Tax Deduction Guide for UK Business Owners

Understanding how to claim tax deductions on business equipment can significantly impact financial planning and profitability for businesses in the UK. Whether you are a sole trader, a small business owner, or a large enterprise, the ability to deduct the cost of essential equipment from your taxable income can provide valuable savings.

This guide explains everything you need to know about claiming tax deductions, including what qualifies, how to claim, and key tax allowance schemes.

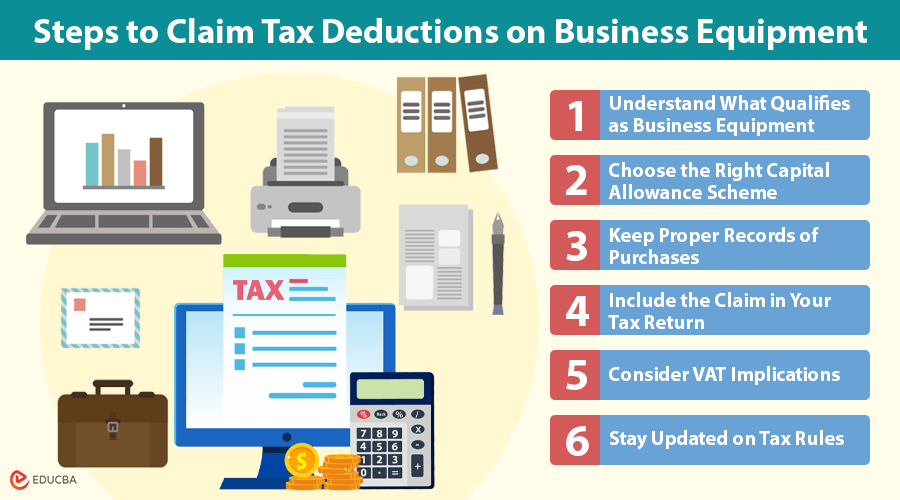

Steps to Claim Tax Deductions on Business Equipment

Follow these essential steps to maximize your tax savings and comply with UK tax regulations when claiming deductions on business equipment.

Step 1: Understand What Qualifies as Business Equipment

Before making any claims, it is essential to determine what qualifies as business equipment. In the UK, business equipment typically falls under capital allowances. These include items necessary for conducting business, such as:

- Office Equipment: Computers, printers, desks, chairs

- Machinery & Tools: Equipment used for manufacturing or construction

- Company Vehicles: Vans, trucks, and low-emission vehicles

- Security Systems: CCTV, alarm systems

- Specialist Equipment: Industry-specific tools

It is important to note that consumable items, such as stationery or software subscriptions, usually fall under revenue expenses rather than capital allowances and should be claimed differently.

Step 2: Choose the Right Capital Allowance Scheme

There are different ways to claim tax deductions on business equipment in the UK, depending on the nature of the purchase. The key schemes include:

- Annual Investment Allowance (AIA): Enables businesses to deduct the full cost of qualifying equipment in the year of purchase. As of 2024, the AIA limit is £1 million per year, making it suitable for most businesses.

- Writing Down Allowances (WDA): Writing Down Allowances allows businesses to deduct a percentage of the asset’s value each year for equipment purchases exceeding the AIA limit or not qualifying for full deduction. The rates are typically 18% for main pool assets and 6% for special rate pool assets (such as integral building features and long-life assets).

- First-Year Allowances (FYA): First-year allowances allow businesses to claim a 100% deduction on specific types of equipment, such as energy-efficient machinery or low-emission vehicles, in the year of purchase.

Step 3: Keep Proper Records of Purchases

Businesses must maintain accurate records of all equipment purchases to claim tax deductions. These records should include:

- Invoices & Receipts: Proof of purchase

- Payment Records: Bank statements, credit card transactions

- Purchase Details: Date, supplier, and item description

- Asset Details: Description of the asset and its intended business use

HMRC requires businesses to keep these records for tax audits for at least six years.

Step 4: Include the Claim in Your Tax Return

The method of claiming tax deductions varies depending on your business structure:

- For Sole Traders and Partnerships: Claim the deduction through the Self-Assessment tax return (SA103 form) and declare capital allowances in the relevant section.

- For Limited Companies: Claim capital allowances through the Company Tax Return (CT600) and enter the relevant deductions in the capital allowances section.

Using accounting software or consulting a tax professional to ensure accuracy when submitting your tax return is advisable.

Step 5: Consider VAT Implications

If your business is VAT-registered, you can reclaim VAT on business equipment through your VAT return. However:

- Capital allowances apply to the net cost (excluding VAT) if your business is VAT-registered.

- You can claim the full amount (including VAT) if not VAT-registered.

- Keep detailed records of VAT payments and reclaims to ensure compliance with HMRC regulations.

Ensuring correct VAT calculations helps businesses maximize savings while complying with tax regulations.

Step 6: Stay Updated on Tax Rules

Tax laws and allowances can change, so it is important to stay informed about updates related to tax deductions on businesses. Keeping up with HMRC guidance and tax rule changes can help businesses:

- Maximize their tax savings by using the most up-to-date capital allowances.

- Avoid penalties for incorrect tax filings.

- Plan equipment purchases strategically to take advantage of available deductions.

Consulting a tax professional or checking HMRC updates regularly ensures compliance with the latest regulations.

Final Thoughts

Claiming tax deductions on business equipment reduces taxable income and improves cash flow. Businesses can optimize their tax benefits by understanding what qualifies, choosing the right capital allowance scheme, keeping accurate records, and correctly reporting deductions. For complex cases or large purchases, seeking advice from an accountant can enhance tax efficiency and compliance.

Recommended Articles

We hope this guide on tax deductions on business equipment helps you maximize your savings and optimize your financial planning. Check out these recommended articles for more insights on business tax strategies.