Introduction to the Impact of Inflation on Savings

Inflation affects the value of money over time, which can significantly impact savings. As prices increase, the purchasing power of your money decreases, and this erosion of purchasing power directly contributes to the impact of inflation on savings. Most traditional savings accounts offer interest rates lower than inflation, meaning your money loses value over time. This is why it is important to understand inflation and how it impacts your financial decisions.

Understanding Inflation

Inflation is the process by which the cost of goods and services increases over time, causing the value of money to decline. When inflation rises, the value of money decreases, making everyday goods and services more expensive.

Two main factors can cause inflation:

- Demand-pull inflation: Prices increase when demand for goods and services exceeds supply.

- Cost-push inflation: When production costs, like wages or raw materials, increase, leading to higher prices.

The impact of inflation on savings becomes evident when the inflation rate outpaces the interest earned on savings. Most traditional savings accounts offer interest rates lower than inflation, meaning your money loses value over time.

Causes of Inflation

Understanding the causes of inflation helps you better manage its impact on your finances. Inflation can result from two main factors:

- Demand factors: Economic growth, higher consumer spending, and government expenditures can boost demand for goods and services, driving prices up.

- Cost factors: Rising production costs, such as wages and raw materials, can push businesses to raise prices.

These demand and cost factors can interact in complex ways, leading to inflation that can be challenging to manage.

The Impact of Inflation on Savings

The impact of inflation on savings is profound. As inflation rises, the real value of your savings decreases. For example, if inflation is higher than the interest earned on your savings, your money loses value over time. This is especially problematic for long-term savings goals like retirement or buying a home.

Traditional savings accounts often provide low interest rates that fail to keep up with inflation. High inflation means that the money you have saved today will buy less. To combat this, exploring ways to protect your savings from inflation is essential.

If you are unsure about the best strategies for safeguarding your savings, consulting with top financial planners in Sydney can help you create a personalized plan that outpaces inflation and maximizes returns. A professional can assist you in exploring your options and make sure your financial strategy is in line with your goals.

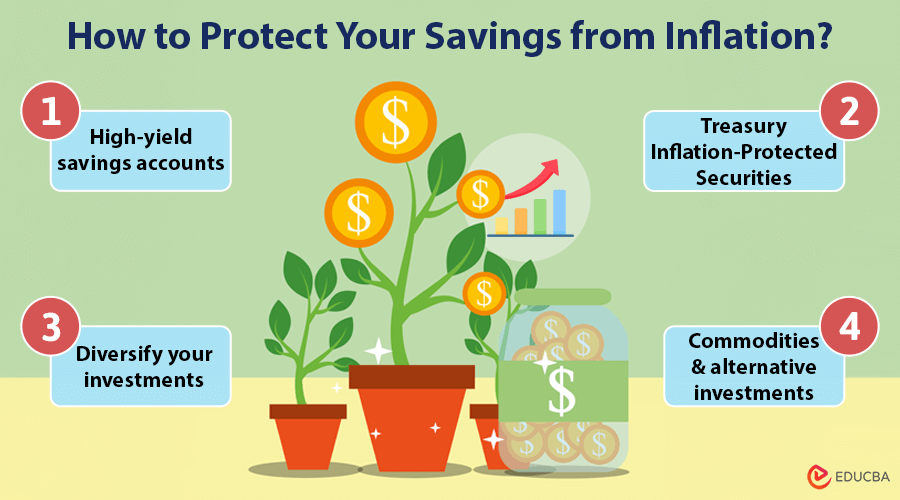

How to Protect Your Savings from Inflation?

You can use several strategies to protect your savings from the impact of inflation on savings:

- High-yield savings accounts: These accounts offer better interest rates than traditional ones, making it easier to keep pace with inflation.

- Treasury Inflation-Protected Securities (TIPS): These government-backed securities protect against inflation by adjusting the principal according to the Consumer Price Index. TIPS provides a guaranteed real rate of return, making it a strong choice for those looking to hedge against inflation.

- Diversify your investments: Stocks, real estate, and precious metals like gold tend to outperform traditional savings accounts during periods of inflation. Diversifying your investment portfolio allows you to potentially achieve returns that exceed inflation.

- Commodities and alternative investments: Investing in commodities such as oil, natural gas, and agricultural products or exploring alternative investments like private equity can help your portfolio grow in response to inflationary pressures.

Inflation and Tax Implications

Inflation also has tax implications that can affect your savings. Each year, the IRS adjusts tax brackets for inflation to prevent “bracket creep,” which occurs when inflation causes you to move into a higher tax bracket despite no actual increase in income.

Additionally, inflation adjustments affect various tax laws, such as personal exemptions and tax credits, which can reduce your taxable income. However, not all tax items adjust for inflation, so you should stay informed and consult a tax professional.

Final Thoughts

Inflation is a powerful force that can erode the value of your savings over time. Recognizing how inflation affects savings and actively safeguarding your money is essential for preserving your purchasing power. By investing in inflation-protected securities, diversifying your portfolio, and using high-yield accounts, you can better safeguard your finances against the growing pressures of inflation.

In the long term, staying knowledgeable and making wise financial choices will help protect the value of your hard-earned money, even during rising prices.

Recommended Articles

We hope this guide on the impact of inflation on savings helps you safeguard your finances. For more personal finance strategies and insights, explore these recommended articles.