Innovation in the Banking Sector: Overview

Innovation in the banking sector is transforming how financial institutions operate and serve customers. By adopting advanced technologies like AI, blockchain, and digital payments, banks enhance customer experiences, improve operational efficiency, and promote financial inclusivity. Data-driven solutions enable personalized services while automation streamlines processes. Mobile and online banking also provide convenience, making financial services accessible globally. As customer expectations evolve, continuous innovation ensures banks remain competitive, secure, and aligned with modern needs in the digital era.

The Evolution of Customer-Centric Banking

The evolution of the banking sector towards digital innovation has redefined customer experiences. Key points include:

- Digital Tools and Accessibility: Online and mobile banking provide real-time account access, enabling fund transfers, bill payments, and investment tracking without physical visits.

- AI and Personalization: Artificial intelligence (AI) and machine learning analyze customer behavior, offering tailored recommendations for savings, loans, and investments, enhancing satisfaction and loyalty.

- Seamless Digital Onboarding: Technologies like biometric authentication and e-KYC simplify account opening and service access securely in minutes.

These innovations prioritize customer convenience and efficiency.

Redefining Banking Operations with Technology

Innovation in the banking sector has significantly enhanced operational efficiency and adaptability. As banks embrace digital banking modernisation, they unlock greater flexibility and improved customer experiences. Key advancements include:

- Automation: Replacing manual tasks with automated systems for faster, more accurate processes.

- Risk Management: Utilizing advanced algorithms and predictive analytics to improve lending decisions and fraud detection.

- Cloud Computing: Enabling real-time data access, scalability, and robust disaster recovery.

These innovations streamline operations, reduce costs, and ensure banks adapt swiftly to evolving market dynamics while maintaining trust and efficiency.

Financial Inclusion With Innovation in the Banking Sector

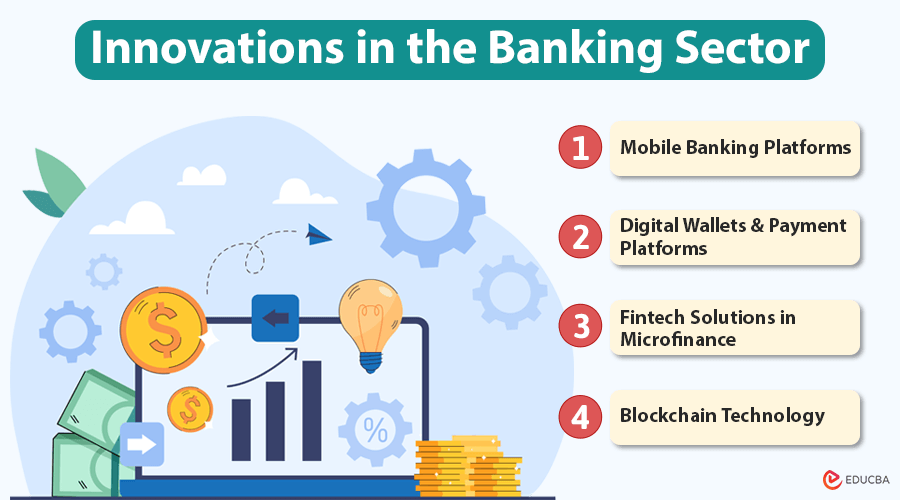

Innovation in the banking sector significantly contributes to financial inclusion, addressing challenges in underbanked regions. Key advancements include:

#1. Mobile Banking Platforms: Provide financial services to rural areas with limited traditional infrastructure.

#2. Digital Wallets and Payment Platforms: Simplify transactions for users without formal bank accounts.

#3. Fintech Solutions in Microfinance: Enable access to small loans and savings products for underserved communities.

#4. Blockchain Technology: This ensures secure, transparent services, reducing costs and extending access to low-income populations.

These innovations foster universal financial access and economic growth.

The Role of Data in Transforming Banking

Data has become the backbone of innovation in the banking sector, driving improved decision-making and customer satisfaction. Banks use data to:

- Analyze customer behavior for tailored services.

- Implement predictive modeling for risk management.

- Develop personalized marketing strategies to boost engagement.

This aligns with digital transformation, which plays a pivotal role in modernizing systems and integrating data seamlessly. By leveraging innovative data management practices, banks achieve operational efficiency, deliver superior customer experiences, and maintain competition in the dynamic financial landscape.

Transforming Customer Service with AI and Chatbots

Innovation in the banking sector has revolutionized customer service, primarily driven by the incorporation of artificial intelligence (AI):

- AI-Powered Chatbots: Handle millions of queries daily, providing instant, accurate, and personalized responses.

- Empathetic Interactions: Bots detect emotional cues and escalate complex issues to human agents when needed.

- Real-Time Feedback Analysis: AI identifies customer pain points, allowing banks to address concerns proactively.

This innovation ensures faster assistance, improved customer satisfaction, and operational efficiency in modern banking.

The Future of Banking: Open Banking and APIs

Innovation in the banking sector is advancing with the rise of open banking and APIs. These technologies enable secure sharing of financial data between banks and third-party suppliers, fostering collaboration and enhancing customer services:

- Personalized Solutions: The APIs allow tailored financial products and services.

- Enhanced Transparency: The customers have greater control over their data.

- Improved Competition: It encourages innovation among financial institutions and fintechs.

This approach redefines banking by prioritizing customer-centric, data-driven ecosystems.

Balancing Innovation with Security and Regulation

Innovation in the banking sector offers many advantages but also brings challenges, particularly around security and compliance.

- Cybersecurity Risks: With increasing digital transactions, financial institutions face heightened threats from hackers. Bank passkeys are emerging as a key solution, enabling phishing-resistant authentication and reducing reliance on vulnerable passwords

- Regulatory Compliance: Emerging technologies like AI and blockchain often outpace current regulations, requiring updated frameworks to safeguard consumers and encourage innovation.

- Customer Trust: Ensuring transparency and securing customer data builds trust, which is crucial for sustainable growth. Balancing innovation with responsibility is essential for maintaining confidence.

Final Thoughts

Innovation in the banking sector is crucial for staying competitive and meeting evolving customer demands. It enhances customer experiences, boosts operational efficiency, and promotes financial inclusion. By embracing technologies such as AI, blockchain, and digital payments, banks can offer personalized, accessible services while addressing challenges like security and regulation. Continuous innovation helps banks remain agile, ensuring they exceed customer expectations. Banks position themselves for long-term success in a fast-changing financial landscape by leading in technological advancements.

Recommended Articles

We hope this article on innovation in the banking sector has been helpful to you. Check out these recommended articles for more insights on banking functions.