What is Mobile Payment?

Mobile payment or mobile pay refers to transferring funds using a mobile device through various means, such as banking apps, UPI, or other digital platforms.

Mobile payment allows individuals to make purchases or conduct instant financial transactions without using cash, cheques, debit, or credit cards. It is a digital technology evolving continuously and is a great platform to connect customers. There are various modes of payment using mobiles, such as third-party apps or others using a digital wallet already installed on the phone.

This payment offers convenience and speed and provides security to sensitive data compared to traditional payment methods. Due to instant money transfer features, a report predicts that global mobile payments will escalate from $2.98 trillion in 2023 to $18.84 trillion by 2030.

Table of Contents

- What is Mobile Payment?

- Types

- How Does it Work?

- Advantages

- Disadvantages

- Case Study: Success of UPI in India

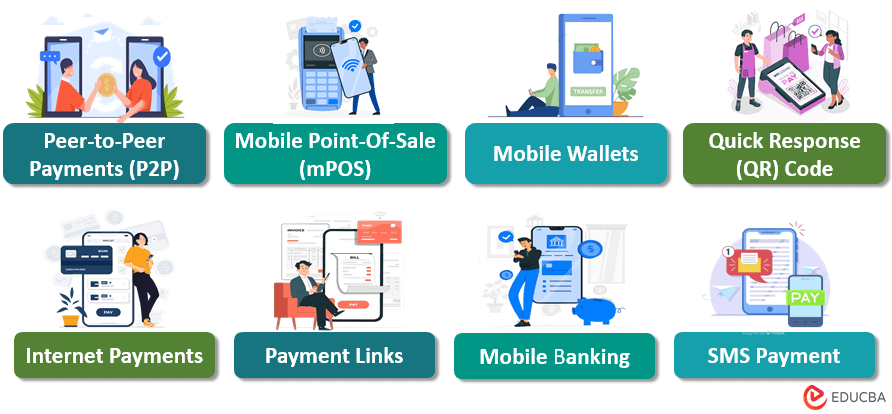

Types of Mobile Payments

1. Peer-to-Peer Payments (P2P)

Peer-to-peer payments (P2P) means transferring money between two individuals or parties. This payment includes paying grocery bills, a friend’s contribution, rent, or purchasing items.

2. Point-of-Sales

Point-of-sales refers to the place (checkout counter) in physical stores where transactions take place, and buyers make payments for goods or services. It is also known as in-store mobile payment.

Nowadays, retailers use mPOS, i.e., Mobile point-of-sale, which is a smartphone, tablet, or another device equipped with a card reader and payment software. It is better than traditional POS terminal points because it allows small businesses or individuals to conduct transactions on the go.

The following are the types of POS system

A) Near-field Communication (NFC) Payments

NFC technology allows two devices to communicate via radio frequency when they are very close, usually within a few centimeters. In POS, NFC-enabled devices, like smartphones or contactless cards, can exchange data when they’re brought near a reader with an NFC chip. This technology is commonly useful for contactless payments, where buyers can simply tap their phone on an NFC-enabled POS terminal to make a transaction.

B) Sound Waves-Based Payments

Sound wave-based payments involve high-frequency sound waves to transmit payment information between devices. A POS system sends unique sound waves containing payment details to mobile devices. The users will process the transaction and return the details to the POS system. This payment happens without the use of the internet.

C) Magnetic Secure Transmission (MST) Payments

MST technology works like NFC, but instead of radio frequency, it emits magnetic fields to communicate with devices. This magnetic field works like the magnetic debit or credit card strip. This system includes MST-enabled mobile devices and POSt terminals that can read magnetic signals.

3. Mobile Wallets

Mobile payment integration in ewallet app development can make wonders. With this, mobile wallets or digital wallets are digital platforms or apps allowing users to store credit or debit card details (payment information) for digitally making in-store or online transactions. Users must install these apps (Apple Pay, Google Pay) on their mobile devices, enter card details, and tap or scan at a payment terminal equipped with NFC or a QR code.

4. Quick Response (QR) Code

A QR (Quick Response) code is a two-dimensional barcode (fashion in black-and-white icons) displayed at the point of sale containing information readable by a smartphone camera or mobile app scanner. It can store different data types, such as website URLs, contact information, or payment details.

Users usually scan the code through a mobile wallet, enter the amount, and proceed with the payment details to finalize the transaction.

5. Remote Banking

Remote banking refers to conducting activities or transactions without visiting a bank branch. It includes accessing accounts, transferring funds, paying bills, and managing finances through online banking platforms over the phone browser or using mobile apps.

This payment type is called card-not-present purchases, where a user might manually enter card details or use a link to make the payment.

A) Internet Payments

Internet payments include any transactions made online through a web browser, for example, Chrome, or via a mobile app. It involves using various online methods to pay for products or bills, such as credit/debit cards, digital wallets, bank transfers, or other online payment systems. It also helps users track their expenses and access transaction details anytime and anywhere.

B) Payment links

Payment links or pay-by links are secure pages (URLs or hyperlinks) generated by businesses or individuals as a payment gateway or platform to complete a transaction. Here, users are sent those links containing payment details through email or a messaging app.

Upon clicking the link, users must enter the amount, card, or bank details for the transaction to complete; sometimes, the retailer already mentions the amount.

C) Mobile Banking

Mobile banking refers to performing transactions through a banking app (provided by a bank) via a mobile device, usually a smartphone or tablet. It includes checking account balances, transferring money between accounts, paying bills, and more. These banking apps use two-step verification or One-Time-Passwords (OTPs) technology and other measures for better security and authentication of transactions.

D) SMS

This SMS mobile payment service app allows users to pay for products via text messages, for example, Venmo. Users pay a specific number, and the receiver approves the transaction via SMS or text.

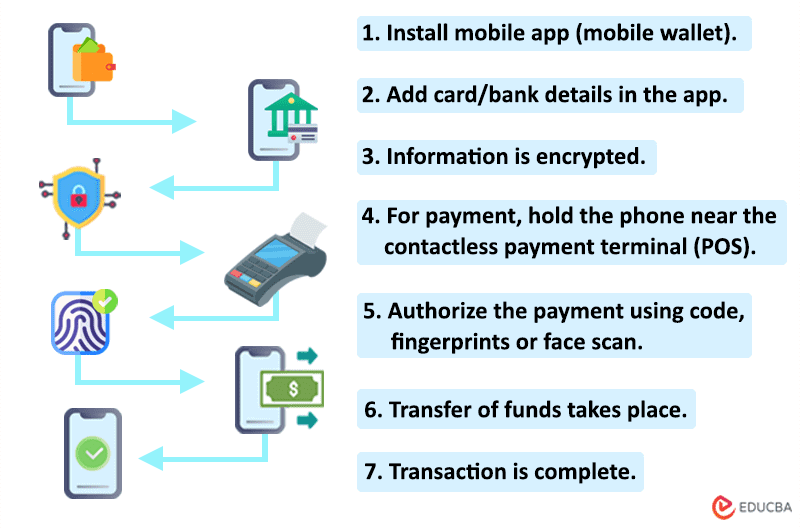

How Does Mobile Payment Work?

Let’s understand how mobile payment works, considering digital wallets, with the help of the following steps.

1. Install the App

Choose a payment method like a mobile wallet (e.g., Apple Pay, Google Pay) to link to your debit/credit card or bank account. Then, download and install the App.

2. Add Card or Bank Details

Add your card or bank account details to link it with a digital wallet. However, the app may verify your details through a code sent to your phone or other security measures. Mobile payment systems use encryption to secure your account and payment details.

3. Proceed with Payment

For in-store purchases, hold your phone near the contactless payment terminal, and for online shopping, you can select the payment option and follow the instructions.

4. Requires Authorization

Depending on the method, you might need to authenticate the transaction using a PIN, biometric data (like fingerprint or face recognition), or a password.

5. Processing the Transaction

Your phone sends encrypted payment information to the retailer’s payment system or the bank. The retailer or bank receives the request and verifies the transaction.

6. Payment Confirmation

Upon successful transactions, you will receive a confirmation message on your phone or through the app. You may also get a digital receipt for the transaction.

Advantages of Mobile Payment

The following are the advantages of mobile payment.

1. Convenient to Use

Mobile payment is convenient as it eliminates the need to carry physical cards or cash. It allows for quick transactions, especially in situations where you don’t have enough money in your hands or your wallet handy. It also prevents any situation of theft or theft of funds.

2. Provides Easy Accessibility

It enables digital transactions anytime, anywhere because it only requires a mobile phone and an internet connection. This accessibility is especially useful for online shopping or when traveling. It reduces the time spent searching for ATMs where you have to walk or drive to withdraw cash.

3. Ensures Speedy Transactions

It allows contactless payment transactions that happen in a few seconds, thereby reducing the waiting time or long queues for payments to process.

4. Encrypts Data for Security

It uses encryption technology to secure bank/card and transaction details. This payment mode consists of multi-layer authentication steps like using PIN and biometric features (voice, face, or fingerprint recognition). It prevents unauthorized persons from accessing your card details.

5. Helps to Track Transaction Details

It often stores transaction details, making tracking and monitoring your spending easy. This feature can help with budgeting and financial management.

6. Globally Accepted

This payment mode is increasing in popularity and is accepted worldwide. It makes it a convenient option for international travelers or conducting cross-border transactions.

7. Improves Sales and Customer Satisfaction

For businesses, a seamless checkout experience attracts more customers and increases sales. It will improve customer satisfaction and increase conversion rates.

Disadvantages of Mobile Payment

The following are some of the disadvantages of using mobile payment.

1. Faces Security Risks

Even though mobile payment has many advantages, it can still face security risks such as hacking, malware, or data breaches. It will interfere with the sensitive financial information.

2. Charges Transaction Fees

Some payment systems or banks may charge transaction fees, especially for cross-border or international payments. The fees also depend on the transaction amount, which can add to the overall amount.

3. Not Accepted Everywhere

Not all merchants or businesses accept mobile payments. It can limit users’ ability to make transactions.

4. Dependency on Network and Technology

This type of transaction relies on technology and requires internet or network connectivity. However, making payments can be challenging or impossible in areas with poor or no signal. Also, any device malfunctions, network service interruptions, or battery failure could disrupt transactions.

5. Risk of Unauthorized Access or Misuse

If a user’s phone containing payment information is lost or stolen, there is a high risk of unauthorized access to sensitive financial data, leading to potential misuse or scams.

Case Study

How did UPI lead to the mobile payment revolution in India?

UPI, or Unified Payments Interface, developed by the National Payments Corporation of India (NPCI), has transformed mobile payment in India with its seamless and secure payment system. The value of UPI transactions was over 118 billion in 2023, showing a significant growth of 60% from 74 billion compared to 2022.

The success of UPI is not limited to big companies; it also benefits street hawkers across India. Previously, they used to handle transactions in cash, but now, with UPI, they can accept digital payments easily. After purchasing products or items, customers scan the QR code, enter the amount, and pay with a UPI app on their mobile phones. It makes the whole buying and payment process faster and smoother, increasing sales for these small businesses.

Additionally, UPI records digital transaction details and thus empowers street hawkers to track their sales and expenses better. It helps to make their business more transparent and organized. This has improved their financial management skills, allowing them to grow and develop their businesses.

Final Thoughts

Mobile payment is more efficient for transactions than traditional payment methods. It is accepted globally and has multiple security layers to protect your information. Although it is the easiest and most convenient way to make transactions, it also has some drawbacks. This payment may sometimes lead to security issues and risk of data breaches.

Frequently Asked Questions (FAQs)

Q1. What are the top 5 mobile payment applications?

Answer: The top 5 mobile payment applications or apps are as follows:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Venmo

Q2. Why do businesses need mobile payments?

Answer: Due to emerging technology, businesses need mobile payment for various reasons. One of the main reasons is that it provides customers with a quicker, more convenient, and enhanced shopping experience. For businesses, it reduces the time spent on traditional card processing or handling cash, leading to errors while counting.

By offering this payment option, businesses also attract tech-savvy users, increasing conversion rates. It also provides valuable data on customer behavior and preferences, helping businesses better understand their customer’s preferences and set marketing strategies to improve sales.

Recommended Articles

We hope this article on “Mo bile Payment” was helpful to you. To learn about related topics, you can refer to the articles below.