How To Get a UAE Audit License for Your Firm?

Auditing services are in great demand in the UAE. Dubai offers businesses significant benefits, and many companies properly submit to and comply with UAE tax regulations. This is the key reason why knowing the procedure for getting a UAE audit license is significant if you want to work as an auditor or run an audit firm in the United Arab Emirates.

What is an Audit License in UAE?

An audit license allows your firm to offer auditing and bookkeeping services to other companies. The noteworthy factor is that only approved and officially listed auditors are legalized to conduct audit services in the UAE.

Types of UAE Audit Licenses

The UAE provides two main types of audit licenses based on the specific needs of businesses and industries:

1. Internal Audit License

Internal auditors evaluate a firm’s core controls, risk management, and authority procedures. Companies that need to conduct internal audits must get this license.

2. External Audit License

With this license, external auditors can offer independent audit services to third-party clients, such as:

- Government agencies

- Private corporations

- Non-profit organizations

External auditors evaluate financial records and ensure compliance with applicable laws.

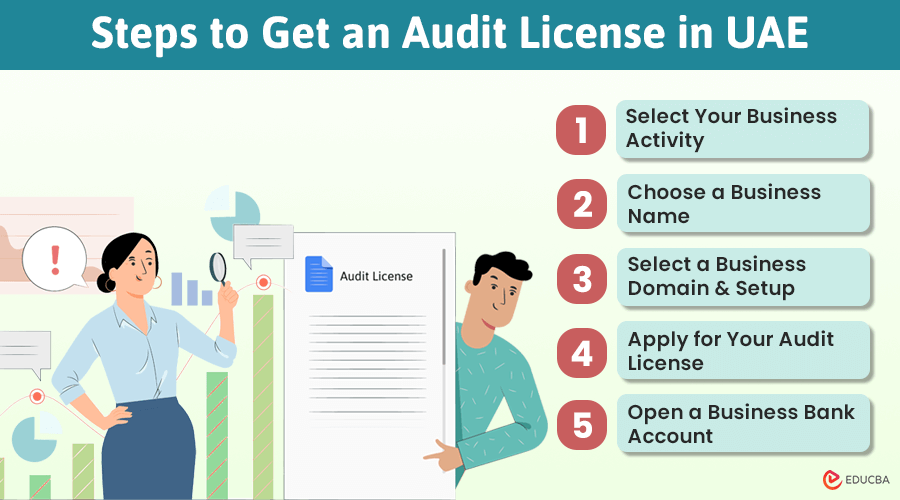

Step-by-Step Process to Get a UAE Audit License

Follow these steps to get an audit license in UAE:

1. Select Your Business Activity

The first step is to specify your business activity, which may include:

- Auditing services

- Accountancy

- Tax consulting

Any company that runs without disclosing its relevant business activity on the trade license can face severe penalties from the UAE authorities.

2. Choose a Business Name

The second step requires you to choose a unique and compliant company name. Keep in mind the following guidelines:

- Avoid using names of well-known brands.

- Use unique, non-religious words.

- You can use abbreviations.

Ensure your chosen name is available for registration. A professional firm like Farahat & Co. can assist with name registration.

3. Select a Business Domain and Setup

Decide if you want to operate on the mainland or in a free zone. Both have specific benefits:

| Free Zone | Mainland |

| 100% foreign ownership | Requires a local sponsor (51% Emirati national-owned) |

| Tax exemptions and business incentives | Direct access to the UAE market |

| Simplified incorporation and business support | Additional compliance measures |

4. Apply for Your Audit License

You must submit an application for a specialized services license through:

- Department of Economic Development (DED)

- Relevant UAE free zone authority

5. Open a Business Bank Account

Before you start trading, you must open a corporate bank account for your audit firm in UAE.

Final Thoughts

Getting a UAE audit license is essential for conducting auditing services. The process is not simple, so it is highly recommended that you partner with an audit firm like Farahat & Co. Their expertise ensures a smooth licensing process and helps improve your company’s financial health by maintaining the highest standards of accountability.

Recommended Articles

We hope you found this article on ‘UAE Audit License’ insightful. For more information on audits, refer to the posts below.