Introduction to Investing in Gold Coins

Gold has long been considered a sign of money and a reliable investment. One of the most prominent ways to invest in gold is through gold coins, which offer beauty and value. However, securing these assets can be a challenge. Many investors turn to safe deposit box services or precious metals vaults to ensure safety. These secure storage solutions provide peace of mind, protecting your investment while you enjoy the benefits of investing in gold coins in a safe environment.

Why Invest in Gold Coins?

Gold coins are one of the most popular investment choices because they tend to maintain their value during economic downturns. The benefits of this investment include portfolio diversification, protection against inflation, and security during currency instability. These coins, available in bullion, modern-minted, and numismatic categories, also offer historical significance and aesthetic appeal, making them attractive to collectors. As a fixed asset, gold coins are a stable investment with potential for long-term value appreciation.

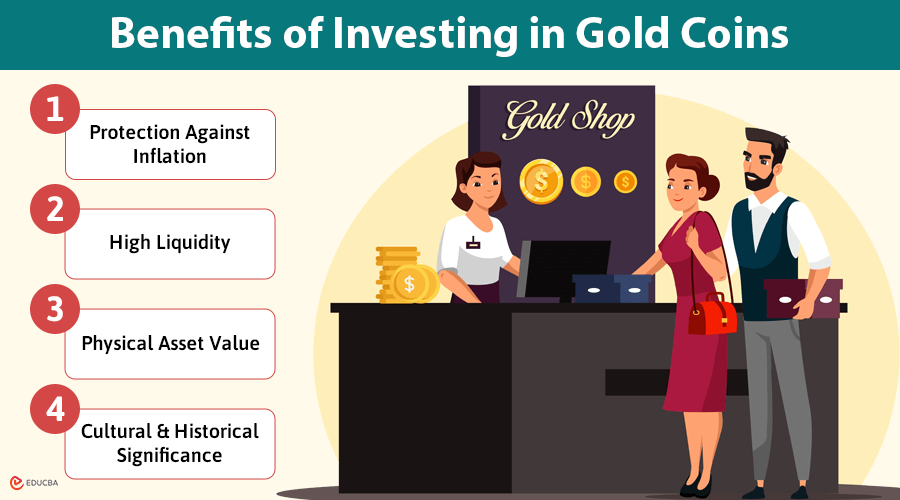

4 Benefits of Investing in Gold Coins

Gold coins are considered one of the best investment forms due to their beauty and intrinsic value. Their worth, distinct from stocks or bonds, and their physical form appeal to collectors and investors.

Gold coin investment offers the following benefits:

#1. Protection Against Inflation: Gold is a reliable store of value during economic instability, protecting wealth from inflation and currency fluctuations. Its intrinsic value makes it a preferred choice for preserving purchasing power in uncertain financial environments.

#2. High Liquidity: Gold coins are highly liquid assets, easily traded or sold for cash. This flexibility ensures quick financial access, making them practical for emergencies or unexpected monetary needs without significant procedural hurdles or delays.

#3. Physical Asset Value: Owning gold coins offers a tangible sense of security and fulfillment. Unlike digital investments, their physical presence provides a unique comfort, reinforcing their reliability and enduring appeal in a technology-driven financial landscape.

#4. Cultural and Historical Significance: Gold coins embody cultural richness and artistry, representing historical eras and traditions. Their value extends beyond economics, serving as timeless symbols of heritage and craftsmanship appreciated by collectors and investors alike.

Secure Storage for Gold Coins with Safe Deposit

When considering investing in gold coins, security is crucial. Renting a safe deposit box protects your valuable collection from theft, damage, or other risks.

These secure facilities, typically in banks or vaults, offer controlled access and stringent security measures. Rent a safe deposit box to secure your gold coins and give peace of mind, knowing your investment is secure and well-protected as part of your financial strategy.

How to Choose a Reputable Safe Deposit Box Provider?

Choosing a reliable, safe deposit box service provider involves carefully evaluating key factors to guarantee the security and privacy of your valuables.

- Credible Institutions: Choose service providers with positive user feedback and a strong reputation for trust and reliability.

- Insurance and Audits: Select insured facilities that undergo regular audits to safeguard your items against loss or theft.

- Security Features: Evaluate security measures like video monitoring and access control and train personnel to ensure the highest protection standards.

- Location and Access Hours: Consider the facility’s location and access hours to ensure convenience and flexibility for your schedule.

- Privacy Policies: Inquire about the provider’s privacy policy to maintain confidentiality and peace of mind when engaging in gold coin investments or other valuable holdings.

Tips for Storing and Maintaining Gold Coins

Storing a coin collection is crucial for its preservation. Proper handling and storage can prevent damage and maintain the collection’s value over time.

Proper coin storage includes the following guidelines:

- Container Selection: Choose acid-free holders or capsules to prevent scratching and tarnishing, ensuring no direct contact between the coins.

- Environment: Keep the collection in cool, dry, and dark areas to avoid exposure to sunlight and temperature fluctuations, which can alter the metal.

- Inspection and Maintenance: Check coins regularly for wear or damage, and dust them gently without rubbing the surface to avoid scratches.

- Handling: Never put coins in your mouth, as oils and dirt can cause corrosion. Use clean cotton gloves when necessary.

- Documentation: Record changes in the collection’s value and trends to help with insurance claims and preserve the investment’s worth, ensuring its beauty.

Potential Risks of Gold Coins Investments

Buying gold coins can be risky due to market fluctuations and the potential for counterfeit coins. Ensuring genuineness and finding reputable dealers are crucial to avoid significant financial losses.

Gold coin investment requires attention to several factors, such as:

- Market Fluctuations: The price of gold is highly variable and influenced by economic shifts, making it a potentially unstable investment.

- Genuineness: Ensuring the authenticity of gold coins is vital to avoid financial loss from counterfeit products.

- Storage: Secure storage, such as safe deposit boxes, is necessary but comes with costs and potential liquidity concerns.

- Insurance: Protecting gold coins with insurance adds additional expenses, making it essential to account for all related costs.

Understanding these risks can significantly enhance an investor’s ability to make informed decisions and effectively navigate the gold coin market.

Final Thoughts

Investing in gold coins is appealing but comes with challenges. Market fluctuations make gold’s value unpredictable, and counterfeit coins pose risks, emphasizing the need for trusted dealers. Storage is another concern; safe deposit boxes offer security but limit accessibility. Despite these drawbacks, gold remains a reliable asset during economic volatility. To succeed, carefully assess market trends, risk tolerance, and storage options, choosing reputable services to secure and manage your investment effectively.

Recommended Articles

We hope this article on investing in gold coins has been helpful. Explore other recommended articles for more valuable insights on similar topics.