What is Commodity

In trading a commodity is a raw material which can be bought and sold. A Commodity has and derives its value. The main emphasis here is that commodities are bought and sold.

Commodities that are traded are generally of two types’ i.e. hard commodities and soft commodities. Hard commodities generally includes variety of natural resources like gold, rubber, oil, etc, and soft commodities are generally agricultural products like corn, wheat, coffee, sugar etc.

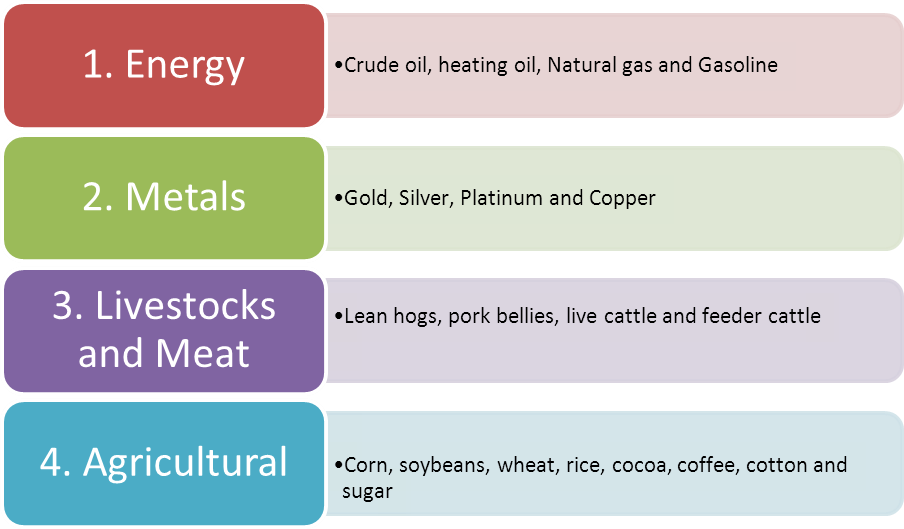

The common four categories of commodities include-

What are the basics of Commodity Trading?

This process of commodity trading does involve an Investment strategy. The process of trading revolves around the buying and selling of commodities that are well classified. The trading process necessitates one to participate in the transactions of the commodity exchange.

Evolution of Commodity Market-

Japanese merchants stored rice in warehouses for future use, and warehouse holders issued receipts against the stored rice, known as rice tickets. These rice tickets were later accepted as a form of commercial currency.

Chicago (USA), in the middle of the 19th century, budded as the location for organized trading in commodities. In Chicago, the farmers and dealers started to make promises. These promises were to exchange the produce for cash in the future. This led to the emergence of the contract for “Futures”. In short, the commodity producer agreed to sell the produce to the buyer. This contract had a future delivery date and a specified price.

Who are the Participants of the commodity market?

The process of commodity trading requires a large number of participants. For the process of trading, the participants must have diverse risk profiles. Trading participants generally includes hedgers, speculators, and arbitrageurs.

Speculators:

They are traders who trade for making money. Generally, the trends and direction of the futures prices are used by them for speculation purposes. For speculators, it is an investment option.

Arbitrageurs:

They are traders who buy and sell commodities based on the difference in commodity prices across various exchanges. They try to make money based on the price difference across different markets. Arbitrageurs involve themselves in concurrent buying and selling of the same commodity in different markets.

Hedgers:

Hedgers, who generally are the commercial producers and consumers of the commodities, participate in the market to reduce their price risk in the spot market. They participate in the futures market to hedge or protect themselves against the risk of losses from fluctuating and volatile prices.

How does Commodity trading works? (Example)

Let’s understand this with the help of an example-

Suppose if a sugarcane farmer wants to protect himself from possible declining future prices at the harvest time.

The farmer has and will incur a specific cost for planting, growing and harvesting his sugarcane crop. He wants to make a profit during the final sale, which includes all the cost incurred by him plus the extra profit.

But the fact is that his sugarcanes cannot be harvested and sold for yet another seven months.

Weather conditions like temperature, rain, drought, etc could impact his crop as well as the final price that he expects to get in return.

So keeping in mind this whole scenario and to reduce his risk, the farmer agrees to sell his sugarcanes in the future markets today. In the future market, the seller will sell the product (sugarcane) to a commercial producer at a predetermined price, and delivery will take place seven months later.

Now, if there’s high demand for his Sugarcane at the time of the harvest season, farmer’s crop would be worth even more money in the future market

And even if there was not enough demand for the sugarcane during the harvest time, he is still able to protect himself by securing a pre-determined profit for his Sugarcanes.

Learn various trading strategies. Understand the process of trade execution. Practice effective execution of trades in equities, commodities, currencies, bonds.

Segments in the commodity market:

Over-the-counter (OTC) market and Exchange-traded market are the major segments involved here.

Over-the-counter (OTC) market:

In Over-the-counter market, the involved parties trade on the basis of mutual understanding between them. OTC market is also referred to as “customized market” because of no formal structure.

Mostly delivery based trading takes place in these markets. Such markets are entirely unregulated with respect to the disclosure of information between the parties which may lead to counter-party risk. Mostly farmers, processors, wholesalers, etc. trade in such market.

Exchange-traded market:

This is a place where the commodities are traded over the exchange. These markets are standardized and regulated. The exchange here acts as an intermediary to all commodity transactions.

Commodity trading Risks-

- Price risk-

May result from a fall in the exchange rates.

- Geopolitical risk-

For access to the large deposits of oil located in the Gulf region, so the companies wanting to extract this oil have to deal with the respective countries of the Middle East to have authority over this oil.

- Speculative risk-

Speculators may increase market volatility by moving the markets in different ways.

Changes in the market factors like interest rates, foreign exchange, etc may lead to an increase or decrease in the value of a portfolio.

- Operation risk-

It may include risks arising from people, systems, and processes concerned with a particular business or a Company.

- Credit risk-

It is the risk arising due to non-repayment.

- Quantity risk-

This risk of the unpredictable quantity of agricultural commodities may arise due to weather conditions, amount of rainfall, temperature, insects, etc.

Difference between a Commodity and a Financial derivative:

- Settlement of financial derivative contracts is in cash, while commodity trading contracts can be settled through cash or delivery.

- The concept of varying quality of asset exists in Commodity trading, which does not stand true for financial derivatives.

Advantages of commodity trading:

- Liquidity

- Commission

- One can go short

- No time decay

Disadvantages of commodity trading:

- Leverage

- Speed of trading

- Physical Delivery risk

- Risky Business as a whole!

Some general Commodity Trading Queries that you may have-

From where do I start Trading in commodity futures?

One may start their trading journey from various renowned commodity exchanges like the Chicago Board of Trade (CBOT), New York Mercantile Exchange (NYMEX), etc., that are available globally.

If you are looking for trading in INDIA you have the following three options. All these three exchanges have electronic trading and settlement systems.

- National Commodity and Derivative Exchange,

- Multi Commodity Exchange of India Ltd

- National Multi Commodity Exchange of India Ltd.

How to choose the broker and from where?

There are many established equity brokers who have their memberships with leading commodity exchanges like NCDEX and MCX.

Some of these brokers include-

- Share khan

- ICICIcommtrade (ICICIdirect)

- ISJ Securities

These brokers also offer trading through the Internet just like for equity trading.

How much is the minimum investment requirement for Commodity Trading?

For trading purposes, a minimum investment of up to Rs 5,000 may be considered. Typically, traders need to pay margins to the exchanges through their brokers. A margin is a percentage of the total contract value that has to be deposited with the exchange as a security deposit. The margin ranges from 5-10 percent of the value of the commodity contract.

While the prices and commodity lots in agricultural commodities may vary from exchange to exchange, one would require approximately Rs 5,000 as minimum funds to begin trading.

Does one always have to give delivery or can settle in cash?

One can do both, as all the exchanges have both these systems. After all, it’s your choice. If one wants the contract to be cash-settled, then one must inform or indicate about this at the time of placing the order.

If one plans to take or make delivery, then the required warehouse receipts are essential.

But the most wonderful thing is that there is an option to settle in cash or through delivery and it can be changed as many times till the last day of the contract expiry.

Does one need an account for trading in commodity futures?

To start the commodity trading process, one needs a bank account and a separate commodity Demat account from the National Securities Depository Ltd.

What will be my relationship at the broker level?

One has to enter account agreements with the broker. This basically includes the procedures of the Know Your Client format. You also need to provide your PAN details, bank account number, etc.

How much are the brokerage charges?

The brokerage charges may range from 0.10% – 0.25% of the contract value. The point to note here is that the brokerage charges will be different for different commodities. It may also change, based on trading and delivery transactions. The brokerage charges are to have adhered to the maximum limit specified by the exchanges.

From where do I track the information on commodities?

Spot commodity prices, as well as various commodity market news, are daily displayed in some renowned financial newspapers. These newspapers may also include some commodity articles which may be helpful sometimes.

You may also subscribe to some magazines on agricultural commodities and metals. Also, research and analysis support is provided by renowned brokerage firms.

The common route though for accessing the information is through websites. There are many websites which offer free information or else you may also want to subscribe to some paid websites.

How is the Commodity Trading and exchanges regulated?

The Forward Markets Commission regulates various commodity exchanges of India. But the main difference here is that the brokers need not register themselves with the regulator (like the equity markets). However, the forward Market commission may inspect the broker in case of any foul practices.

In which all commodities can one trade?

Although the Government has made all the commodities eligible for trading, nationwide exchanges have reserved only a few selected commodities for starters. NMCE trades a large number of agricultural and metal commodities, whereas NCDEX and MCX trade in several agriculture, metal, and energy commodities.

How is a defaulter penalized?

NCDEX and MCX maintain the settlement guarantee funds and have penalty clauses in case of any default by their members. A separate arbitration panel of exchanges is also present to consider various default cases.

Does one have to pay an extra margin to take delivery of goods?

Yes. For taking the delivery, the margin may increase increases up to 20-25 percent of the contract value. In such cases, the broker levies an extra.