What is an Omnibus Account?

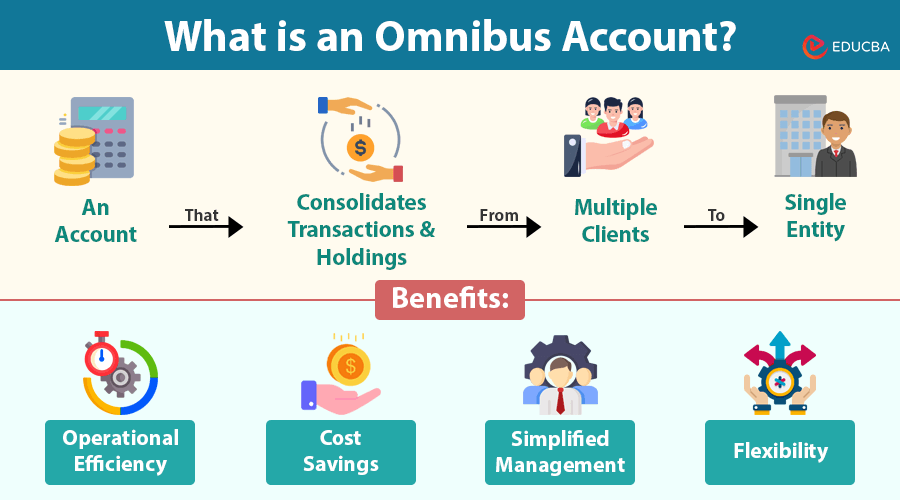

An omnibus account is a type of account that consolidates multiple transactions and holdings from various clients or investors into a single entity. The term “omnibus” derives from the Latin word “for everyone,” reflecting the combined nature of these accounts. Financial intermediaries, such as brokers, clearinghouses, and financial institutions, typically use omnibus accounts to streamline trading and reduce operational complexity. While these accounts aggregate transactions, the intermediary maintains detailed internal records to track individual clients’ contributions, positions, and holdings.

For example, a brokerage firm may use an omnibus account to manage all trades for a specific group of investors. The brokerage ensures that individual transactions are executed and recorded, but the clearinghouse or exchange sees only the omnibus account’s activity.

Features of Omnibus Accounts

- Aggregation of Accounts: A master account combines multiple individual accounts for operational efficiency.

- Intermediary Control: The intermediary (broker, financial institution, etc.) manages and tracks individual client holdings and activities.

- Confidentiality: External entities, such as exchanges or clearinghouses, do not receive disclosure of account holders’ identities.

- Efficient Transactions: Transactions are consolidated, allowing faster processing and reduced administrative workload.

- Internal Record-Keeping: The intermediary maintains detailed records of each client’s activities despite external aggregation.

Uses of Omnibus Accounts

Omnibus accounts serve a wide range of financial scenarios, including:

- Brokerage Services: Brokers use these accounts to manage trades for multiple clients efficiently.

- Fund Management: Asset managers use omnibus accounts to pool funds from multiple investors, simplifying the investment process.

- Clearing and Settlement: Clearinghouses use these accounts to process trades more efficiently by treating multiple transactions as a single unit.

- Custodial Services: Banks and custodians use omnibus accounts to hold securities for multiple clients.

Advantages of Omnibus Accounts

- Operational Efficiency: Financial intermediaries reduce administrative complexity by consolidating accounts and speeding up transaction processing.

- Cost Savings: Aggregating accounts minimizes transaction fees and administrative costs.

- Confidentiality: Individual account details are shielded from external entities, providing privacy to clients.

- Simplified Management: Managing multiple accounts under one umbrella simplifies bookkeeping and oversight.

- Flexibility: Omnibus accounts allow intermediaries to offer customized services to clients while streamlining operations.

Risks and Challenges

While omnibus accounts offer significant benefits, they also come with certain risks:

- Lack of Transparency: Because external parties cannot see individual client details, the risk of reduced oversight increases.

- Operational Risk: Errors in internal record-keeping can lead to disputes or inaccuracies in client holdings.

- Compliance Issues: Intermediaries must comply with regulatory requirements to protect individual client rights.

- Fraud Risk: The aggregated nature of these accounts may make them vulnerable to fraudulent activities if not properly monitored.

- Regulatory Scrutiny: It must adhere to strict regulations to prevent misuse, such as money laundering or insider trading.

Regulatory Oversight

Given the potential risks, omnibus accounts are subject to regulatory scrutiny. Financial regulators impose rules to ensure intermediaries maintain accurate records, protect client assets, and comply with anti-money laundering (AML) and know-your-customer (KYC) requirements. Intermediaries must also be ready to provide detailed records during audits or investigations.

Final Thoughts

Omnibus accounts play a crucial role in the financial industry by simplifying operations and enabling efficient management of multiple clients’ accounts. They offer significant advantages in cost savings, confidentiality, and streamlined processes. However, their use requires robust internal controls and adherence to regulatory standards to mitigate risks and maintain trust.

Investors and financial professionals must understand the structure and functionality of omnibus accounts to make informed decisions and ensure compliance with industry regulations.

Recommended Articles

We hope this guide helped you understand the role of omnibus accounts in financial services. Check out these recommended articles for insights on brokerage accounts, fund management, and financial regulations.