Tips to Improve Your Credit Profile – Overview

A credit profile is a comprehensive summary of an individual’s credit history and financial behavior compiled by credit reporting agencies. It includes information such as credit accounts (e.g., credit cards, loans), payment history, credit inquiries, and public records (e.g., bankruptcies, liens). In this article, we will look at tips to improve your credit profile, empower your wallet, and fortify your credit profile.

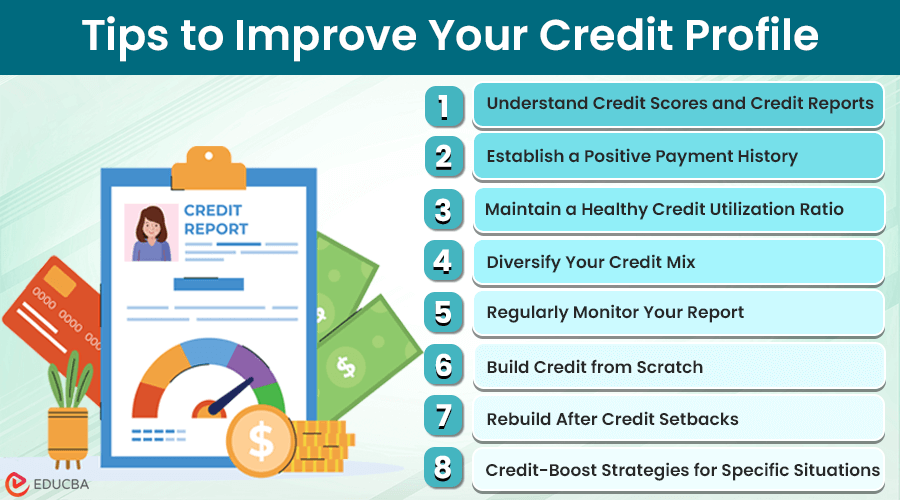

8 Tips to Improve Your Credit Profile

Here are the tips to improve your credit profile:

Tip 1: Understand Credit Scores and Credit Reports

Your credit score is a three-digit number that shows how reliable you are with money based on your past financial behavior. A higher score makes you look better to lenders. Meanwhile, credit reports are detailed records of your credit activities, like your payment history, accounts, and any credit checks.

The two dominant credit scoring systems are the FICO Score and the VantageScore. While they calculate scores differently, they generally look at similar factors: how well you pay your bills, how much debt you have, how long you have had credit, the types of credit you use, and any recent credit inquiries.

Tip 2: Establish a Positive Payment History

Your track record of making payments plays a crucial element in calculating your credit score. It is crucial to always pay your loans, credit cards, utility bills, and subscriptions on time. Paying bills late or missing payments can severely damage your credit score, underscoring the importance of prioritizing timely payments.

To avoid the pitfalls of missing payments, consider setting up automatic payments or using reminders. These tools can be your best friends in managing your financial obligations. They not only assist in keeping track of your bills but also guarantee that you uphold a favorable credit score through punctual payments.

Tip 3: Maintain a Healthy Credit Utilization Ratio

Your credit utilization ratio, or the amount of credit you use compared to your total available credit, is another essential factor in your credit score calculation. Experts recommend keeping your credit utilization ratio low to maintain a healthy credit profile. To achieve this, consider making payments more frequently or requesting a credit limit increase from your lenders.

Let us say you have a credit card with a limit of $10,000, and you currently owe $3,000. Here, your credit utilization ratio would be 30% (3,000 divided by 10,000 and then multiplied by 100%). Now, imagine you pay and bring your balance down to $2,000. This would lower your credit utilization ratio to a more favorable 20%.

Tip 4: Diversify Your Credit Mix

Having various types of credit accounts, such as mortgages, loans, and credit cards, can positively impact your credit score. It indicates your ability to manage diverse financial obligations effectively. Lenders like seeing this because it proves you’re good with money in different ways.

But do not open lots of new accounts all at once. This can make your score drop for a bit. It happens because of more credit checks and changes in how much credit you use and how long accounts are open.

Tip 5: Regularly Monitor Your Report

Keep an eye on your credit reports regularly. Major credit bureaus in different countries, like TransUnion, Equifax, Experian, and TransUnion CIBIL, offer one free report each year. If you spot any mistakes, challenge them with the credit bureau immediately. Mistakes could include wrong personal details, incorrectly listed payments or accounts that are not yours.

Fixing these errors can ensure that your credit history is correct. This matters because lenders and others who check your credit need to see accurate information to judge whether you are a reliable borrower.

Tip 6: Build Credit from Scratch

If you are new to credit or have little credit history, there are a few tricks to start building your credit profile. Secured credit cards are a good option—they ask for a deposit that you get back later. Paying off your secured card on time shows that you are handling credit responsibly, which boosts your credit score.

Another approach is to be added as an authorized user on someone else’s credit card. This can help you pay off debt faster by piggybacking on their positive credit history. This means you can use their card, and any good credit habits they have will rub off on you. But make sure the main cardholder has a solid credit history, as this affects your score, too.

Tip 7: Rebuild After Credit Setbacks

Tough times like bankruptcy or losing your home can damage your credit, even if you have been good with money. However, getting back on track takes time and careful money management.

First, deal with any debts you owe or overdue bills. Talk to a credit counselor to figure out a plan to pay them off. Once that is done, start fresh by opening new credit accounts and ensuring you pay on time. It shows you are serious about handling your money well.

Tip 8: Credit-Boost Strategies for Specific Situations

Keeping your credit in good shape is always important, but different situations require different approaches. For instance, if you are getting ready to apply for a mortgage, having a great credit score and fixing any problems on your credit report is important.

Likewise, if you have a lot of student loan debt, it might be smart to focus on paying off certain debts first to improve your credit.

Final Thoughts

Building a good credit score needs time and discipline, but the benefits, including better loan terms, lower interest rates, and increased financial freedom, make the effort worthwhile. Start executing these strategies today to secure a stronger financial foundation for tomorrow.

Frequently Asked Questions (FAQs)

Q1. How often should I check my credit reports?

Answer: Check your credit reports once a year. Some experts suggest checking one every four months to look for mistakes or fraud.

Q2. Can closing credit card accounts improve my credit score?

Answer: Closing credit card accounts lowers your credit score. It reduces your total available credit and can make your credit usage ratio look higher. It is usually better to keep older accounts in good standing, even if you are not using them often.

Q3. How long do negative entries remain on my credit report?

Answer: Late payments or collections usually stay up to seven years from the date they first occur, and bankruptcy can stay up to ten years.

Q4. Can I remove bad things from my credit report?

Answer: You cannot remove accurate negative information from your credit report. If you spot any errors or outdated information, you can argue it with the credit bureaus to try and have it corrected or removed.

Q5. How much does my credit score need to go up for better loans?

Answer: Securing better loan terms hinges on various factors, but even a slight boost in your credit score, such as an increase of 20-30 points, could make you eligible for reduced interest rates or more favorable loan conditions.

Recommended Articles

If you found this article helpful and want to learn more about the tips to improve your credit profile and related topics, please check the links below for further information.