What is Debt Financing?

Debt financing is when companies raise money either by selling debt instruments (bonds or debentures) or by borrowing from external sources as a loan. For instance, Airbnb founders Brian Chesky and Joe Gebbia used business credit cards to borrow more than $25,000 for their business.

Businesses mainly choose this type of financing when they don’t want to give up ownership or lose control of their company. They can use the borrowed money as working capital, for expansion, to buy machines & equipment, or to fund a large project.

Table of Contents

Key Highlights

- In debt financing, a borrower takes money from the lender as a loan or by selling debt instruments.

- Its various sources include bank loans, SBA loans, bonds, business credit cards, equipment financing, and more.

- One of its key advantages is that the interest payments on the loan can be tax-deductible.

- On the other hand, one of its main disadvantages is that businesses need to make regular payments to the lender irrespective of their financial conditions.

How Debt Financing Works?

Here’s how debt financing works:

#1: Borrowing

- An individual, company, or government entity needing funds starts by looking for a lender (bank, financial institution, or individual).

- Instead of asking for a loan, the government or major companies sometimes issue debt instruments that the lenders can purchase.

#2: Agreement on Terms

- After finding an appropriate lender, the borrower applies for debt financing, and the lender reviews their credit history, financial stability, and the purpose of the loan.

- When everything is in line, both parties agree on the loan terms, including the amount, collateral, interest rate, repayment schedule, etc.

#3: Receiving the Funds

- If the lender approves the borrower’s request, they will release the funds.

- In the case of selling debt instruments, when the lender purchases the instrument, the borrower receives the money they require.

#4: Repayment

- Over time, the borrower repays the borrowed money along with the agreed-upon interest, usually in installments.

- If the borrower fails to make the payments, it can damage their credit score, they can lose the collateral, and also be subjected to legal action.

- In the case of debt instruments, the borrower has to repay the borrowed money as well as annual coupon payments (typically similar to interest payments).

Types

We can classify debt financing into two categories: Short-term and long-term.

1. Short-Term

It involves borrowing money for a brief period, typically less than a year. This form of financing helps companies manage day-to-day financial obligations and address short-term challenges.

The main purpose is to resolve immediate financial needs like working capital requirements, buying seasonal inventory, or managing temporary cash flow. The borrower must repay the amount within a few months or a year. Common examples include short-term loans, lines of credit, trade credit, etc.

2. Long-Term

It means borrowing money for a longer period. It could be anywhere between a few years to decades. Businesses use this to buy machinery and equipment, expand, or fund large-scale projects.

They can repay the amount in regular installments over a few years. Long-term bank loans, bonds, SBA loans, etc., are some of the examples of long-term debt financing.

Sources

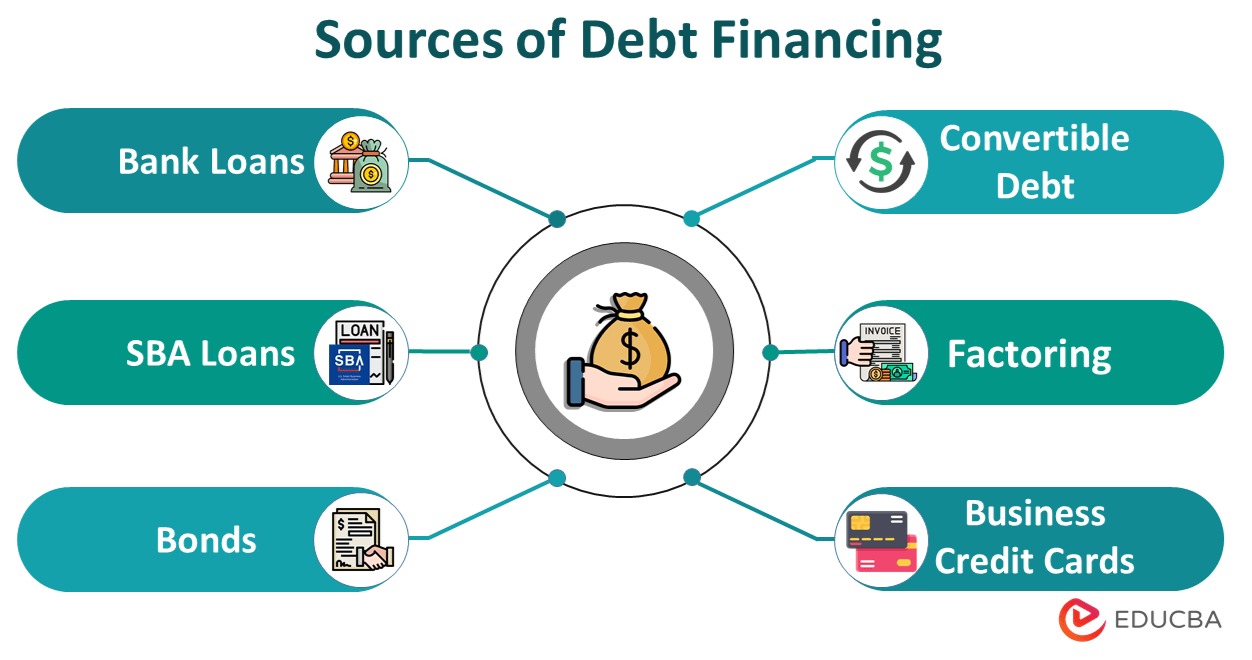

Following are some of the primary sources of debt financing:

1. Bank Loans: Traditional bank loans are versatile financing options for individuals and businesses. It can be a personal or business loan. They serve diverse purposes, including covering personal expenses, launching a new business, or expanding an existing one.

2. SBA Loans: The US Small Business Administration (SBA) offers various loans to small business owners. The purpose of these loans is to make it easier for small businesses to access funds at favorable terms and lower interest rates.

3. Bonds: Governments and big corporations usually issue public bonds, meaning individuals and institutions can buy these bonds. Simply put, the government borrows money in exchange for these bonds. In return, the buyer (lender) receives periodic interest payments and the full principal amount upon the bond’s maturity.

4. Convertible Debt: This is when the lender has the option to convert the loan into equity (such as common stock) at a later date. It helps the borrower get the required funds while the lender can get higher returns if the business is successful.

5. Equipment Financing: Businesses use this type of debt financing specifically to purchase equipment (machinery or vehicles). The purchased equipment serves as collateral for the loan, making it easier to obtain financing at a lower interest rate.

6. Business Line of Credit: It is a flexible funding source, basically a combination of loans and credit cards. Businesses can take money from this line of credit when they are in immediate need of funds. However, they can withdraw up to a limit and have to pay interest on the amount withdrawn.

7. Business Credit Cards: Business credit cards, like business line of credit or normal credit cards, let you borrow money as per your requirement. They are useful to fund short-term and small expenses. Moreover, the business has to repay the borrowed amount in a specified time, typically a month.

8. Factoring: When a business needs immediate cash/funds and has a lot of pending credit payments (Accounts receivable), it can sell it to a third party. This way, the business gets immediate cash instead of waiting for the customers to pay their invoices. On the other hand, the third-party financial company gets the invoices at a discount, providing them with a higher profit when the customers finally pay the invoices.

Examples

Here are a few examples of debt financing:

Example #1: Bonds

Suppose Lisa & Co. wants $1.2 million to expand their manufacturing business. Instead of taking a traditional loan, the company issues 200 bonds worth $6,000 each that will mature in 3 years. Soon enough, they sell all the bonds, raising $1.2 million for the expansion.

After the expansion, the company starts making coupon payments (interest) to the investors who purchased the bonds. The coupon payments are based on the bond’s face value and the coupon rate. For example, if the bond has a face value of $6,000 and a 2% coupon rate, the company would make annual coupon payments of $120 ($6,000 x 2%).

At maturity (which, in this case, is 3 years), the investors receive the face value of the bonds. So, if each bond has a face value of $6,000, the investors will receive $6,000 per bond. They will also have received $360 ($120 x 3 years) in interest. This return is how the company repays the borrowed principal amount with interest. As a result, with each bond, the investor made a profit of $360.

Example #2: Convertible Debt

Imagine Leah is a founder of a tech startup that is gaining momentum but needs capital to grow. She draws an agreement with an investor ready to lend $70,000 through a convertible debt. This agreement specifies that the debt will convert into equity if she successfully raises substantial funding from venture capitalists.

Thus, after a successful funding round of $5 million from venture capitalists, the $70,000 debt automatically converts into company shares. This makes the angel investor an equity shareholder in her company.

Advantages & Disadvantages

These are the main benefits and limitations of debt financing.

| Advantages | Disadvantages |

| When a business obtains debt financing, they do not have to give up ownership or control of the company. | Paying interest can be expensive in the long run, especially for large loans, making the cost of borrowing higher. |

| Sometimes, businesses can set flexible repayment terms, making it easier to create a budgeted repayment schedule. | As the business needs to make regular payments irrespective of its performance, it might be unable to invest in other business areas. |

| In many cases, the interest payments on debt financing are tax-deductible, helping businesses reduce tax liability. | If a company is unable to repay its debts, it might face legal actions or lose collateral it put up as security. |

| Successfully repaying debt financing can help businesses build their credit history and improve their credit score. | Taking on too much debt can make it difficult to secure additional financing in the future. |

Final Thoughts

Before deciding on debt financing, companies should carefully weigh its pros and cons against other options like equity investing. This will help them determine the best approach for their needs and circumstances. Ultimately, a well-informed decision about financing can help a company achieve its financial goals and succeed in the long term.

Frequently Asked Questions (FAQs)

Q1. How can startups get debt financing?

Answer: It is harder for startups to secure debt financing when compared to established businesses. Therefore, startups must have a strong business plan and should be able to demonstrate their ability to repay the debt.

Startups can secure debt financing through traditional bank loans, online lenders, peer-to-peer lending, convertible notes, or crowdfunding. However, each financing option has unique terms and requirements, so startups must assess which one aligns with their needs.

Q2. What does structured debt financing mean?

Answer: Structured debt financing is when lenders create a flexible debt financing structure that suits the borrower’s needs. It usually happens when business needs are too complex for standard debt financing. Lenders create a debt structure using multiple debt instruments simultaneously in these situations. They also customize terms regarding collateral, repayment schedules, and interest rates.

Q3. What is the most commonly used debt instrument?

Answer: The most common debt instrument is a bond. They are a form of debt financing where the government or a corporation borrows money from the general public by promising periodic interest payments and repayment of the principal amount when the bond matures.

Recommended Articles

EDUCBA presents the above article about Debt Financing. If you found this article helpful, you might also like the following articles: