Ensuring Comfort in Your Golden Years

As individuals age, securing proper health coverage becomes more crucial. Health insurance plans for senior citizens provide essential benefits such as coverage for pre-existing illnesses, high sum assured amounts, and coverage for specific treatments. These plans aim to ensure financial stability in later life and assist with the increasing healthcare expenses that seniors frequently encounter. However, no specific insurance companies in India offer tailored health plans for senior citizens, making it essential to carefully compare policies, premiums, coverage options, and additional benefits.

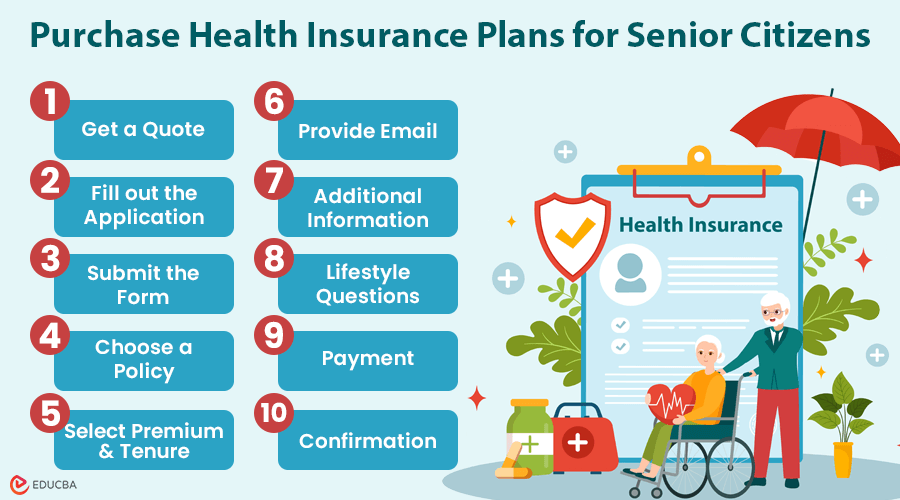

How to Purchase Health Insurance Plans for Senior Citizens

After comparing all the health insurance companies in India, one should follow the below steps to purchase a health insurance plan from the chosen company:

- Get a Quote: Click on the “Get Quote” option to open the online application form.

- Fill out the Application: Provide basic details such as name, contact number, gender, date of birth, and address.

- Submit the Form: Click “Get Quote” again to proceed.

- Choose a Policy: Click “Buy Now” to view a list of available policies and select the one that best suits you.

- Select Premium and Tenure: Choose the premium amount and policy tenure.

- Provide Email: Enter your email ID and click “Next” after verifying all details.

- Additional Information: Please provide details such as height, weight, marital status, nationality, address, nominee details, etc.

- Health and Lifestyle Questions: Answer health and lifestyle questions and click “Next”.

- Payment: After you verify your details, the system will direct you to the payment page. You can make payments via UPI, net banking, or credit card.

- Confirmation: An SMS will confirm that we have successfully processed your payment. The system will provide the policy document for download and send a copy to the registered email within 5-7 working days.

Coverage Provided by Health Plans for Senior Citizens

Health insurance plans tailor comprehensive coverage to ensure elderly individuals can access the necessary medical care. Below is a detailed overview of what these plans typically cover and exclude:

| Covered Benefits | Exclusions |

| Hospitalization Expenses: All essential costs like room rent, doctor’s consultation, medications, ICU charges, and operation theater costs. | Pre-existing Diseases: Conditions or injuries that existed before the policy was purchased are excluded. |

| Domiciliary Charges: If home treatment is prescribed, costs like doctor visits and medicines at home are covered. | Medical Conditions in the First 30 Days: Conditions diagnosed within the first 30 days of the policy, except for accidental injuries, are not covered. |

| Pre and Post-Hospitalization: Medical expenses incurred before and after hospitalization, ensuring you are covered even after leaving the hospital. | AIDS Treatment: Costs related to AIDS treatment are not included in the policy. |

| AYUSH Treatments: Coverage for alternative treatments such as Ayurveda, Naturopathy, Yoga, and Homeopathy for a holistic approach to health. | Self-Inflicted Injuries or Suicide: Any injuries or claims resulting from self-harm or suicide are not covered. |

| Mental Health Treatments: Care for mental health issues, including therapy and psychiatric treatments, is covered. | Non-Allopathic Treatment: Treatments outside of traditional medicine (non-allopathic) are not covered. |

| Congenital Diseases: Coverage for medical conditions related to congenital (birth-related) diseases, ensuring all aspects of health are cared for. | Cosmetic Surgery: Surgeries for cosmetic purposes, unless medically necessary due to an accident, are excluded. |

| Ambulance Charges: Emergency transportation costs by ambulance to ensure timely care during emergencies. | Drug or Alcohol Abuse: Costs related to addiction treatment and rehabilitation are not covered. |

| COVID-19 Coverage: Protection against treatment costs related to COVID-19, including hospitalization and emergency care. | War and Civil War: Injuries caused by acts of war or civil war are excluded from coverage. |

| Dental and Optical Treatment: This excludes routine dental and eye treatments unless they are due to an accident. |

Final Thoughts

As individuals age, their healthcare needs grow, making health insurance for senior citizens a vital consideration. These plans help cover medical expenses and offer valuable financial security in old age. Although basic health plans can become expensive as one ages, a senior citizen health insurance plan can be customized to meet specific needs. It offers financial protection and ensures that the elderly receive timely and necessary medical care. Investing in good health insurance plans for senior citizens enhances overall well-being and provides peace of mind.

Recommended Articles

We hope this guide on health insurance plans for senior citizens helps you choose the best coverage for your healthcare needs. Check out these recommended articles for more tips on navigating insurance options and ensuring peace of mind in your golden years.