Why Should You Manage Education Loan After Graduation?

Graduating is an exciting milestone, but managing your education loan debt can feel challenging. It’s essential to understand how to handle loan repayments after graduation to avoid financial pressure. This guide provides helpful tips to manage education loan after graduation and reduce debt more efficiently.

By choosing the right education loan abroad, you can alleviate financial stress and allow yourself to concentrate on making the best out of your chosen program. Here are key details about education loans from leading banks:

| Feature | Details |

| Interest Rate | Starts at [REPO* + 3.75%] |

| Maximum Loan Amount | Up to Rs. 3 Cr |

| Collateral Requirement | No collateral for loans up to Rs. 1 Cr for certain premium institutions |

| Repayment Tenure | Up to 15 years |

| Moratorium Period | 12 months post-graduation |

| Processing Time | Varies based on documentation |

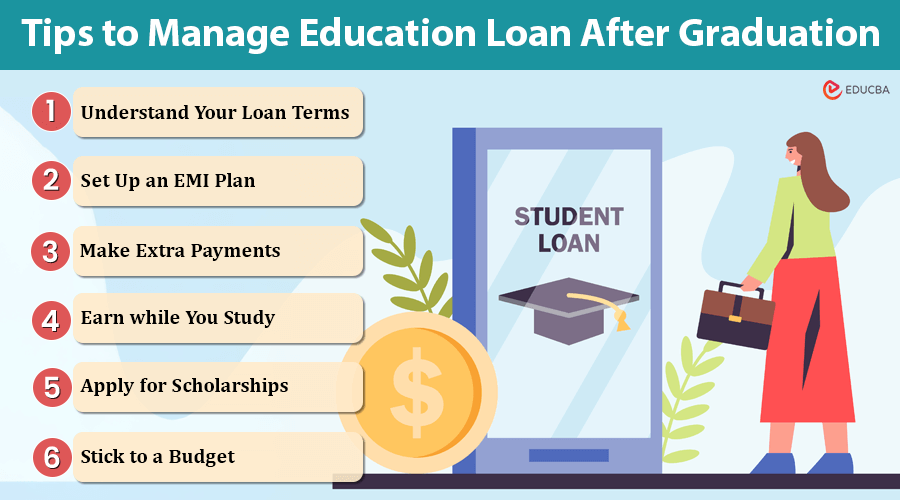

Tips to Manage Education Loan After Graduation

Once you have completed your education with the help of an education loan for abroad and planning to start repayments (EMI) within the next 3 to 6 months, you must consider the points mentioned below:

1. Understand Your Loan Terms

Take time to thoroughly review your loan’s specifics, including the interest rates, repayment schedules, and any grace periods. Understanding these details is crucial for effective financial planning and managing your repayments.

By being aware of your loan’s terms, you can make informed decisions, avoid unexpected costs, and ensure timely payments. This will help you maintain control over your finances and manage your debt more efficiently.

2. Set Up an EMI Plan

As a means of repayment, managing EMI acts as a crucial step. A balanced EMI amount may significantly affect a borrower’s overall interest payments and credit health.

Use an instant student loan EMI calculator to assess your current financial obligation. Most education loan providers offer a part-payment facility, where the amount is adjusted against the principal instead of interest payments.

3. Make Extra Payments

Whenever possible, contribute additional funds to your loan principal beyond the required monthly payments. This extra payment reduces the outstanding principal, which in turn decreases the total interest accrued over the life of the loan. By paying more than the minimum, you can shorten the repayment period, save money on interest, and clear your debt faster.

4. Earn while You Study

Most foreign countries allow students from other countries to work part-time and earn their living to accommodate routine expenses. If you are still in the course, you must look for part-time job opportunities and use the proceeds towards your loan payments.

5. Apply for Scholarships

Many universities, NGOs, and government schemes offer educational scholarships to deserving students. These scholarships and their amounts depend on various criteria, including merit, overall academic performance, and extracurricular activities such as arts and sports.

If you excel in any of these areas, consider applying for a scholarship either before or after admission to significantly reduce the amount of your education loan.

6. Stick to a Budget

As a student, life is full of daily hustle to meet financial needs while studying. It is important to ensure that your expenses stay within a specific budget. Any type of overspending could lead to a cash crunch, ultimately resulting in an additional burden in terms of interest or principal repayment. It is crucial to save more and be reluctant to exhaust credit card limits or take out short-term loans, even while earning.

7. Automate Your Loan Payments

Setting up automatic payments ensures your loan installments are paid on time each month, preventing missed deadlines and late fees. This method streamlines your repayment process, reduces the risk of forgetting payments, and helps you manage your finances more effectively.

By automating payments, you can maintain consistency in your repayment schedule and focus on other financial goals with peace of mind.

8. Explore Loan Refinancing and Balance Transfers

Most well-known lenders, such as ICICI Bank, offer balance transfer or refinancing options for education loans. Refinancing lets you switch your existing loan for one with a potentially lower interest rate, which can reduce your overall expenses and simplify the repayment process.

9. Seek Financial Guidance

A financial advisor can guide you better and also provide a personalized plan tailored to your specific financial goals. Also, use the resources and support from ICICI Bank to manage your education loan effectively and make informed decisions.

Final Thoughts

Managing an education loan for studying abroad requires careful planning and proactive steps to prevent financial strain. Students and guardians can significantly reduce the long-term burden by making informed decisions right from the beginning. It is crucial to take advantage of the support provided by financial institutions and government schemes.

Always research thoroughly and seek guidance from financial experts, such as those at ICICI Bank, to create a repayment strategy that suits your unique situation. Staying informed and strategic will allow you to effectively manage education loan after graduation and stay focused on achieving both your academic and professional goals.

Recommended Articles

If you found this article on ‘Manage Education Loan After Graduation‘ interesting, you can also check the suggestions below: