Why is Health Insurance Important After Career Change?

Health insurance after a career change is important because it covers medical costs, protects against emergencies, and avoids penalties for gaps in coverage. As people switch jobs, start their own businesses, or retire, ensuring continuous coverage for themselves and their families is often their concern. Understanding and planning for health insurance helps individuals navigate career changes confidently, knowing their health needs are covered. However, career transitions have become increasingly common in today’s job market. Hence, it ensures access to necessary healthcare services and supports overall well-being.

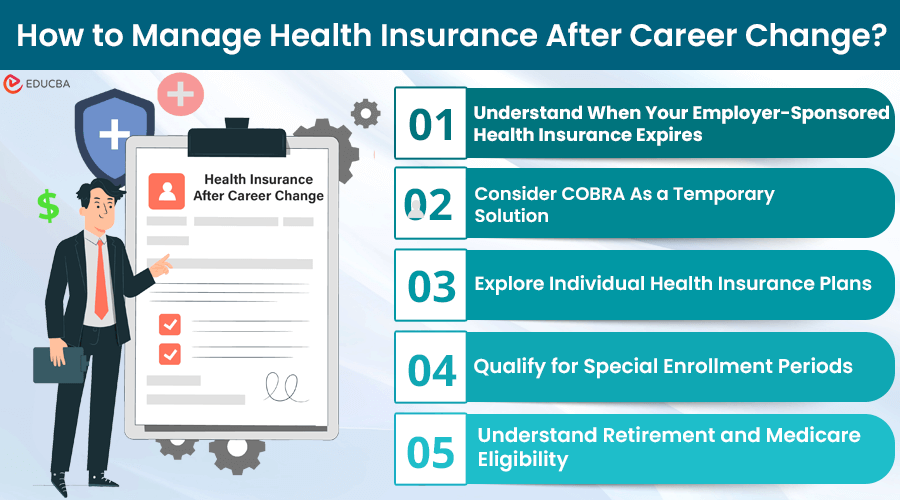

How to Manage Health Insurance After Career Change?

Managing health insurance after a career change involves more than just adjusting to a new job or lifestyle; it also requires careful planning to maintain continuous health insurance coverage. Here are key steps and options to consider during this period:

#1. Understand When Your Employer-Sponsored Health Insurance Expires

When you leave your job, either voluntarily or involuntarily, your employer’s health insurance plan will typically end on the last day of the month when your employment ends. This means that you and your dependents will no longer be covered under that plan, and you will need to look for alternative options to maintain continuous coverage.

As a result, it is important to understand when does health insurance expires after leaving a job. This is a common concern during career transitions, and it’s essential to understand the timeline and options available to ensure uninterrupted coverage.

If you fail to secure alternative coverage, you could face high medical costs, even for routine check-ups or minor illnesses. Therefore, it is vital to act quickly, explore your options, and avoid unexpected financial burdens from medical expenses.

#2. Consider COBRA As a Temporary Solution

The Consolidated Omnibus Budget Reconciliation Act (COBRA) acts as a temporary solution for those who have lost their employer-sponsored health insurance. It allows you to continue your existing health insurance for up to 18 months by paying the full premium plus an administrative fee.

While COBRA can be expensive, it ensures continuity of care with your current healthcare providers until you secure new coverage through another employer or an individual plan.

Steps to enroll in COBRA:

- Your employer must send you a COBRA notification after you leave your job.

- Review the COBRA premium costs and compare them to your anticipated healthcare needs.

- Fill out the COBRA election form included in your notification packet and submit it within 60 days.

- Pay the initial premium to activate your COBRA coverage.

- Continue paying monthly premiums to maintain coverage during the eligibility period (usually 18 months).

#3. Explore Individual Health Insurance Plans

If COBRA is too costly or you prefer to explore other alternatives, consider purchasing individual health insurance plans customized to your needs. The plans are available through the Health Insurance Marketplace (Healthcare.gov) or directly from private insurers. Individual plans offer a range of coverage levels and monthly premiums. Such plans help you find the best option for your budget and healthcare requirements.

Key considerations when choosing an individual plan:

- Coverage Levels: Look at bronze, silver, gold, or platinum plans to find the right balance of premiums and out-of-pocket costs.

- Deductibles and Copayments: Understand how much you will pay out-of-pocket before the insurance starts.

- Network Provider: Ensure your preferred hospitals are covered.

- Specific Services: Check coverage for services you or your family members need, such as prescription drugs and specialized treatments.

#4. Qualify for Special Enrollment Periods

Life events such as marriage, job loss, divorce, having a baby, or moving to a new state may qualify you for a Special Enrollment Period (SEP). This allows you to sign up for a new health insurance plan outside the regular enrollment window. It ensures you do not experience a coverage gap.

How to utilize a special enrollment period:

- Determine if your life event qualifies for a SEP.

- Act quickly, as SEPs typically have a limited window of 60 days.

- Gather the necessary documentation to prove your qualifying event.

- Sign up for a new health insurance plan or private insurer through the Marketplace.

Failing to enroll during this period may result in waiting until the next open enrollment period, potentially leaving you without coverage for an extended period.

#5. Understand Retirement and Medicare Eligibility

Understanding Medicare eligibility is important for those nearing retirement. At 65, you qualify for Medicare, the federal health insurance for seniors and disabled individuals. If you retire before 65, you will need other options like COBRA or individual health insurance to cover you until then.

It’s important to familiarize yourself with the different coverage options under Medicare, including:

- Part A (hospital insurance)

- Part B (medical insurance)

- Part D (prescription drug coverage)

Additionally, you may want to consider supplemental Medicare plans, such as Medicare Advantage or Medigap policies, to help you cover out-of-pocket expenses not covered by traditional Medicare.

Final Thoughts

Health insurance after a career change requires proactive planning and an understanding of your options. Whether you choose COBRA, individual health insurance plans, or transitioning to Medicare, taking the necessary steps to ensure continuous coverage is crucial for your health and financial stability. Acting promptly and making informed decisions will help you navigate this complex process smoothly.

Frequently Asked Questions (FAQs)

Q1. What happens if I miss the deadline to enroll in COBRA or a Special Enrollment Period?

Answer: Missing the deadline to enroll in COBRA or a Special Enrollment Period may leave you without health insurance coverage until the next annual ‘Open Enrollment Period’. During this time, you may have to explore short-term health insurance options or rely on healthcare services with out-of-pocket payments.

Q2. If I relocate to a new state after losing my job, do I need to change my health insurance plan?

Answer: If you move to a new state, your health insurance options may change, as some plans are limited to specific geographic regions. You may need to explore new health insurance plans available in your new state or update your information if you qualify for a Special Enrollment Period due to the relocation.

Q3. What is the difference between an individual health insurance plan and a group health insurance plan?

Answer: Individuals or families purchase health insurance directly, while employers or organizations typically offer group health insurance plans to their employees or members. Individual plans may have different coverage options, premiums, and provider networks than group plans.

Recommended Articles

If you found this article on ‘Health Insurance After Career Change’ helpful and want to learn more about related topics, please check the links below.