Introduction to Maintaining a Good Credit Score

The economy is heavily dependent on credit. A credit card can be very feasible if used correctly and smartly. A credit card is also a great way to build the length of your credit history and have an advantage when you apply for a loan or a mortgage. However, it is important to understand the impact of credit score on your line of credit. In this article, we will look at what a credit score is, why it matters, and steps to maintain a good credit score.

Table of content

- Understanding credit score

- Why is a good credit profile important for credit score?

- Factors to maintain a good credit score

- Credit score range

- How to maintain a good credit score?

Understanding Credit Score

A credit score is a number that shows how trustworthy you are with credit, usually between 300 and 850. It is calculated based on your credit history and the information in your credit report. A higher credit score boosts your chances of being approved for credit and getting better terms.

Why is a Good Credit Profile Important for Credit Score?

A credit profile tracks your loan history, what kind of credit you use, the loan length, and, most importantly, whether or not you have paid your loans on time. After this analysis, it gives you a credit score. The higher this score, the better your chances of getting a loan at lower interest rates and access to better credit cards like the Rupay Credit Card. Your credit score determines your capacity to repay the loan you are applying for within the time limit; thus, it is very important for lenders before they consider approving a loan.

What are the Factors that Help Maintain a Good Credit Score?

Credit cards can significantly affect your credit profile, either positively or negatively. Using them smartly is important for keeping a good credit score. Here is how you can manage your credit score through credit card use:

- Payment History: This is the most important factor, making up 35% of your credit score. Always pay your bills on time to keep your score healthy. Late payments can harm your score.

- Hard Inquiry: When a lender checks your credit report to decide whether to give you credit, is called hard inquiry. This accounts for 10% of your score. While it helps lenders evaluate your creditworthiness, having too many inquiries in a short period can decrease your score and indicate that you might be in financial trouble.

- Card Payments: Every missed payment gets recorded, so making timely payments is essential. If your score is low, consistent on-time payments can help improve it within 6-8 months.

- Length of Credit History: This contributes 15% to your score. Lenders prefer to see that you have managed credit over a longer period. It is advisable to keep old credit cards open, even if you do not use them, to maintain your credit history.

- Credit Utilization Ratio: This makes up 30% of your score and measures the percentage of your available credit that you are using. Keeping your utilization below 40% of your limit is best, as lower usage shows you are responsible with credit.

- EMI-to-Income Ratio: Your monthly loan and credit card payments should stay under 50% of your salary. If your repayments are too high, lenders may consider you a risk since it suggests you spend too much of your income on debt.

- Credit Mix: Having various types of credit, like credit cards, loans, and mortgages, contributes 10% to your score. A diverse credit profile shows lenders you can responsibly manage different types of credit. Adding a new card, like the Rupay Credit Card, can improve your credit mix.

What are the Credit Score Range?

Here are the different ranges of credit scores:

- Poor Credit (300-579): This score indicates a history of not paying bills on time or having too much debt. With this score, Getting loans or credit cards can be difficult.

- Fair Credit (580-669): A fair score allows you to get a credit card or loan, but you may have to pay higher interest rates. It shows that you have had some financial issues.

- Good Credit (670-739): This is a solid score. It means you are likely to get loans and credit at reasonable interest rates and that you usually pay your bills on time.

- Very Good Credit (740-799): A very good score indicates that lenders see you as a low-risk borrower. You can expect good loan terms and lower interest rates.

- Excellent Credit (800-850): This is the highest score. You are considered a very reliable borrower and likely get the best loan terms and lowest rates available.

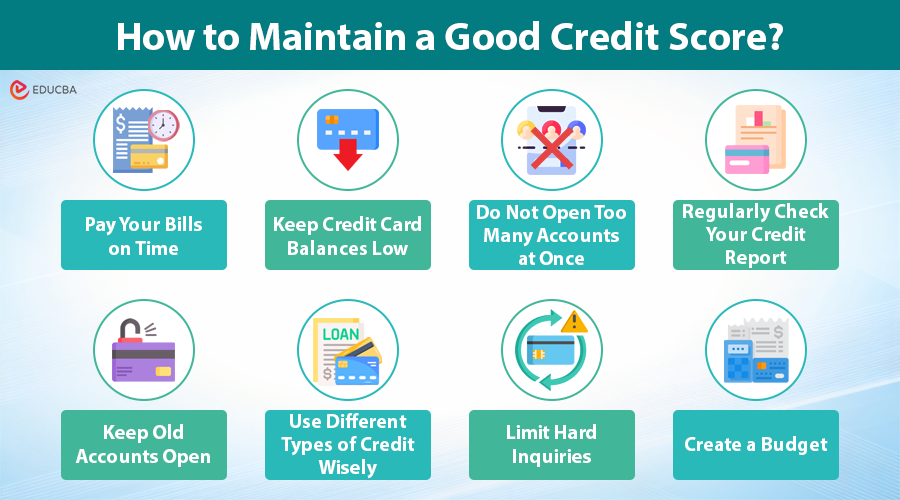

How to Maintain a Good Credit Score?

Here are some key steps to maintain a good credit score:

- Pay Your Bills on Time: Always make payments by the due date. Late payments can hurt your credit score.

- Keep Credit Card Balances Low: Use only a small portion of your credit limit. Aim for less than 30% of your total credit available.

- Do Not Open Too Many Accounts at Once: Applying for new credit can briefly decrease your score. Only apply for credit when you really need it.

- Regularly Check Your Credit Report: If you notice any mistakes, be sure to report them to the credit bureau.

- Keep Old Accounts Open: The length of your credit history matters. Keeping older accounts open can help improve your score.

- Use Different Types of Credit Wisely: Having a mix of credit types, such as a credit card and a loan, can boost your credit score if you manage them well.

- Limit Hard Inquiries: Too many inquiries in a short time can lower your score.

- Create a Budget: Managing your money helps you pay your bills on time and avoid unnecessary debt.

Final Thoughts

It is important to maintain a good credit score for achieving financial goals and securing favorable lending terms. By following these tips, you can ensure your credit score remains in good standing. Keep in mind that creating and keeping a strong credit profile takes time, but the rewards are worth it. Start today, and take control of your financial future.

Frequently Asked Questions (FAQs)

Q1. How much will my credit score decrease when I apply for a new credit card?

Answer: The impact of a hard inquiry from a new credit card application is typically small, often resulting in a drop of around 5-10 points. This decrease is usually temporary, and your score can recover within a few months, provided there are no other negative factors.

Q2. How long does a new credit card account stay on my credit report?

Answer: A new credit card account will remain on your credit report for as long as it is open and active. If the account is closed, it will stay on your report for up to 10 years if it was in good standing, and for up to 7 years if it had negative information.

Q3. Does credit card increase CIBIL score?

Answer: Yes, a credit card is one of the best ways to improve credit and enhance your credit scores by demonstrating how you manage credit regularly. Pay your bills timely using your credit cards and keep your credit usage low to increase your credit score.

Q4. Should I pay off my credit card bill right after I make a purchase?

Answer: Yes, to maintain good credit and avoid debt, it is advisable to pay off your credit card bill in full each month.

Recommended Articles

We hope this guide on how to maintain a good credit score has provided valuable insights for your financial journey. Explore these recommended articles for more tips on managing your finances and achieving your goals.