What is the Gold Standard?

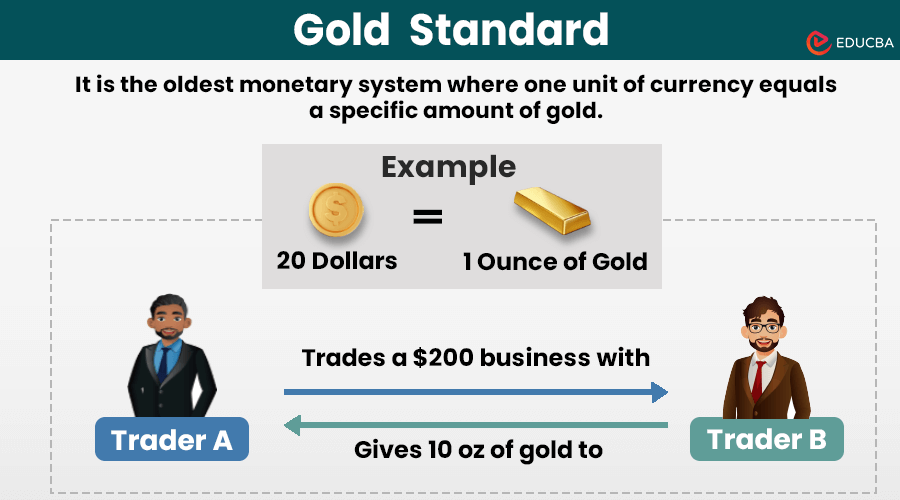

The gold standard is the oldest monetary system in which the value of a unit currency is equal to a specified amount of gold. Here, businesses used gold as a mode of financial transaction in trading in exchange for paper currency.

It is also known as the gold exchange system and was popular in international trade in the 18th and early 19th centuries. In 1821, the United Kingdom was the first to adopt this standard, followed by Germany in 1871 and then by many other countries. However, this system was effective from 1821 till the outbreak of World War I. In the gold standard system, individuals and businesses can convert their currency into gold at that predetermined rate. Here, the government only monitored and controlled the price and supply of gold and currency in the economy.

Table of Contents

- What it is?

- How does it work?

- Types

- Examples

- What replaced the Gold Standard?

- Advantages

- Disadvantages

How Does It Work?

- The countries that followed the gold standard would set a fixed price for their paper currency or money and gold quantity. It was the standard rate for everyone in the country.

- They also would set fixed exchange rates between the currencies of different countries.

- The people could convert their currency value to a specific quantity of gold set by the government at that time or period.

Types

The following are the types of gold standard.

1. Gold Coin Standard

It is also known as a gold specie or gold currency standard widely used before World War I. In this standard, each unit of paper currency directly corresponded to a specific amount of gold in the form of gold coins. Individuals or banks could exchange their paper money for actual gold coins.

2. Gold Bullion Standard

After World War I, a gold coin standard system was replaced by gold bullion and adopted by the British first and then the rest of the nations. Here, individuals could exchange gold not in coin form but in gold bullion (bar). Also, the government did not allow the minting of gold into coins, indirectly preventing the wastage of the precious metal.

3. Gold Exchange Standard

This system came into force in the early 1900s, and Holland was the first country to adopt it. Under this system, the value of domestic paper currency was not linked to gold, so one could not convert it into gold. Instead, they could convert the domestic currency into foreign countries’ currency, which followed the gold standard. Here, the individual can use this foreign currency and convert it into gold in that country at a fixed exchange rate.

For instance, if 1 unit of currency of Country A is equal to 0.5 units of Country B’s currency. Under this gold exchange standard, people in Country A could exchange their money for Country B and then convert it to gold in Country B.

4. Gold Reserve Standard

A “Tripartite Monetary Agreement” was formed between Great Britain, the U.S.A., and France in 1936 to promote foreign trade. In this standard, the government could only import and export gold for financial matters. But, only the government did this; individuals could not export and import gold. This standard promoted foreign trade and stabilized the exchange rate without affecting the domestic currency.

5. Gold Parity Standard

In this type, every member nation had to specify the par value of its currency in relation to gold. This fixed value was useful to determine the exchange rate. Also, it did not interfere with currency value or the monetary system of neighboring countries.

Examples

Let’s understand this system with the help of the following examples.

Example #1

Let’s say the government in the U.S. sets a gold standard monetary system where 1 ounce of gold is equal to $30. During this period, trader A supplies $300 goods to trader B, and in exchange, trader B will give 10 ounces (if 1 oz=$30, so $300 = 10 oz) of gold to trader A.

Example #2

Suppose the U.S. sets 1 ounce of gold at $20, and the U.K. sets 1 ounce of gold at £10. Now, Joseph, a businessman from the USA, has signed a trade agreement with David, a businessman from the U.K. Here, both of them will do the financial transactions based on the gold standard monetary system. Then, Joseph exports goods worth $1000 to David in the U.K., and David has to pay him according to the set exchange rate.

Now,

$20 = £10 ,i.e., $2 = £1

So, $1000 = £500

Therefore, David will pay £500 to Joseph at the exchange rate of gold value.

What Replaced The Gold Standard?

The great depression of the 1930s forced countries to abandon the “Gold Standard” policy. The major reason for abandoning this standard was that it reduced the value of paper money.

The demand for paper currency was falling, people were trying to convert currency into gold, and the central reserve was running out of gold. In 1931, Great Britain became the first country to break this standard.

Under the presidency of Franklin D. Roosevelt (FDR), the U.S.A. started abandoning this standard but fully abandoned it in 1971. The citizens of the U.S.A. who were holding gold were forced to sell their gold bullion or gold coins to the government at $20.67 per ounce.

No countries now follow the gold standard but are replaced by fiat currency systems. In this system, the government or authorities maintain and set the value of the unit currency, and people confidently accept it. Fiat money has no intrinsic value, and it is not worth or set according to any other means, like gold or silver.

Advantages

Here are the advantages of the gold standard.

- This standard monetary system helps the government maintain a stable national economy.

- It encouraged international trade between countries by setting fixed exchange rates. For example, when governments and individuals imported and exported goods from foreign countries, they paid in gold coins or bullion instead of paper money.

- This system reduced the money supply, and inflation was under control.

Disadvantages

Here are the disadvantages of the gold standard.

- During the economic crisis, it became difficult for governments to circulate money, but there was more gold than paper money in government reserves.

- The countries not following this standard were usually not involved in trade and business with those following it.

- Also, not every country has rich gold mines, and due to an inadequate supply of gold metal, they lost the advantages of this monetary standard.

- This system reduced the value of paper money and increased the value of gold as a monetary factor.

- The fixed exchange rate created an imbalance between countries, leading to disruptions in international trade.

Final Thoughts

This standard was once the popular monetary system among many nations. Even though it was useful and many countries profited from this system, every country abandoned this system later. Moreover, while some nations still maintain gold reserves, all nations now use paper or fiat money policies to create economic equality.

Recommended Articles

We hope this article on “Gold Standard” was beneficial to you. To learn more about related topics, refer to the articles below.