Updated October 3, 2023

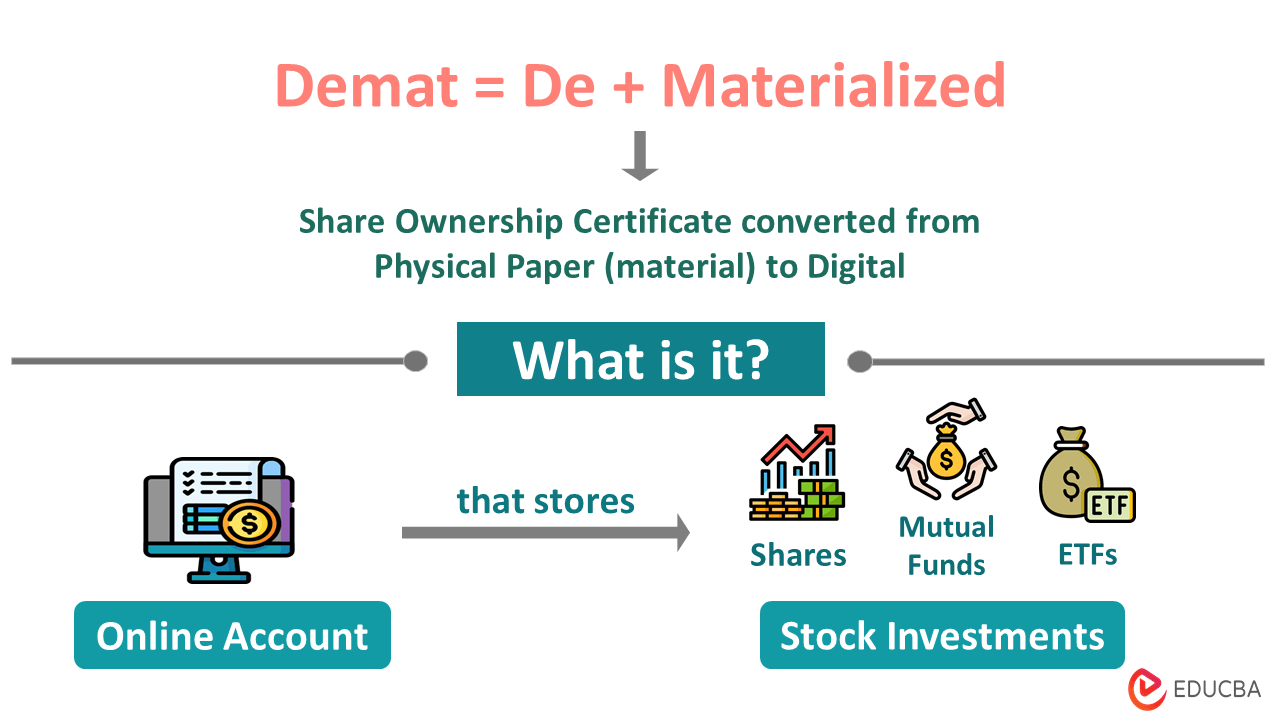

What is a Demat Account?

A Demat account (Dematerialized account) is similar to a savings account for your stock investments, which stores your shares, ETFs, mutual funds, etc.

Ever since the stock market adopted digitalization, shares are now handled digitally rather than in physical form. Since then, you need to open this account to store your investments. This makes trading and storing stocks safer and easier than physical shares.

Having this account is compulsory per the Depository Act of 1996. So, institutions like the National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL) were established to facilitate this.

Table of Contents

Key Highlights

- A Demat account is a digital storage for securities replacing paper share certificates.

- There are three types: Regular, repatriable, and non-repatriable.

- The benefits of using this account are that it is simple and secure, saves time, can hold diverse investments, etc.

- While a trading account lets you buy and sell stocks, a Demat account is helpful for holding the stocks you own.

Types

Before you open this account, knowing which is the best choice for you is important. Thus, here are the three types of accounts you can open:

1. Regular

Investors who are citizens of India and live in the country can use regular accounts.

- National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL) offer and regulate these accounts.

- You can open them with intermediaries such as stockbrokers or depository participants.

- This lets you easily shift your holdings from one account to another institution without any charges.

2. Repatriable

A repatriable Demat account, popularly known as an NRO account, is specifically for non-resident Indians (NRIs) who want to trade in Indian shares but do not live in India.

- This account is regulated by the Foreign Exchange Management Act (FEMA).

- The account holder can transfer their funds (profits) to Indian accounts. They only need to link the account to a NRE bank account.

- To open this account, NRIs must provide essential documents at the Indian Embassy in the country the NRI resides in.

3. Non-Repatriable

A non-repatriable Demat account is very similar to a repatriable account, with the only difference being that a person with a Non-Repatriable account cannot move money to India.

- It is compulsory for the NRI to link their account to an NRO (Non-Resident Ordinary) bank account.

- NRIs cannot transfer the profits and gains to Indian accounts.

- However, they can transfer the initial investment amount or interest earned after deducting the TDS (Tax Deducted at Source).

- Also, as per the Reserve Bank of India (RBI), the account holder can only send up to $1 million annually to Indian accounts.

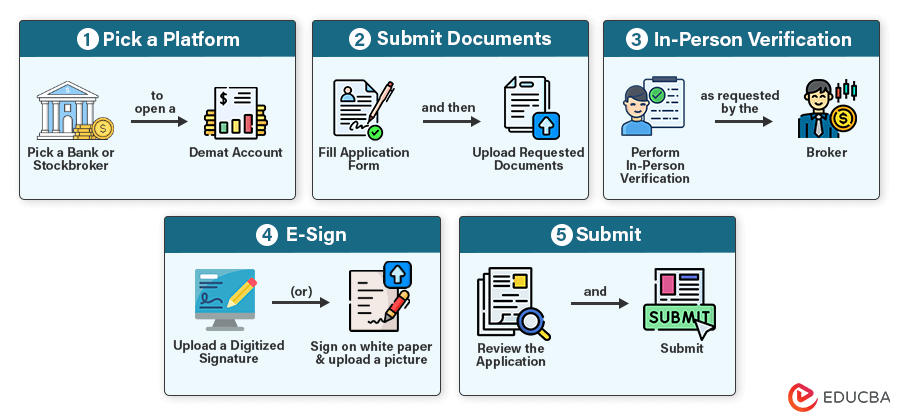

How To Open?

Follow these steps to open a Demat account:

Step #1: Pick a Demat Platform

Pick a depository participant, a financial institution that helps investors manage electronic securities. Banks, stockbrokers, and online investment platforms in India provide depository participant services. Some popular platforms are Zerotha, Grow, etc.

Step #2: Prepare and Submit the Documents

Once you pick from a stockbroker, you need to fill out the application. You will also have to upload the requested documents, such as a photo, PAN card, address proof, bank details, etc., for KYC purposes.

Step #3: Complete IPV (In-person Verification)

After successfully uploading the documents, you must perform an in-person verification. It’s a process of recording yourself for around 30 seconds to verify they are your documents. You might have to perform specific actions, for example, holding a paper with some number.

Step #4: E-Sign the Form

Once done with in-person verification, the next step is for you to upload your signature. You can either generate your digital signature beforehand or sign on a white paper and upload its picture. Generally, the broker’s website will ask for a signature at the end of verification.

Step #5: Review and Submit the Application

The last step is to review your application. You can edit any inaccuracies before you submit the form. So make sure your application is all correct. Once ensured, submit your application and make account opening charges (differs from broker to broker). You will then receive the details of your new Demat account via email.

How Does a Demat Account Work?

Here’s a detailed breakdown of how it works:

- Placing your Order: To start a trade, you place an order through your online trading account.

- Order Processing: The stock exchange will process your placed order.

- Share Ownership Confirmation: Upon successful processing, the shares will be added to your account, confirming your ownership.

- Selling Shares: When you sell your shares, shares are removed from your account, and the received cash value is added to your trading account.

In this process, linking your trading account with your Demat account is crucial. This linkage ensures that funds are seamlessly debited from your trading account when you buy shares and credited when you sell, streamlining your trading transactions.

How To Close?

Although you can track the closure form online, you cannot close your account online on all platforms.

How to Close Demat Account Online?

Go to your respective platform and close your account as per their guidelines. For example, these are the steps to close an account on Zerodha.

Step #1: Login to Zerodha Console

Step #2: Go to Accounts and Segments

Step #3: Choose Close Account, mention your reason, and Continue

Step #4: Perform e-sign-in and authorize the process

Step #5: Finally, add your Aadhaar number and enter the OTP you get.

How to Close Demat Account Offline?

If you want to close your account offline, follow these steps:

Step #1: Clear your Account

Before you go ahead and delete your account, you need to check off a few things. Make sure your Demat account does not have:

- Any open buy or sell positions (Shares that are available to be bought or sold)

- Share and bond holdings (stocks that you own)

- Money or available funds in the account.

If your Demat account has the above-mentioned, consider withdrawing the positions and funds as well as selling or transferring all your holding.

Step #2: Download and fill out the Closure Form

Next, you must download the closure form from your respective platform’s website. For example, this is the form to close an account on Zerodha. After downloading, fill in your name, client ID, etc., and sign it.

Step #3: Visit the Depository Participant’s (DP) Office and submit documents

To submit the form, you can either go to the DP’s office in person or post the form and documents to the respective address. If you are visiting the office, submit the required documents, like your photo, sign, etc., to the respective person.

Step #4: Wait for Confirmation

Finally, after submitting the form, you may have to wait 7 to 10 days to receive the letter of confirmation. After that, you can check if the Demat account is closed by trying to log in.

Benefits

A Demat account offers a variety of benefits to the account holder. Some of those benefits are as follows:

- Simple Access: They are transparent to users and are easily accessible at any time and from any location in the world.

- Diverse Holdings: One account can contain a number of investments, such as mutual funds, equity shares, bonds, and exchange-traded funds.

- Instant Observing: They make it simple to monitor holdings from the convenience of one’s own home.

- Saves Time: With this account, trading becomes incredibly convenient and less time-consuming since everything is in digital format.

- Corporate Benefits: The account immediately notifies the holder of dividends, interest, or refunds as soon as they are credited. Everything is automatically updated, including bonus issues, stock splits, rights shares, etc.

- Less Chance Of Document Loss: It can keep a permanent digital record of your share, making online share storage a much safer and better solution.

- Preventing Fraud: When dealing with paper shares, fraud remains an issue. These accounts eliminate the risk by allowing digital storage of shares. So you can access your shares and other relevant data safely and more authentically.

Final Thoughts

A Demat account is your entry point into the world of digital securities trading. They are becoming more important as stock markets embrace digitization. So, when you enter the world of investing, keep in mind that a Demat account is your key to easy and safe trading.

Frequently Asked Questions (FAQs)

Q1. Is the Demat account free?

Answer: Demat accounts are not usually free, as investors might have to pay opening charges or transaction fees. The charges of opening this account range from broker to broker.

Q2. What is a DR Demat Account?

Answer: A DR account is a special account from which you can invest your money in foreign stocks like Google, Apple, Amazon, etc. These stocks are not available for investors using normal Demat accounts, so investors who want to buy foreign stocks without opening a foreign account, can use the DR account.

Q3. Which bank is best for a Demat account opening?

Answer: You can open your Demat account from any preferred bank. The top listed Indian banks are ICICI Direct, Axis Direct, SBI Securities, HDFC Securities, and Kotak Securities. Some of the best foreign brokers are E*TRADE, Fidelity Investments, Charles Shwab, etc.

Q4. Is it safe to use a Demat account?

Answer: Yes, it’s 100% safe to use a Demat account. It removes the danger of physical share certificates, enables safe online access, and protects ownership, making it a trustworthy and secure digital investment management tool.

Q5. What are some disadvantages of using a Demat account?

Answer: There are no downsides to utilizing a Demat account. However, some people perceive the charges of opening the account as a disadvantage. However, we should remember that this is an investment, not a cost.

Recommended Articles

We hope this article on the Demat account resolved all your questions regarding the topic. For similar content, visit the following articles,