What are Financial Modeling Tools?

Financial modeling is a crucial skill for businesses and investors alike. However, creating a model that is robust, accurate, comprehensive, and easy to read can be difficult. Thus, there are financial modeling tools that are powerful software applications that businesses, analysts, and investors can use to create a flawless financial model quickly. This is because financial modeling tools provide easy-to-use options for data input and manipulation, formulas and functions, graphs and charts, analysis features, and more.

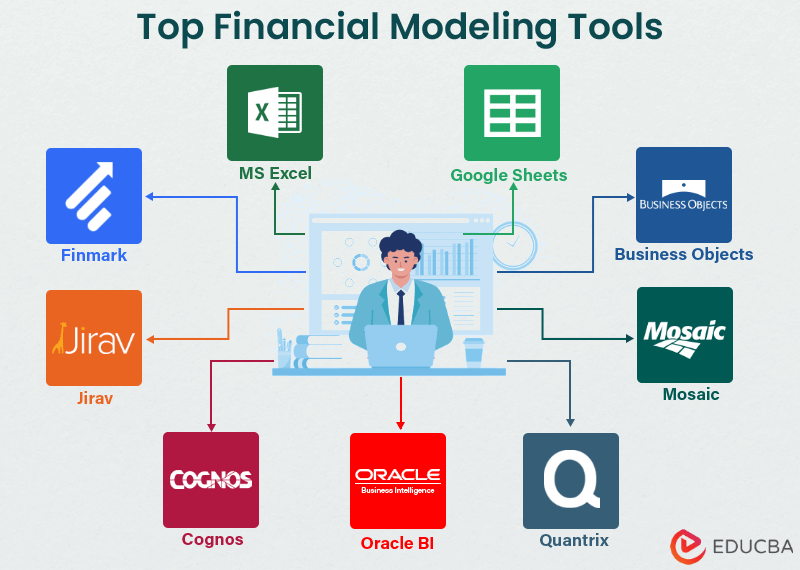

Let us highlight some of the top financial modeling tools in the market. We will also see insights into their features to help you choose the right tool.

Table of Contents

1. MS Excel

Microsoft Excel is a software spreadsheet application useful in many fields but is particularly valuable for financial modeling. This spreadsheet is a grid of cells that you can use to enter data, do calculations, and create charts. Excel is a potent tool because it is versatile and has many features, making it perfect for financial analysis and modeling.

Key Features:

- Data Manipulation: Excel provides arithmetic operations and statistical analysis tools for complex calculations, organization, and manipulation. It makes it a fundamental tool for financial modeling.

- Graphs and Charts: The software offers various graphs and chart types to represent complex financial data in a simple, clear, and visually appealing way.

Pros:

- Flexibility: Excel allows professionals to build highly customizable financial models as per their specific needs and requirements.

- Familiarity: Many individuals in the business and finance sectors are already proficient in using Excel, minimizing the learning curve for financial modeling tasks.

- Accessibility: It is easily accessible and widely available, making it a practical choice as a financial modeling tool.

Cons:

- Complexity: Dealing with intricate models or large datasets can lead to errors and be difficult to interpret.

- Limited Collaboration: Excel provides limited real-time collaboration features compared to other specialized collaboration tools.

More Details on MS Excel for Financial Modeling

| Category | Descriptions |

| Integrations | Supports integration with Netsuite or similar software. |

| Scenario Analysis | Excel has a scenario analysis feature. |

| Support and Resources | Excel offers online resources and assistance to users facing challenges or seeking innovative solutions. |

| Pricing | Excel is part of the Microsoft Office Suite, available through subscription or purchase. |

2. Google Sheets

Google Sheets is a widely used financial modeling tool with several advantages over Excel spreadsheets. It provides collaborative functionality, meaning multiple users can work on the same document and view real-time changes. In addition, it handles large projects and datasets effectively.

Key Features:

- Real-time Collaboration: Google Sheets is a cloud-based application that enables real-time editing, comments, and tracking of changes on a single document by multiple users.

- Version History and Revision Control: It provides detailed version history of document changes, enabling users to restore previous versions and track modifications for accountability and error correction.

Pros:

- Automatic Saving: Changes are automatically saved in sheets, reducing the risk of losing data due to unexpected system failures.

- Accessibility and Compatibility: It is accessible from various devices and platforms like desktops, laptops, smartphones, and tablets, ensuring flexibility and productivity.

Cons:

- Limited Offline Access: Although Google Sheets offers offline mode, some features won’t work without the internet, and some are not as good as other offline spreadsheet software.

- Lack of Advanced Features: Google Sheets may lack some advanced features present in other spreadsheet software like Microsoft Excel.

More Details:

| Category | Description |

| Integrations | Allows integration with various Google Workspace tools such as Google Forms, Google Docs, etc. |

| Scenarios | Suitable for scenario analysis. |

| Support | Supports documentation, conferences, and community chat services. |

| Pricing | Generally available for free. However, premium subscription plans offer additional features and storage. |

3. Quantrix

Quantrix Modeler is an innovative financial and business modeling application aiming to overcome the limitations and risks associated with conventional spreadsheets. It offers a range of distinctive features for financial and operational scenario development.

Key Features:

- User-Friendly Interface: Quantrix Modeler’s interface offers a user-friendly environment for constructing and managing complex models without unnecessary complications.

- Multi-Dimensional Approach: It offers a multi-dimensional modeling approach, meaning users can build models with multiple aspects and show relationships between different data points.

- Scenario Management: It supports financial simulation and scenario analysis and provides valuable insights for potential outcomes.

Pros:

- Reduce Error: Quantrix helps identify, reduce, and prevent formula errors in financial models with built-in error-checking features.

- Data Security: It employs security measures that comply with data privacy regulations to protect sensitive financial data.

Cons:

- Less familiar: Some users may not know Quantrix software, so learning, sharing, and collaboration with teams may be difficult.

- Expensive: Quantrix Modeler is a paid software and is costly, too.

More Details:

| Category | Description |

| Integrations | Offers integrations with various external data sources. |

| Scenarios | Supports scenario analysis and management. |

| Support | It provides training and support resources to guide users on software usage and helps troubleshoot any issues. |

| Pricing | $2,450 per user/ year (as of May 2023). For more details, visit the website. |

4. Oracle BI

Oracle Business Intelligence (BI) provides a platform for financial modeling, including scenario modeling, data integration, and reporting. It aids businesses in making informed decisions by analyzing potential future scenarios.

Key Features:

- Great Analytical Tool: Oracle BI offers robust functionalities that facilitate data analysis using various scenarios.

- Reporting: It offers various tools to create interactive and customizable reports, dashboards, graphs, charts, and tables.

- Data Reuse: Users can reuse data models, reducing the need to rebuild models and saving time and effort.

- Comprehensive Analytics: It provides advanced analytics features, allowing users to access real-time data and build predictive models to understand departmental performance and business insights.

Pros:

- Scalability: Oracle BI has good scalability, making it suitable for handling larger datasets.

- Actionable Insights: It delivers actionable insights through in-depth analysis.

- Mobile App: It provides a mobile app for on-the-go flexibility.

Cons:

- Visual Appeal: Some users find Oracle BI lacking in visual appeal and unsuitable for visualization.

- Complex Architecture: Its architecture can be complicated to understand, potentially affecting user experience.

- Version Changes: The software undergoes significant changes from version to version, making transitions challenging.

More Details:

| Category | Description |

| Integrations | Allows integration between various financial modules and tools through data maps and Smart Push. |

| Scenarios | Provides Scenario analysis to create data models for future analysis. |

| Support | Provides 24/7 support in case of queries. |

| Pricing | Price varies according to the plan and subscription. For more details, visit the website. |

5. IBM Cognos

IBM Cognos is a suite of IBM’s business intelligence and financial performance management software products. It provides a range of tools for financial modeling, including Query Studio and Report Studio. These tools are useful for creating queries, dashboards, data visualization, reporting, analysis, and aiding organizations in making informed decisions.

Key Features:

- Query Studio: Allows users to create ad-hoc queries and reports without in-depth technical knowledge.

- AI-Driven Enhancements: Cognos uses AI-driven features that improve decision-making and business outcomes.

- Report Studio: It offers advanced reporting capabilities, enabling the creation of detailed, informative, portable, and formatted reports for offline use.

- Data Visualization: Provides options for creating interactive and visually appealing data visualizations, like charts and dashboards.

Pros:

- Data Source Connectivity: Cognos can connect to multiple data sources, providing high-quality data analysis and reporting.

- Agility: The platform enhances the business experience by providing insights that assist quick, informed decision-making.

Cons:

- Learning Curve: Some users find Cognos to have a steep learning curve due to its complicated feature set.

- Customization Complexity: Customizing Cognos reports and functionalities can be complex and time-consuming.

- Costly: The platform’s enterprise pricing of premium subscriptions can be relatively high, potentially limiting accessibility for smaller businesses.

More Details:

| Category | Description |

| Integrations | Integrates with various data sources, tools, and software applications, enhancing its versatility. |

| Scenarios | Allows scenario analysis for financial planning to help in decision-making. |

| Support | Offers customer support through calls, emails, and more. |

| Pricing | For standard: $10 per user/month For premium: $40 per user/month For more details, visit the website. |

6. Jirav

Jirav is an all-in-one financial planning and analysis (FP&A) solution to assist companies in their business planning and forecasting processes. It is helpful in budgeting, financial modeling, and forecasts, allowing users to construct sophisticated plans and models with ease.

Key Features:

- Budgeting: Jirav offers a streamlined budgeting process, making it easier for users to create, allocate, manage, and monitor budgets in real time.

- Reporting and Dashboarding: It allows users to create customized reports and dashboards to visualize financial data and performance metrics.

- Single Platform: It offers a centralized platform where team members can collaborate within the platform on financial planning and analysis tasks.

- Automation: Jirav automates repetitive financial tasks, such as data entry and calculations, saving time and reducing the risk of errors.

Pros:

- Save time: It eliminates the need for manual data consolidation, reducing the risk of errors and saving time.

- Easy to Use: Jirav has a user-friendly interface, making it easily accessible for finance professionals and business owners.

Cons:

- Limited Offline Access: Jirav is a cloud-based platform and relies on an internet connection. It had limited offline access features, making working on unreliable internet connection difficult.

- Difficult to Comprehend: Beginners might find Jirav difficult to understand.

- Higher Costs: Jirav’s subscription fees are higher than other project management solutions, making it less accessible to small businesses or startups with limited budgets.

More Details:

| Category | Description |

| Integrations | Supports Integration |

| Scenarios | Allows scenario planning and analysis. |

| Support | Offers customer support through emails. |

| Pricing | For Starter: $10,000/year For Pro: $15,000/year. For more details, visit the website. |

7. Finmark

Finmark is a user-friendly financial modeling tool designed to simplify building financial models and forecasting finances, particularly for startups. Finmark is a more accessible and efficient method that startups can use to model their economic outcomes.

Key Features:

- Simplifies Financial Modeling: Finmark streamlines the process of creating financial models, making it easier for startups to plan and project their finances.

- Interactive Modeling: The tool allows users to dynamically interact with their financial models, facilitating better understanding and analysis.

- Realistic Scenarios: Finmark enables users to create models that closely resemble real-world financial situations, providing a more accurate basis for decision-making.

- Interactive Analysis: The tool’s interactive features, like centralized budgeting and forecast revenue, enhance financial model analysis and improve decision-making.

Pros:

- User-Friendly Interface: Finmark offers an intuitive interface that makes financial modeling accessible to users without extensive spreadsheet expertise.

- Accessible: The user-friendly interface is helpful for individuals who may not be proficient in spreadsheet software.

Cons:

- Limitation in Complex Modeling: While suitable for startups and simpler financial projections, Finmark may not accommodate highly complex financial modeling needs.

- Learning Curve: Users familiar with traditional spreadsheet-based methods might need time to adapt to Finmark’s approach.

More Details:

| Category | Description |

| Integrations | Allows integration with various tools and platforms, like accounting, payroll, and financial data sources. |

| Scenarios | Suitable for scenario analysis, like financial insights, modeling, and fundraising. |

| Support | Provide customer support and solve queries through published articles, mail, etc. |

| Pricing | Finmark provides custom pricing depending on the revenue; for more details, visit their website. |

8. Business Objects

Business Objects is a suite of business intelligence tools provided by SAP. It is helpful for businesses with reporting, querying, data visualization, and sharing insights.

Key Features:

- Reporting and Analysis: Business Objects allows generating various analytical reports and performing in-depth business data analysis.

- Data Visualization: It can create interactive dashboards and visualizations for better data understanding.

- Collaboration: It allows sharing of reports and insights with colleagues securely.

Pros:

- User-Friendly: Business Objects provides a user-friendly interface for business users.

- Customization: It allows you to create customized reports and dashboards according to the company’s needs.

Cons:

- Complexity: Sometimes, implementing and managing data in a Business Objects system can be complex.

- Cost: The licensing and implementation costs can be higher compared to others.

More Details

| Category | Description |

| Integrations | Allow integration with various data sources, including databases, spreadsheets, SAP applications, and non-SAP data sources. |

| Scenarios | Useful for scenario analysis. |

| Support | Provides support through documentation, training, and troubleshooting. |

| Pricing | For price and package, visit the website. |

9. Mosaic Tech

Mosaic Tech is a strategic finance platform for agile planning, real-time reporting, and data-driven decision-making. It aims to streamline financial analytics and planning processes, allowing businesses to predict financial outcomes based on defined goals and historical data.

Key Features:

- Real-time Financial Analytics: Mosaic offers real-time insights into financial data, enabling teams to make strategic decisions promptly.

- Agile Planning: The platform supports agile financial planning, allowing businesses to adapt their strategies based on changing market conditions.

- Customizable Scenarios: Users can create and analyze multiple scenarios to assess potential financial outcomes based on different assumptions.

Pros:

- Budgeting and Planning: The platform supports budgeting and planning processes, aiding in strategic financial management.

- Data Syncing: The software facilitates syncing and mapping data from multiple systems, simplifying data integration.

Cons:

- Limited Functionality: Some users find Mosaic Tech’s functionality limited, particularly in comparison to more advanced tools.

- Tracking Limitations: It does not offer comprehensive tracking features, making it difficult to track changes.

More Details

| Category | Description |

| Integrations | Integrates with ERP systems and various data sources to gather financial data for analysis and reporting. |

| Scenarios | Supports the creation of customizable scenarios, allowing users to model different financial outcomes based on varying parameters. |

| Support | Provide support through blogs, podcasts, chat features, etc. |

| Pricing | It provides custom pricing depending on the module and features; for more details, visit the website. |

These are the top financial modeling tools used by businesses and investors.

Recommended Articles

This article provides a comprehensive overview of the top financial modeling tools available. You also learn about their prices and extra features along with key features, pros and cons. For more financial modeling-related articles, visit the following recommendations,