Introduction to Individual Health Insurance

Health insurance is important for covering healthcare costs and protecting your finances. Individual Health Insurance is for people who do not have coverage through their job or a family member’s plan. This article will explain why individual health insurance is important, what its main features are, and how to choose the best plan for you.

What is Individual Health Insurance?

Individual health insurance is a plan that helps cover healthcare costs for you or your family. It is especially helpful for self-employed individuals, those working in small companies without employer-provided health benefits, or people between jobs. With individual health insurance, you control your healthcare coverage, regardless of your employment situation.

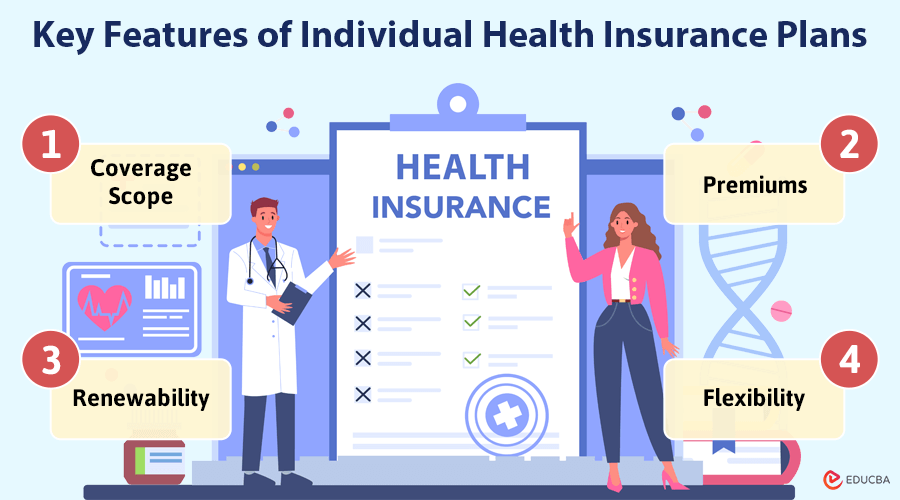

Key Features of Individual Health Insurance Plans

Following are the key features of Health Insurance Plans:

1. Coverage Scope

Individual Health Insurance plans typically cover hospitalization, pre and post-hospitalization, and sometimes outpatient expenses (OPD). The scope of coverage may vary by plan and insurer.

2. Premiums

The premium amount you pay for Individual Health Insurance depends on factors like your age, medical history, and the level of coverage you choose. Generally, younger individuals pay lower premiums.

3. Flexibility

Unlike group insurance plans, Individual Health Insurance is highly customizable. You can select add-ons or riders to enhance your coverage based on your needs.

4. Renewability

Most Individual Health Insurance plans offer lifetime renewability, allowing you to continue your coverage as you age.

Benefits of Individual Health Insurance

Following are benefits of Individual Health Insurance:

1. Control and Customisation

With Individual Health Insurance, you have complete control over your plan’s features, such as the deductible amount, policy limits, and co-payment clauses.

2. Tax Benefits

Premiums paid for individual health insurance qualify for tax deductions under Section 80D of the Income Tax Act. This offers you annual tax benefits, which can help reduce your tax liability.

3. No Dependence on the Employer

When you have your health insurance policy, you are covered regardless of your job status. This means you will not have to worry about losing coverage if you change jobs.

4. Coverage for Pre-existing Diseases

Many Individual Health Insurance plans cover pre-existing conditions after a waiting period, which is essential for individuals with known health issues.

How to Choose the Right Individual Health Insurance Plan?

Selecting the right individual health insurance plan involves several important steps:

1. Assess Your Healthcare Needs

Consider your age, health condition, family medical history, and how much you can pay in premiums.

2. Compare Plans

Research different insurance plans to compare coverage, benefits, exclusions, and premiums.

3. Read the Fine Print

Make sure to thoroughly read the terms and conditions of the plan, including waiting periods for pre-existing conditions, exclusions, and renewal terms.

4. Check the Insurer’s Reputation

Look into the insurer’s claim settlement ratio and read customer reviews to assess their reliability and customer service quality.

5. Consult with Professionals

If you find it difficult to choose the right plan, consider consulting a health insurance advisor who can guide you.

Common Exclusions in Individual Health Insurance Plans

It is important to be aware of what Individual Health Insurance typically does not cover:

- Cosmetic Surgery: Procedures that are not medically necessary are usually not covered.

- Certain Diseases: Some policies may exclude specific diseases or conditions, especially early ones.

- Pregnancy and Childbirth Expenses: Some Individual Health Insurance plans may not cover pregnancy-related expenses, or there may be a waiting period before coverage starts.

- Dental and Vision Care: These services are generally not covered unless medically necessary.

Final Thoughts

Individual Health Insurance is an important investment for both your health and financial safety. With healthcare costs on the rise, having a reliable plan keeps you ready for health emergencies. By choosing a plan that fits your needs, you can have peace of mind and avoid the financial burden of medical expenses.

The best time to purchase Individual Health Insurance is when you are healthy, as early enrollment helps you avoid long waiting periods and allows you to secure better premium rates. This way, you will have comprehensive coverage when you need it the most.

Recommended Articles

We hope this guide on individual health insurance has been helpful. For more insights on selecting the right health coverage, check out these recommended articles.