Consequences of a Bad Credit Score – Introduction

Your credit score is important for many reasons. If you have a low credit score, this can make it tough for you to access credit when you need it. If your credit score is higher, it is easier to get credit during emergencies and when you need to make a big purchase.

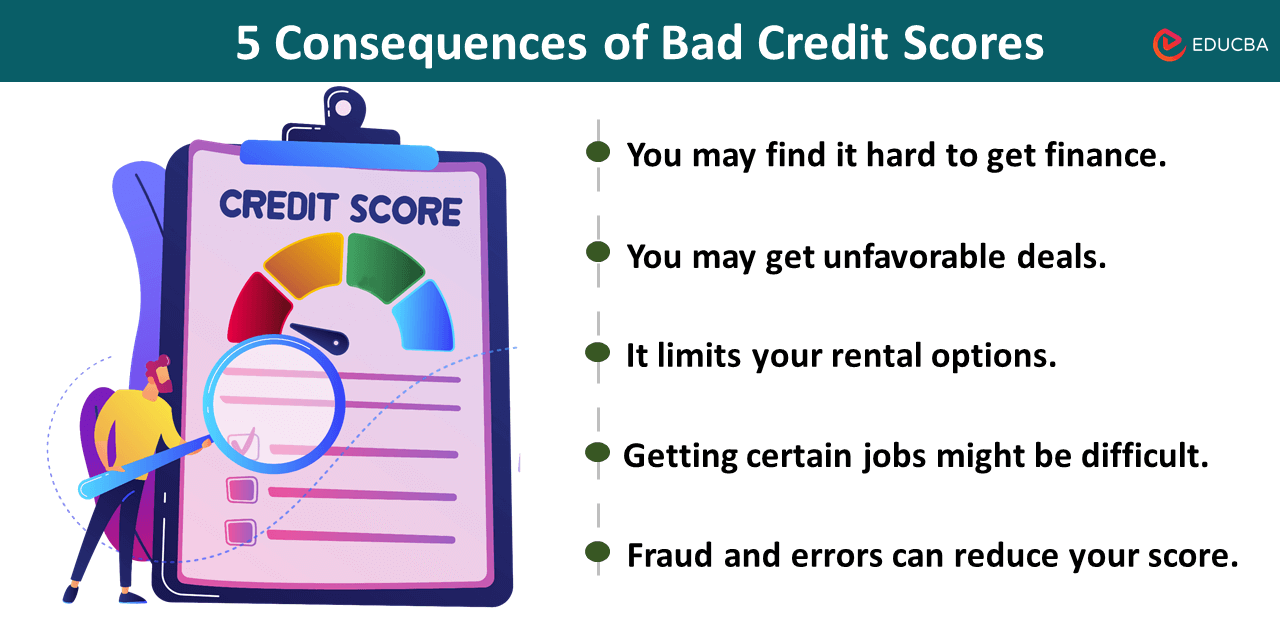

Ignoring your credit score is not a good idea. It’s important to stay aware of it and take necessary actions. Your credit score can drop for different reasons, and you might need to take various steps to improve it again if you struggle to get credit. Here are five consequences of a bad credit score.

What are the Major Consequences of a Bad Credit Score?

If you have a low credit score, it can have several consequences, as it reflects your creditworthiness and financial responsibility. Here are some potential repercussions of having a low credit score:

1. You May Find It Hard to Get Finance

Many Banks and credit unions tend to check your credit score and then decide whether to lend you money. If your credit score is low, they might see you as more of a risk, making it difficult to get approved for loans or credit cards. However, specialized options like bad credit loans from easyfinancial can offer a solution, even if traditional lenders might charge you higher interest rates. It is because they think there’s more risk involved due to your lower credit score.

2. You May Get Unfavorable Deals

When you have a low credit score and manage to get approval for a loan or credit card, the terms will likely not be in your favor. The lender may tend to charge you higher interest rates, provide lower credit limits, and offer less favorable repayment terms. These terms can result in you paying more money over the long term. Higher interest rates mean more money paid in interest, lower credit limits limit your borrowing capacity, and less favorable repayment terms can increase overall costs. Knowing these potential consequences is important when dealing with financial products with a low credit score.

3. It Limits Your Rental Options

Having a poor credit score can complicate securing a rental, as landlords and property managers generally check your credit when you are looking to rent a place.

In such cases, landlords may request a larger security deposit from you. Alternatively, they might ask for a co-signer on the lease, which means someone else agrees to take responsibility for the rent payments if you cannot fulfill them. A lower credit score might make landlords concerned about your ability to meet financial commitments, hence the request for a bigger security deposit or a co-signer.

4. Getting Certain Jobs Might be Difficult

When applying for a job, some employers check your credit as part of their hiring process, especially if it involves handling money. Although not all employers follow this practice, low credit scores affect your chances of getting certain jobs. This is particularly true for positions in finance or roles that require a high level of trust, as employers may view a low credit score as a potential risk regarding financial responsibilities and reliability. It’s important to be aware of this possibility, even though not all jobs consider credit scores during hiring.

5. Fraud and Errors Can Reduce Your Score

Checking your credit file regularly is important because fraud and errors can lower your credit score. People who fall victim often see their credit scores drop when criminals use their names to access money. Reviewing your credit reports helps you identify unfamiliar activities, such as unauthorized credit applications or transactions. If you notice any fraudulent activities, report it as soon as possible.

Errors can also lead to credit score decreases. For example, if lenders incorrectly report late payments, it can negatively impact your credit. If you find a late payment on your credit report but know you paid on time, dispute it with the lender or contact the credit reporting agency to correct your report. Taking action against fraud and errors is crucial for maintaining a more accurate and higher credit score.

How to Improve a Low Credit Score?

It takes time and effort to improve a low credit score. Here are some steps you can take to improve your credit score gradually:

- Boost your credit scores by taking credit cards or loans that are designed to improve your credit scores. Ensure the chosen credit-builder product reports to major credit agencies: Experian, Equifax, and TransUnion.

- Pay your credit card bill every month to show responsible credit management. Avoiding missed payments shows lenders you are serious about your financial commitments.

- Don’t use up all your available credit; keep it reasonable. Lenders like it when you show you can handle your credit wisely.

- Resist the temptation of making minimum payments. It can lead to higher long-term interest payments. If you only make minimum payments, lenders might think you are not trying to pay off what you owe.

- Being on the electoral roll enhances your credibility as a borrower. Lenders often see this as a sign of stability, contributing positively to your creditworthiness.

- Avoid withdrawing cash with your credit card due to high interest swiftness and fees. Lenders may view such transactions negatively.

- Be cautious when applying for new credit, as hard checks during the application process can cause your credit score to drop. Multiple hard checks in a short span of time can negatively impact your credit score.

Final Thoughts

A poor credit score stops you from receiving the temporary financial assistance you might need. Maintain a good credit score because the consequences can lead to rejection when seeking funds. By keeping your credit score healthy, you ensure the availability of financial resources, which becomes especially important if you are planning major transactions, such as purchasing a house in the future. Understanding the consequences of a bad credit score highlights the importance of proactive credit management for securing financial stability and future endeavors.

Recommended Articles

If you found this article on the consequences of a bad credit score useful, please check out the following recommendations: