, typically including additional late payment fees.

11. Timesheet

Service industries commonly use this type. It details the hours worked by employees or contractors, along with their hourly rates and the total amount due.

12. Commercial

Businesses use commercial invoices for international trade. It also acts as a custom document that outlines who the seller and the buyer are and the items being sold.

13. Recurring

When a buyer often buys the same items in the same quantity from one constant business, the firm sends them a recurring invoice (same repeated invoice). They can send these on a weekly, monthly, quarterly, or annual basis.

14. Mixed/Hybrid

It combines a sales and a purchase invoice and has two sections, one for sales and one for purchase. Businesses use this when they are both the seller and the buyer. For example, if Company A sells chairs and tables to Company B and, at the same time, buys machinery from Company B, they will send a mixed invoice to Company B.

Uses

Invoices serve multiple purposes, including the following:

- Record Keeping: They provide a comprehensive record of transactions, helping businesses and individuals track their financial activities over time.

- Proof of Transaction: They act as evidence of the sale, protecting both the seller and the buyer in case of disputes.

- Legal Compliance: Many countries require businesses to issue invoices for tax purposes.

- Inventory Management: They help businesses monitor their inventory by recording items sold and their respective quantities.

- Payment Tracking: They facilitate payment tracking by specifying due dates and payment methods.

Invoice Vs. Receipt Vs. Bill

Following are the main differences between an invoice, a bill, and a receipt.

| Aspects | Invoice | Bill | Receipt |

| Purpose | Payment Request Document (Has all details of the purchase). |

Payment Request Document (mentions only the item names and amount to be paid). | Payment confirmation document |

| Uses | Issued when products and services are offered on credit. | Sent to receive immediate payment after the delivery of the goods or services. | Acts as proof of payment. |

| Timing | Before, during, or after a good is delivered and the payment is still pending. | Immediately after the sale and before the payment. | After the buyer makes the payment. |

| Contents |

|

|

|

Final Thoughts

A proper invoicing system helps a business streamline its payment process and keep an eye on all transactions. It helps prevent fraud, late payments, and duplicate payments. Moreover, digitizing this process can help businesses save time and money and make the entire process more transparent.

Frequently Asked Questions (FAQs)

Q1. What happens if I receive an invoice?

Answer: An invoice serves as a legally binding agreement to deliver goods or render services and a request for payment. If you receive an invoice, you are legally required to make the payment according to the payment terms agreed upon by both parties.

Q2. Who can issue an invoice?

Answer: Any individual or business that offers a product or a service to a buyer can issue an invoice. There are various formats that you can use to create an invoice that suits your particular situation.

Q3. Why does a company ask for an invoice?

Answer: A company that has bought a good or service from you will ask you for an invoice to keep a record of the payment. It helps them in the cash-flow management.

Recommended Articles

We believe this all-inclusive article on an invoice has provided all the information you need. To know about more such topics, refer to the following.