Finding Error While Applying for a Business Loan?

For business owners who want to grow, make investments, or control cash flow, applying for a business loan is essential. However, the process can be complex, and mistakes in your loan application could lead to delays, rejections, or unfavorable terms. From overlooking your credit score to failing to compare interest rates, many common business loan application mistakes can affect your chances of securing the right loan. You may increase your chances of acceptance and make sure the loan satisfies your company’s demands by staying aware of these errors and making necessary preparations. This guide will highlight key errors to avoid during the application process.

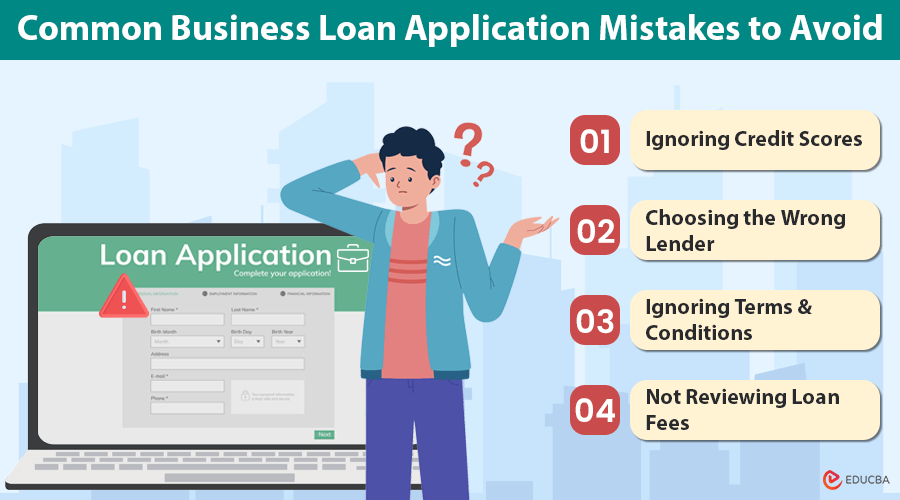

Common Business Loan Application Mistakes to Avoid

Here are some common mistakes to avoid when applying for a business loan:

#1. Not Assessing Loan Requirements

Assessing your business’s financial needs is essential before applying for a business loan. Borrowing too much or too little can lead to problems. Excessive borrowing puts pressure on repayments, while insufficient funds might not help you achieve your goals. Carefully calculate the exact amount you need for working capital or asset purchases. This ensures your loan aligns with your business requirements without creating unnecessary financial strain.

#2. Ignoring Credit Scores

Your credit score is a crucial factor in approving your business loan. A low score may lead to rejection or higher interest rates. Before applying, review your credit score and resolve any issues, such as overdue payments. Fix any inaccuracies in your credit report and work on improving your score. You can obtain better loan terms and increase your chances of acceptance with a high credit score.

#3. Choosing the Wrong Lender

Selecting a lender without sufficient research can lead to unfavorable loan terms, such as high interest rates or strict conditions. Different lenders offer different terms for business loans. Financial marketplaces like Bajaj Markets simplify the process by comparing loan products from various lenders. This helps you find loans with better interest rates and flexible repayment options suited to your business needs.

#4. Providing Incomplete Documentation

Incomplete or incorrect documentation is one of the most common mistakes when applying for a business loan. To evaluate your eligibility, lenders need specific documents, like financial statements and proof of income. If any documents are missing, your application may be rejected or delayed. Prepare a comprehensive checklist of all required materials and ensure everything is in order. The Bajaj Markets App can help guide you through the documentation process, making applying easier.

#5. Overlooking the Importance of a Business Plan

A solid business plan is crucial when applying for a business loan. It shows the lender how you intend to use and repay the loan. Lenders may hesitate to approve your application without a clear and detailed plan. Your business plan should include realistic revenue projections, market analysis, and a breakdown of loan utilization. A well-prepared business plan increases your chances of loan approval and demonstrates to lenders that you have a clear strategy.

#6. Applying for Loans with Short Tenures Without Planning

While short loan tenures may reduce the total interest costs, they often come with higher monthly repayments. These higher payments could strain your cash flow, affecting daily operations. It is essential to balance the loan tenure with your ability to repay. Financial marketplaces like Bajaj Markets offer online tools to compare loan tenures and EMIs. This allows you to choose the most suitable loan tenure that aligns with your business’s financial capabilities.

#7. Ignoring Terms and Conditions

It is critical to read loan agreements carefully. Not paying attention to the terms and conditions could lead to unexpected costs or restrictive clauses. Key details, such as processing fees, prepayment penalties, and fluctuating interest rates, can often be hidden in the terms. Bajaj Markets simplifies this process by providing easy access to loan details, helping you make an informed decision.

#8. Overestimating Revenue Projections

Overly optimistic revenue estimates can create problems when it comes time to repay the loan. Business cycles can be unpredictable, and overestimating earnings may leave you unprepared for slower periods. Be conservative when estimating your revenue, and plan for contingencies by setting aside a buffer for difficult months. This will help you manage repayments, even during downturns in business performance.

#9. Failing to Compare Interest Rates

Interest rates vary significantly across lenders, and your chosen rate will affect your total loan cost. Failing to compare interest rates could result in higher repayments. Financial marketplaces such as Bajaj Markets enable you to compare interest rates across different lenders, making it easier to find the best terms. This straightforward approach can save you money over time.

#10. Applying Without Understanding Eligibility Criteria

Every lender has different eligibility requirements, such as turnover or minimum business age. If you apply for a loan without meeting these requirements, your application may be rejected, negatively affecting your credit score. Research the eligibility criteria before applying. Tools available on the Bajaj Markets App can help you check your eligibility quickly so you only apply to lenders that match your business profile.

#11. Not Reviewing Loan Fees

In addition to interest rates, loans have various fees, such as processing charges, prepayment penalties, and administrative costs. If you ignore these fees, you may underestimate the total cost of the loan. Calculate all associated fees before committing. Bajaj Markets allows you to compare the total cost of loans across different lenders, helping you make an informed decision.

#12. Using Personal Accounts for Business Transactions

It is essential to keep personal and business finances separate. Mixing both can make it difficult for lenders to assess your business’s financial health, reducing your chances of loan approval. Ensure you have a dedicated business account to track income and expenses. Clear financial records will make the loan process easier and simplify tax filing.

#13. Not Exploring Digital Loan Options

Traditional loan applications often involve a lengthy process with lots of paperwork. Many borrowers overlook digital options that can make the process simpler and faster. Platforms like the Bajaj Markets App allow you to apply for loans online, check eligibility, and understand documentation requirements. These digital tools streamline the loan application process and reduce paperwork.

#14. Applying for Multiple Loans Simultaneously

Your credit score may suffer when you apply for multiple loans at once. Multiple loan applications make you seem less creditworthy to lenders. Instead, apply for one loan at a time, focusing on lenders that match your eligibility profile. Bajaj Markets allows you to pre-check eligibility to minimize rejections and maintain a healthy credit profile during application.

Final Thoughts

Avoiding common business loan application mistakes, such as incomplete documentation, overlooking credit scores, or failing to compare loan terms, could improve your chances of securing the right loan for your needs. Leveraging a financial marketplace like Bajaj Markets or its Bajaj Markets App simplifies the process by offering tools to compare options, check eligibility, and understand documentation effectively.

Recommended Articles

We hope this guide on business loan application mistakes helps you avoid common pitfalls and streamline the loan process for your business. Check out these recommended articles for more tips on managing business finances and optimizing your loan application.