Forex Automated Trading Trends for 2025

Forex automated trading is revolutionizing the financial landscape, driven by advancements in algorithms and AI. By 2025, these innovations will reshape the execution of trades, enhancing efficiency and accessibility. Automation minimizes human error and executes trades within milliseconds, empowering traders to stay competitive in an ever-evolving market. Understanding emerging trends is crucial for leveraging opportunities in this dynamic field. With automation at the forefront, traders can confidently navigate the future, optimizing their strategies and gaining an edge in the fast-paced forex market.

Overview of Forex Automated Trading

Forex automated trading uses algorithms and software to execute trades without manual input, leveraging pre-set rules and real-time data. With AI and machine learning advancements, these systems enhance decision-making and precision, offering traders an edge in volatile markets. Expert advisors (EAs) help align strategies with individual goals and risk tolerance. Forex VPS ensures stability and performance, minimizing latency and providing uninterrupted connectivity, crucial for time-sensitive trades and maximizing automation efficiency.

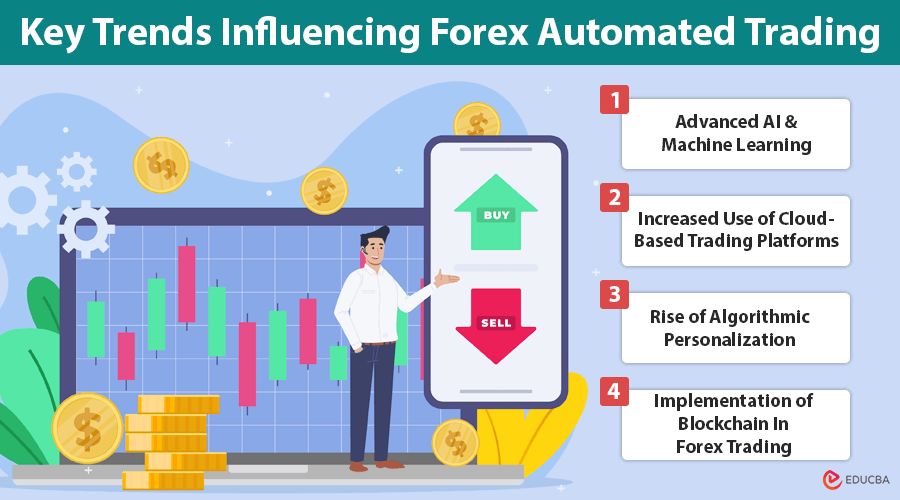

4 Key Trends Influencing Forex Automated Trading

Forex automated trading systems are shaping the market by blending innovative technology with strategic execution. Several key trends are defining how these systems will evolve and transform trading activities in 2025.

#1. Advanced AI And Machine Learning

Artificial Intelligence and machine learning enhance forex automation by analyzing historical data, predicting trends, and adapting strategies in real-time. This enables precise, faster decision-making and competitive advantages in dynamic trading markets.

#2. Increased Use of Cloud-Based Trading Platforms

Cloud-based platforms boost automated trading efficiency with scalable, low-latency solutions. Pairing cloud technology with the best forex VPS enhances system stability, minimizing delays during volatile market conditions for seamless trading.

#3. Rise of Algorithmic Personalization

Personalized algorithmic trading enables traders to customize strategies based on individual goals, risk tolerance, and preferences. It integrates dynamic tools to optimize performance and meet diverse forex trading needs.

#4. Implementation of Blockchain In Forex Trading

Blockchain enhances transparency and security in forex trading by validating real-time transactions and reducing fraud and delays. Smart contracts streamline processes, meeting the demand for secure, automated trading solutions.

Regulatory Developments Impacting Forex Automated Trading

Regulatory changes are reshaping forex trading by enforcing stricter compliance, data protection, global alignment, and regular audits to ensure transparency, security, and fair trading practices.

- Stricter Compliance: Disclosure of algorithm logic and risk parameters ensures adherence to fair trading practices.

- Data Security: Protecting sensitive financial data is mandatory and supported by secure platforms like Forex VPS.

- Global Standards: Unified regulatory frameworks simplify cross-border compliance for trading systems.

- Technology Audits: Regular inspections evaluate algorithm performance, market impact, and resilience under volatile conditions.

Advantages and Challenges of Forex Automated Trading

Forex trading offers opportunities to improve trading precision and efficiency but has notable challenges that traders must address carefully.

Key Advantages of Forex Trading

- Instant Execution in Volatile Markets: Automated systems immediately respond to market conditions, ensuring they execute trades without delays, which is critical in fast-moving forex markets.

- Simplifies Complex Analysis: Algorithms process large datasets in real-time, streamlining market analysis and enabling informed decision-making.

- Consistency in Strategy Execution: Pre-set rules eliminate emotional biases, ensuring all trades align with predefined goals under any market conditions.

- Improved System Stability: Forex VPS minimizes latency and ensures uninterrupted connectivity, vital for reliably executing time-sensitive trades.

- Advanced Decision-Making Tools: AI-powered analytics and machine learning enhance accuracy by adapting to market trends and optimizing strategies in dynamic environments.

Key Considerations for Forex Trading

- Risk of System Failures: Malfunctions or connectivity issues can affect performance, so monitoring and using a dependable VPS is crucial.

- Lack of Contextual Understanding: The automated systems may struggle to account for sudden market changes caused by economic or geopolitical events.

- Regulatory Compliance: Ensuring the system meets transparency and risk disclosure requirements is essential to avoid penalties.

- High Initial Costs: The system development cost may be a barrier for smaller traders, requiring careful resource and risk evaluation to ensure long-term success.

Popular Forex Automated Trading Tools For 2025

- MetaTrader Platforms: The MetaTrader 4 and 5 dominate Forex automation by offering expert advisors (EAs) for custom strategies and integrating with Forex VPS for seamless operation and minimal downtime.

- cTrader: cTrader provides advanced charting and algorithm development tools, ensuring low-latency execution and compatibility with various brokers. Thus, it improves trading efficiency and flexibility.

- TradeStation: TradeStation integrates AI-driven analytics for strategy optimization, providing powerful tools for automating Forex trades and supporting stable performance via Forex VPS in volatile markets.

- NinjaTrader: NinjaTrader excels in custom strategy development. Its built-in programming tools are preferred by advanced traders for their flexibility and comprehensive automation capabilities.

- ZuluTrade: ZuluTrade combines social trading with automation. It allows its users to follow and copy the strategies of successful traders, enhancing trading efficiency and learning opportunities.

- QuantConnect: QuantConnect supports the development of multi-market algorithmic strategies and optimizes performance through a Forex VPS, which is especially beneficial during high-volatility trading sessions.

- TradingView: TradingView integrates charting tools and automation via scripting, with Forex VPS ensuring reliable execution for time-sensitive trades, enhancing overall trading functionality.

Final Thoughts

Forex automated trading will transform the world by 2025, bringing unmatched potential through cutting-edge technology. Staying updated on trends like AI-based strategies, blockchain adoption, and cloud solutions is essential for adapting to the changing market. While automation improves accuracy and efficiency, it is crucial to maintain a balance between effective risk management and regulatory compliance. You can position yourself for sustained success in this evolving field by utilizing the right tools and anticipating industry changes.

Recommended Articles

We hope this article on Forex automated trading has been helpful to you. Check out these recommended articles for more insights on Forex trading and other tradings.