Why and How to Buy Life Insurance Online?

Life is full of unexpected events and happenings. In such times, there is a need for insurance to secure one’s life and safeguard the near and dear ones financially. When you choose to take life insurance, it gives surety and security to the family and provides safety coverage to the person who gets insured. There are many benefits to selecting life insurance, especially when there is a provision for easy life insurance online. But how to buy life insurance online?

Since online things are accessible even from remote areas, there is no need to go the traditional way. There is no need for in-person meetings with any agent or gathering physical copies of the requisite documents, and you can also avoid the lengthy paperwork. The online mode of taking insurance ensures a thorough and speedy process. There are no delays due to paperwork or the unavailability of the agent. You can upload everything easily—documents, proofs, applications, and preferences. There is no dependency upon the insurer. Thus, it saves a lot of time, resources, and effort on behalf of the person who is availing of insurance. Buying life insurance online is simple, provided you follow the right steps.

So, let’s look at what we must do to buy online life insurance.

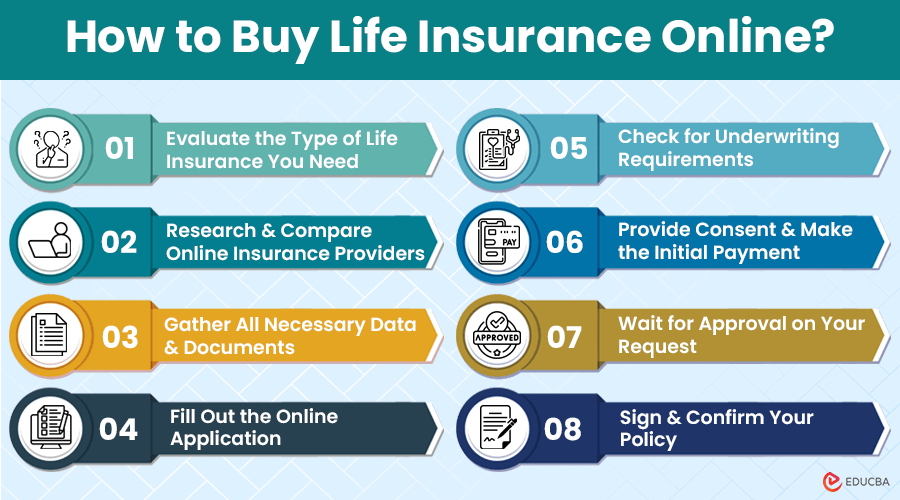

8 Steps to Secure Easy Life Insurance Coverage Online

1. Evaluate the Type of Life Insurance You Need

Before you decide upon a life insurance plan, it is important to evaluate the need for insurance vis-à-vis your budget. You need to decide upon the coverage you need according to the suitability of your situation—you may need a term life, whole life, or universal plan.

Here’s how you can decide on the right type of life insurance plan:

| Type | Duration | Best For |

| Term Life Insurance | Specific period | Covering a set time, like until you pay off your mortgage or your children are financially independent. |

| Whole Life Insurance | Entire life | Lifelong coverage, guaranteed death benefit, and savings component. |

| Universal Life Insurance | Flexible duration | Flexible premiums and death benefits, with an investment component that can grow. |

2. Research and Compare Online Insurance Providers

The next step is to do some research related to the various plans available. It is significant to do a market study and compare the plans and other options. Start by researching the websites of different insurance providers and checking out their plans.

For this, you must consider factors like:

- The past reputation of the insurer

- Quotes (price estimates)

- Coverage options (what the policy covers)

- Policy features (death benefit, riders, or additional benefits)

- Premium amount

- Hidden or extra charges

- Duration of insurance

- Payment schedule (monthly, semi-annual, or annual cost of the insurance)

- Filing process (how to make a claim)

- Required documents

A reputed insurance company would be transparent about all these details in its online portal. Then, shortlist and narrow down your choice of insurance provider.

3. Gather All Necessary Data & Documents

Next, you must collect some information that you will need for filing an application online. These include:

- Personal information (contact information, full name, date of birth)

- Financial information (annual income, existing debts)

- Health information (current medical conditions, lifestyle habits, hereditary health conditions)

4. Fill out the Online Application

Once you are ready to file an application, go to the portal’s application icon and fill in the form accurately. Complete the application by filling in all the required columns and ensuring you follow all instructions carefully.

5. Check for Underwriting Requirements

If the insurance requires you to undergo underwriting, you must adhere to the instructions. Underwriting is a process where the insurer gathers additional information about your health and mental well-being to assess the risk they are taking by insuring you.

This may involve answering health-related questions or even undergoing a medical examination. It’s important to be honest during this process, as any discrepancies could affect your coverage.

6. Provide Consent and Make the Initial Payment

Once you fill out the form, it is time to give consent and make the initial payment on the online portal to initiate the policy issuance procedure. The initial payment, also known as the premium, is the first installment of your insurance policy. It’s important to make this payment on time as it signals your commitment to the policy and allows the insurance company to start processing your application.

7. Wait for Approval on Your Request

Now, the insurance provider will go through the documentation and other needs to issue a policy for your life. The approval process involves the insurance company reviewing and cross checking the information in your application, as well as assessing the risk they are taking by insuring you. This process may take a few days or even weeks, depending on various factors, such as the complexity of your application and the results of any underwriting or medical examinations that may be required.

8. Sign and Confirm Your Policy

Once you receive the approval, it is time to sign and validate the policy after carefully reviewing it. Sign and seal the coverage once you feel satisfied with the terms and conditions. You may also sign in electronic mode or send mail to validate your signature.

Final Thoughts

The online platform transparently provides information about policy options, coverage limits, premium amounts, and terms and conditions of insurance. It allows you to make informed decisions before finalizing any insurance plan. You can research, compare, and then apply for the most suitable plan based on your needs and resources.

When you get the required information under one platform and simultaneously get your queries resolved, it is easy to manage easy life insurance online without making alterations to your busy schedules or traveling far to meet the agents. Since no mediators are involved, you benefit in terms of cost savings, such as low cost of premium, etc. Place the policy documents in a safe place. So, make the prudent decision to go for online insurance and safeguard your future.

Recommended Articles

We hope we have simplified your search for how to buy life insurance online. We have more similar guides on insurance policies that you can check.