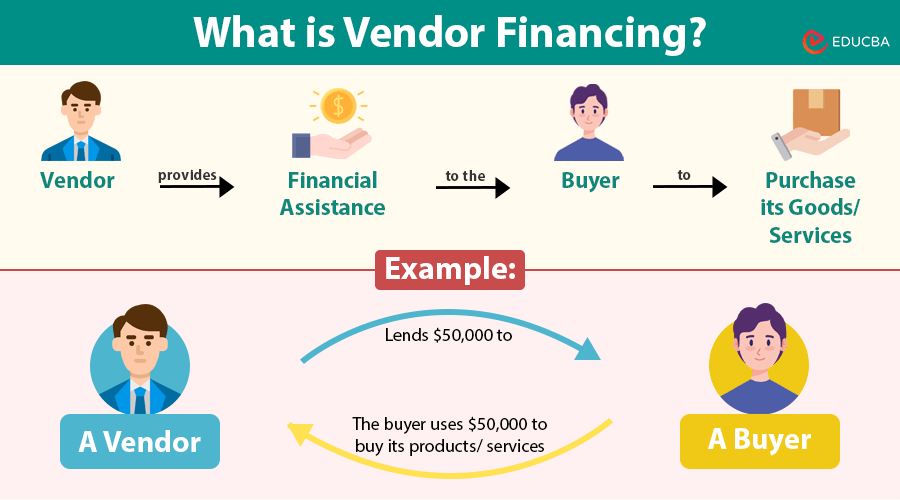

What is Vendor Financing?

Vendor financing is a funding arrangement in which a seller (vendor) provides financial assistance to a buyer to purchase its goods or services. Instead of paying the full amount upfront, the buyer can pay the vendor in installments over time.

Imagine a small retail business that wants to purchase $50,000 worth of inventory from a supplier but lacks the immediate cash flow. Instead of securing a bank loan, the supplier offers vendor financing, allowing the retailer to pay in monthly installments. This arrangement benefits both parties— the buyer secures inventory without a significant upfront cost, while the vendor boosts sales and retains customer loyalty.

How Does it Work?

The process of vendor financing involves several steps:

Step 1: Agreement

- The vendor and buyer discuss and finalize the financing terms.

- It includes the repayment schedule (monthly or quarterly payments), interest rates (if applicable), and any other required collateral.

- Both parties ensure that the terms are mutually beneficial and legally documented to avoid future disputes.

Step 2: Approval

- Before approving the financing, the vendor evaluates the buyer’s creditworthiness, financial stability, and payment history.

- This assessment helps the vendor minimize risk and determine suitable financing terms.

- In some cases, vendors may require financial statements, credit reports, or guarantees from the buyer.

Step 3: Product/Service Delivery

- Once the financing is approved, the vendor supplies the agreed-upon products or services.

- The delivery terms, such as shipping timelines, installation support, or after-sales service, are followed as per the agreements.

- The buyer can start using the products or services even before completing full payment.

Step 4: Repayments

- The buyer makes periodic payments as per the agreed schedule, which may include interest or be structured as a revenue-sharing agreement.

- Some vendors offer flexible payment plans, such as deferred payments or seasonal adjustments, based on the buyer’s business cycle.

- Timely payments help the buyer build a strong relationship with the vendor and potentially secure better terms in the future.

Step 5: Ownership Transfer

- The vendor may keep ownership of the goods until the buyer completes full payment, depending on the agreement.

- In some cases, the vendor may retain the right to reclaim the goods if the buyer defaults on payments.

- Once the buyer repays in full, the vendor transfers ownership, completing the transaction.

Types of Vendor Financing

There are two types of vendor financing:

1. Debt-based Vendor Financing

- The buyer receives goods/services on credit and repays in installments.

- The vendor may charge interest, similar to a traditional loan.

- If the buyer defaults, the vendor may reclaim the goods.

2. Equity-based Vendor Financing

- Instead of cash repayment, the vendor takes equity (ownership shares) in the buyer’s business.

- Common in startups or growing companies.

- The vendor assumes some business risks but gains potential future returns.

Advantages

Following are the advantages of Vendors and buyers:

For the Vendor

- Increases sales: Encourages more buyers by reducing upfront payment barriers.

- Competitive edge: Differentiates from competitors that require full payment.

- Customer loyalty: Strengthens relationships with buyers.

- Potential for high returns: Equity-based financing may lead to long-term profits if the buyer’s business grows.

For the Buyer

- Cash flow management: Reduces the burden of large upfront costs.

- Easier access to credit: Useful for businesses with limited funding options.

- Business growth: Enables scaling operations without external loans.

- Flexible repayment terms: Tailored agreements provide financial ease.

Disadvantages

Following are the advantages of Vendor and buyer:

For the Vendor

- Risk of non-payment: The buyer may default, leading to financial loss.

- Delayed cash flow: Payments are spread over time, affecting liquidity.

- Involves business risk (equity-based financing): If the buyer’s business fails, the vendor loses the investment.

For the Buyer

- Higher costs: Interest rates or revenue-sharing terms may be expensive.

- Potential collateral requirements: Some vendors may require security against credit.

- Ownership dilution (equity-based financing): Giving up equity reduces business control.

Examples of Vendor Financing

Here are some examples:

Example 1: Debt Vendor Financing (Loan-based)

A machinery supplier sells equipment worth $50,000 to a small business and offers vendor financing with the following terms:

- Loan Amount: $50,000

- Interest Rate: 8% per year

- Loan Term: 3 years

Solution:

Given:

- P = 50,000 (Loan Amount)

- r = 8% annual interest / 12 months = 0.00667

- n = 3 years × 12 months = 36 months

EMI= P*r*(1+r)n / (1+r)n – 1

= 50,000*0.00667*(0.00667)36 / (0.00667)36 -1

= 1,566.36

Total Amount Paid Over Loan Period:

Total Payment= EMI*n= 1566.82×36= 56,405.46

Total Interest Paid:

Total Interest= Total Payment−Loan Amount

=56,405.46−50,000

=6,405.46

Thus, under vendor financing, the buyer will pay $1,566.82 per month for 3 years, leading to a total repayment of $56,405.46, including $6,405.46 in interest.

Example 2: Equity Vendor Financing (Ownership-based)

A startup needs $100,000 worth of inventory from a supplier but lacks funds. The vendor agrees to provide the inventory in exchange for 10% equity in the company.

- The startup does not pay upfront but gives the vendor a 10% ownership stake.

- If the startup later grows and is valued at $2 million, the vendor’s 10% stake is now worth $200,000, effectively doubling their investment.

Hidden Risks in Vendor Financing

Here are some hidden risks:

- Over-reliance on vendor credit: If a company gets too comfortable with vendor financing, it may neglect building independent financial strength. A sudden change in vendor terms can disrupt business operations.

- Legal complexities and disputes: Contracts often contain clauses, repossession rights, and interest hikes in case of delayed payments. Always negotiate legal terms carefully.

- Impact on business valuation: If a startup gives away too much equity in a vendor financing deal, investors may view it as a weak financial signal, potentially reducing the company’s valuation in future funding rounds.

Strategies to Maximize Vendor Financing

- Negotiate performance-based repayment: Instead of fixed interest payments, propose a structure where repayments scale with revenue growth. This aligns vendor success with buyer success.

- Multi-vendor financing approach: Instead of depending on a single vector, split your purchases across multiple vectors offering financing. This spreads risk and improves cash flow flexibility.

- Hybrid Financing (debt + equity): Some companies mix partial cash payments with a small equity share, keeping ownership control while securing better terms from the vendor.

Final Thoughts

Vendor financing is a strategic financial tool that benefits both buyers and sellers by enabling business transactions with deferred payments. While it offers advantages like improved cash flow and customer relationships, it also carries risks such as non-payment and financial strain. Understanding the types, benefits, and drawbacks of vendor financing helps businesses make informed financial decisions.

By effectively using this financing, companies can scale their operations, improve sales, and build strong supplier relationships while maintaining financial flexibility.

Recommended Articles

We hope this guide has been helpful. Check out these recommended articles for more insights on business funding strategies, supplier relationships, and financial planning.