EOR for International Payroll: An Overview

Managing international payroll for IT teams involves navigating diverse tax laws, compliance requirements, currencies, and payment methods, which can overwhelm HR departments. In-house payroll management often struggles with currency exchange rates, banking issues, and local tax withholdings, leading to errors, delays, and compliance risks. To streamline these complexities, partnering with the best EOR providers offers a reliable solution. They handle payroll management seamlessly, ensuring compliance with local regulations, timely payments, and employee satisfaction. Using an EOR for international payroll simplifies processes, mitigates risks, and safeguards a company’s reputation while supporting global workforce needs.

The Role of EOR in Streamlining Payroll Operations

EOR for international payroll simplifies managing global teams by serving as the legal employer for international employees. These providers handle payroll tasks, including salary calculations, tax withholdings, social security contributions, and other mandatory deductions, ensuring compliance with local labor laws and regulations.

With extensive networks and partnerships worldwide, EOR services ensure timely and accurate employee compensation while adhering to country-specific requirements. This enables organizations to focus on core operations without worrying about the challenges of international payroll management.

Technology Integration and Automation

EOR for international payroll utilizes advanced technology platforms to automate processes, ensuring efficiency, accuracy, and compliance across borders. These systems typically include:

- Integration with time-tracking tools and project management software ensures accurate payment calculations based on actual work hours and project completion.

- Automated currency conversion and exchange rate management help organizations optimize payroll costs while providing predictable expenses.

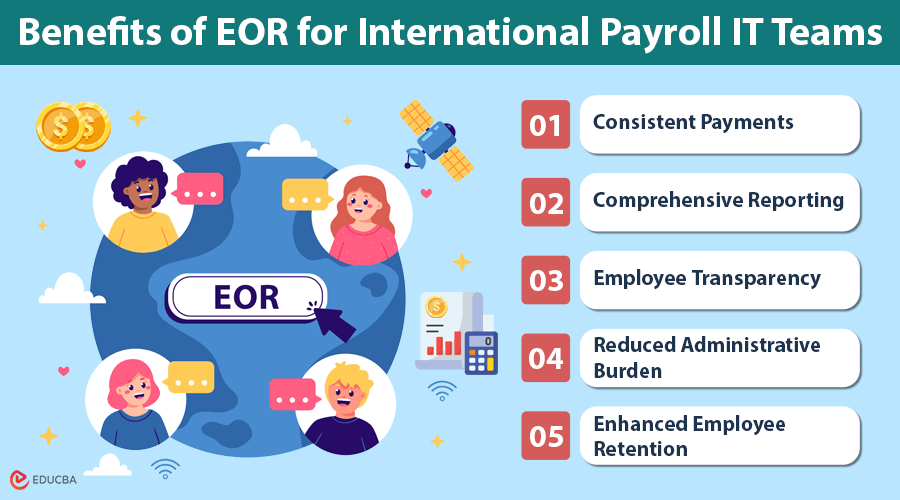

Benefits of EOR for International Payroll IT Teams

EOR for international payroll services provides numerous advantages for both employers and their IT teams:

#1. Consistent Payments: Employees receive timely payments in their local currency, enhancing satisfaction and trust.

#2. Comprehensive Reporting: Employers gain access to detailed reporting and analytics tools, helping them monitor payroll and compliance.

#3. Employee Transparency: IT workers appreciate the self-service portals that offer easy access to pay tax documents, stubs, and benefits.

#4. Reduced Administrative Burden: Standardized payroll processes across multiple countries minimize errors and reduce the complexity of managing international teams.

#5. Enhanced Employee Retention: The reliability of EOR-managed payroll enhances a healthy work environment, fostering employee satisfaction and retention.

Compliance and Risk Management

One of the most significant advantages of using EOR services for payroll management is the reduced risk of non-compliance with local regulations. EOR providers:

- It maintains up-to-date knowledge of local tax laws and employment regulations.

- It handles the mandatory reporting requirements.

- It ensures the proper classification of workers.

- Manage social security and other required contributions.

This expertise is particularly valuable in the IT sector, where companies must quickly scale their teams across multiple jurisdictions while maintaining compliance with various regulatory frameworks.

Cost Considerations and ROI

While implementing EOR services requires an investment, the return on investment often justifies the cost through:

- The reduced administrative overhead and staffing requirements.

- The minimized risk of compliance-related penalties and fines.

- The ability to attract and retain international IT talent has improved.

- Time savings for internal HR and finance teams.

Businesses should consider these factors when evaluating the cost-effectiveness of EOR services for their international payroll management needs.

Implementation of Best Practices

Successfully implementing EOR services for payroll management requires careful planning and consideration of key factors:

- It evaluates current payroll processes and identifies areas for improvement.

- Choose an EOR provider with substantial experience in your target countries.

- Plan for data migration and system integration.

- Develop clear communication channels with the EOR provider.

- Establish metrics for measuring success and ROI.

Organizations should also consider their growth plans and ensure their chosen EOR solution can scale accordingly.

Final Thoughts

Effective payroll management for global IT teams demands solutions that tackle the complexities of international employment while ensuring compliance. EOR for international payroll offers a streamlined approach to managing cross-border payments, benefits, and taxes. Reducing legal risks and administrative burdens allows organizations to focus on growth and innovation. As global workforce needs evolve, EOR services will play a crucial role in simplifying payroll management, ensuring efficiency, and enhancing the employee experience across diverse regions.

Recommended Articles

We hope this article on EOR for international payroll has been helpful to you. Check out these recommended articles for more insights on choosing the right employee services for your organization.