Updated July 27, 2023

Absolute Value Formula (Table of Contents)

What is an Absolute Value Formula?

The term “absolute value” refers to the valuation technique which uses the method of discounted cash flow to determine a company’s commercial worth.

The formula for absolute value can be derived by summing up all the discounted cash flow of each future period. The discounting is done by dividing the cash flow by one plus the discount rate raised to the power of the number of periods.

Mathematically, the formula for absolute value is represented as:

or

where,

- Ci = Cash Flow in (i)th Period

- n = Total Number of Periods

- r = Discount Rate

Examples of Absolute Value Formula (With Excel Template)

Let’s take an example to understand the calculation of Absolute Value in a better manner.

Absolute Value Formula – Example #1

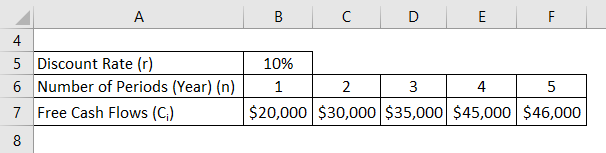

Let us take the example of XYZ Ltd, which has recently set up a manufacturing unit as part of its expansion project. The company expects free cash flow during the next five years. Calculate the absolute value of the newly set up plant if the expected required rate of return is 10%.

Present Value of Free Cash Flow is calculated using the formula given below.

PV of Free Cash Flow = Ci / (1 + r)i

PV of C1 = C1 / (1 + r)1

- PV of C1= $20,000 / (1 + 10%)1

- PV of C1 = $18,181.82

PV of C2 = C2 / (1 + r)2

- PV of C2 = $30,000 / (1 + 10%)2

- PV of C2 = $24,793.39

PV of C3 = C3 / (1 + r)3

- PV of C3 = $35,000 / (1 + 10%)3

- PV of C3 = $26,296.02

PV of C4 = C4 / (1 + r)4

- PV of C4 = $45,000 / (1 + 10%)4

- PV of C4 = $30,735.61

PV of C5 = C5 / (1 + r)5

- PV of C5 = $46,000 / (1 + 10%)5

- PV of C5 = $28,562.38

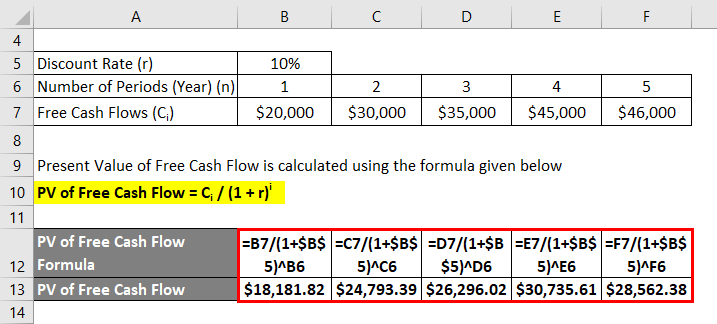

Terminal Value is calculated using the formula given below.

TV = Cn / r

- TV = C5 / r

- TV = $46,000 / 10%

- TV = $460,000

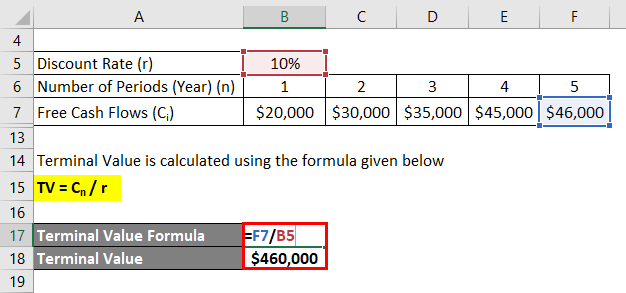

Present Value of Terminal Value is Calculated as

PV of TV = TV / (1 + r)n

- PV of TV = TV / (1 + r)5

- PV of TV = $460,000/(1+10%)5

- PV of TV = $285,624

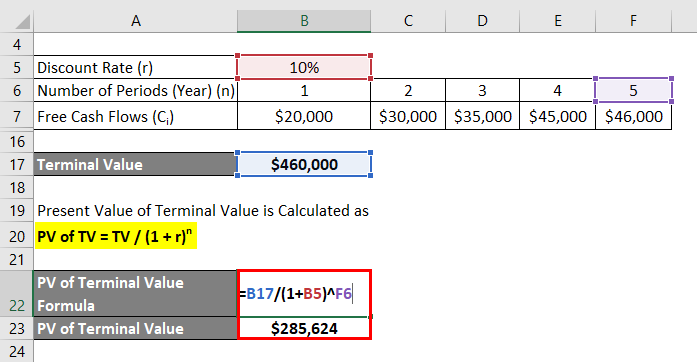

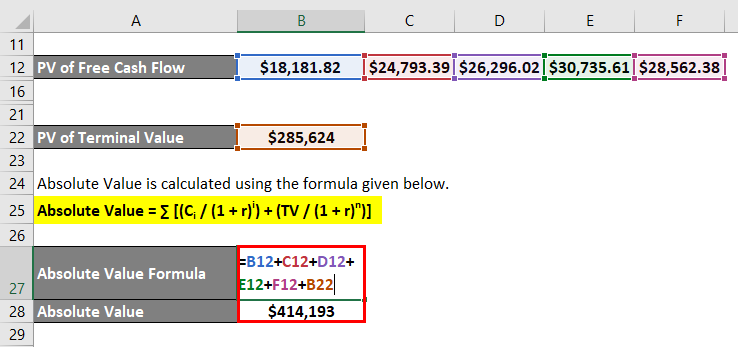

Absolute Value is calculated using the formula given below.

Absolute Value = ∑ [(Ci / (1 + r)i) + (TV / (1 + r)n)]

- Absolute Value = $18,181.82 + $24,793.39 + $26,296.02 + $30,735.61 + $28,562.38 + $285,623.81

- Absolute Value = $414,193

Therefore, the Absolute value of the newly set up unit is $414,193.

Explanation

The formula for absolute value can be derived by using the following steps:

Step 1: Firstly, project the cash flows for each future period. Examples of such future cash flow include income generated from dividends, operating cash flow, free cash flow, etc. The future cash flow for the ith period is denoted by Ci.

Step 2: Next, determine the discount rate, and it is one of the key components of the valuation process. Usually, companies use the weighted average cost of capital (WACC) as the discount rate because it captures the overall return (average of shareholders and creditors’ expectations) expected from the business. It is denoted by r.

Step 3: Next, the terminal value is calculated by dividing the cash flow of the last projected year by the required rate of return. The rationale behind terminal value is to capture the value of the business beyond the purview of the projected periods. It is denoted by TV, and it is mathematically represented as below.

TV = Cn / r

Step 4: Next, discount each of the cash flows (step 1) by using the discount rate (step 2) to compute the respective present values. In fact, the terminal value is also discounted to the present day.

Step 5: Finally, the formula for absolute value is derived by summing up all the present values of the cash flows (step 4) and terminal values (step 3).

Absolute Value = [c1/(1+r)1] + [c2/(1+r)2] + ……..+[cn/(1+r)n] + [TV/(1+r)n]

Relevance and Use of Absolute Value Formula

From the perspective of an investor or analyst, an absolute value is an important concept to master because it is used to determine a company’s market worth. In other words, it is the intrinsic value or true worth of a firm or a company. The price of the stock assessed based on the absolute value can be compared with the market value of the stock to check whether the stock is undervalued, at par, or overvalued.

Nevertheless, the concept of absolute value comes with a caveat that it is practically impossible to forecast future cash flows with certainty. In fact, the challenge crops up from the fact that it is very difficult to assess the growth rate and to forecast with surety for how long the growth will continue in the future. As such, the concept of absolute value should be used but with a certain degree of uncertainty.

Now let us take the case mentioned in example 1 to illustrate in the Excel template below. The table provides a detailed calculation of the absolute value.

Recommended Articles

This is a guide to Absolute Value Formula. Here we discuss how to calculate Absolute Value along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –